African Resources & Commodity Markets

Some resources are held mainly in Africa, but the distribution is massively unequal between countries.

In many articles about Africa’s resources, and it’s common to read statements like “DRC has so much cobalt!” or “Ghana produces so much Gold!” or “France explores former colony Niger for its uranium!”. However, these articles often fail to provide a comparison of the African country's actual dominance in that commodity market or to mention the scale of that market. This article seeks to remedy that.

All these deposits mean nothing if you don’t dig them off the ground and sell them on private arrangements or on the London Metal Exchange or the Intercontinental Exchange Market, the two biggest commodity exchanges on the planet. While these articles may mention reserves, they often don't discuss the size of the market or how much the country earns from selling the material. By understanding and combing thru the data paints a better picture of what resources Africa is a big player in. For example, Africa is not a big player in the lithium market as of 2021 (Zimbabwe & Namibia will be massive suppliers soon!). Lithium is used for electric batteries and it is a small market ($1.5B sold in 2021, growing at 48% from 2020!). Almost a billion of that lithium is sold in Chile, whereas the entire continent of Africa exported $52K in 2021.

While the DRC exports over 50% of the cobalt market, that market is relatively small, with a value of $7.7 billion. To put this in perspective, the natural gas market in 2021 is worth $440B… 63x bigger than the cobalt market.

Some African countries are not major players in commodity markets at all, either because they lack capital, labor, or natural resources, believe in economic self sufficency more than global trade, or because their populations are too small. In fact, some nations don't even export $1 billion worth of any given resource. This includes: Gambia, Sierra Leone, Madagascar, Rwanda and Burundi. As of 2021 data, there are 24 African countries that don’t export $1B of a single good.

Truth is Africa is rich in natural resources (30% of the world’s mineral reserves are in Africa), but only dominates (>50%) in resource markets that are relatively small(i.e. Africa sells 68% of the world’s chromium, a $2.6B market as of 2021, whereas Africa unfortunately only sells 5% of the iron ore market, a much more in-demand, $220B market) Furthermore, only a few African nations dominate those resources. (For example, Africa, has 90% of the world’s chromium and platinum reserves, but almost all of that is located in South Africa).

Through my research, I was reminded that Africa isn’t the only massive exporter of important commodities but the Gulf States, Russia, Kazakhstan, Indonesia, America, Canada, Mexico, and Australia are also massive commodity exporters as well. In 2021, Saudi Arabia exported more oil than all of Africa, Indonesia exports 32x more Palm oil than Africa, and Australia exported 2x the silver than Africa did.

Investigation Time

The tool I used was from my alma mater, MIT, to investigate the claim. The MIT Media Lab’s Observatory of Economic Complexity is the world’s greatest leading data visualization tool for international trade data. MIT Media lab obtains the data from looking at exports and imports of each country each year by both country of origin and by destination to make sure we use accurate data so there’s no mismatches.

Specifically, I examined legal exports of all the 54 African countries using this tool.

Proven Reserves

First thing I wanted to disentangle was proven reserves vs. exports. Proven reserves is how much geologists and engineers can ascertain quantities of commodity with reasonable certainty that the resource can be uncovered. Production is how much is extracted and brought to market each year.

Reserves

With this in mind, I looked at oil reserves. Oil is the world’s largest traded commodity and product by far with nearly $1T traded per year in 2021. The shocking fact that I uncovered was that even if you combined the proven oil reserves of Nigeria, Libya, and rest of the continent, you get 130B Barrels of oil in reserves, which would still be lower than Iraq, which holds the 5th largest reserves of oil.

Natural gas, the 6th largest traded product on earth , has a $440B market in 2021. The summation of the natural gas reserves of Nigeria, Algeria and the rest of Africa would give you 500 trillion cubic feet, which is and sounds like a lot. However, it would still be lower than Qatar, which the third largest reserves at ~900 trillion cubic feet.

As for coal, it is the 18th highest traded product on earth with a total global trade of ~$140B in 2021. In terms of proven reserves of coal, the African continent has the 11th highest reserves of coal on earth, but most those coal reserves (66%) are in South Africa. Poland has more coal reserves than the entire African continent.

Ok so Africa doesn’t dominate reserves in the widely traded oil, coal, and gas energy sectors, but it definitely dominates in some ores and metals in reserves.

Guinea has the highest reserves of bauxite, Democratic Republic of Congo has over 50% of cobalt reserves, South Africa has 90% of the world’s reserves of Platinum and 40% of manganese reserves. But here’s the catch, these markets are not nearly as big as the nearly trillion dollar oil & half-billion gas markets. These markets are based off supply (production) and demand (buyers), and the price the buyers and sellers bid on the commodity markets.

Commodity Markets

The bauxite market is ~$6B, the cobalt market is ~$8B, the platinum market has a respectable $90B, and the manganese market is $7B. You cannot compare fossil fuels to rock and metal extraction, the trade between mining and fossil fuel extraction is off by an order of magnitude. You aren’t going to have Guinea transform into a “Bauxite Qatar” with a $7B bauxite market, while Qatar is the third largest gas exporter in a $440B gas market. The bottom line is that as you comb through the trade data between the 1217 tradable products, none of these markets compare to demand for the fossil fuel market. You can add the markets that Africa is known for in 2021: gold (~$435B), cobalt (~$8B), diamonds(~$115B) , platinum (~$90B), and uranium & thorium ($170M) and you get 86% the oil market trade.

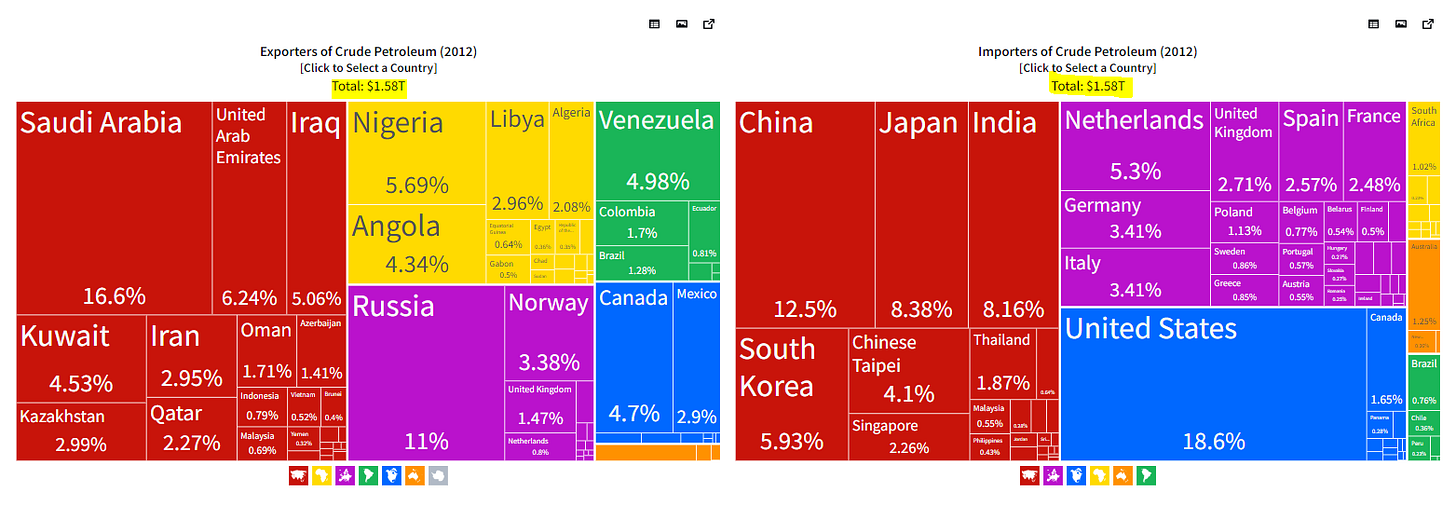

Oil is the most versatile product on earth used for transportation, energy production, makeup, roof shingles, pharmaceutical drugs and many other industrial processes. Bauxite, on the other hand, basically exists to be transformed to aluminum oxide/alumina/aluminum. Cobalt is mainly used for electric cars, smartphones, and used for superalloys in the aerospace industry. Platinum is used for jewelry, dental fillings, and making catalytic converters to reduce emissions for cars. With businesses and governments try to address the climate crisis, will we see demand shift from oil to these other minerals. We are already seeing this shift. In 2012, oil demand peaked as over $1.58T in consumption. In 2021, oil demand was $950B. Meanwhile cobalt demand exploded from $2.77B to $7.71B in 2021. There’s still massive growth that needs to be done since the cobalt base is so low, but the change is happening.

Oil sellers Oil Buyers

We can also see how cobalt is rapidly increasing in demand, from $2.8B in 2012 to $7.8B in 2021. Cobalt is not yet at the same scale as oil, but cobalt is growing fast.

Cobalt Sellers Cobalt Buyers

I just want to end the article buy pointing to some of the top commodities that Africa does and doesn’t dominate, which could lead to some interesting cartelization or price fixing in the future.

Top 10 Commodities where Africa doesn’t dominate

Crude Oil ($951B market in 2021) Africa sold $131B in 2021 (~14%), with Nigeria, Angola, Libya, Algeria, covering 75% of Africa’s oil trade to the globe. In the world, Saudi Arabia and Russia are the biggest sellers. China and the EU are the biggest crude oil buyers.

Natural Gas ($438B Market in 2021, 98% growth from 2020) Africa sold $34.2B in 2021 (8%). Largest contributor was Algeria selling $14.3B. In the world, America and Norway are the biggest sellers. China and the EU are the biggest gas buyers.

Iron Ore ($220B in 2021, 54% growth from 2020). Africa sold $10.4B (5%). The largest contributor was South Africa selling $7.7B. The biggest seller of iron is Australia & Brazil. Together they sell ~75% of the world’s iron to the world’s biggest buyers - China & Japan.

Diamonds ($114B Market in 2021, 56% growth from 2020) Africa sold $18.7B (~16%). Largest Contributors were South Africa and Botswana together selling $13.88B In the world, India and the EU are the biggest sellers (EU has a lot of diamonds from colonialism). The biggest buyers are India and America.

Copper Ore ($91B market in 2021): Africa sold $1.8B in 2021(~2%), with DRC being the largest contributor selling $618M. In the world, Chile and Peru are the biggest sellers, with China and Japan being the biggest buyers.

Platinum ($91B market in 2021, 44% growth from 2020), Africa sold $25B (~27%), with almost all of that came from South Africa. The EU and South Africa are the biggest sellers and the EU and America are the biggest buyers.

Palm Oil ($51.1B, 49% growth from 2020): Africa sold $838M (~1.6%). Largest contributor was Djibouti, which sold $169M. Palm Oil exports is dominated by Indonesia & Thailand. Their biggest buyers are India & the EU.

Zinc($12B market in 2021): Africa sold a relatively small $1.2B in 2021 (10%). Largest contributor was South Africa at $466M.

Rubber ($18B market in 2021, 45% growth from 2020): Africa sold $2.24B (~12%). Largest contributor was Ivory Coast which sold $1.72B. Rubber trade is dominated by Thailand and Indonesia. Their biggest buyers are China & EU.

Nickel Ore ($4.24B market in 2021, 14% growth from 2020): Africa sold a relative small $469M (~11%). Largest contributors were Zimbabwe and Zambia together bringing $250M. Nickel trade is dominated by the Philippines and France’s territory New Caledonia. The world’s biggest buyers of Nickel are China & Canada.

Top 10 Commodities where Africa dominates ( >50% market)

Cocoa: $9.6B market in 2021:, growing 6.7% from 2020: Africa sold $7.11B in 2021, with Ivory Coast & Ghana alone selling 55.4% for the planet. The EU and American firms are the largest buyers.

Cobalt: ($7.7B market in 2021, grew 55% from 2020): Africa sold $4.8B in 2021, with DRC alone selling $4.44B. DRC alone exports over half the global cobalt market with China being the biggest buyer.

Manganese Ore ($6.88B market in 2021, 114% growth from 2020): Africa sold $4.79B (70%). South Africa alone sold $2.9B, and the biggest buyers are China and India.

Bauxite/Aluminum Ore ($5.76B market in 2021, 5.8% growth from 2020): Africa sold $3.3B in 2021, with Guinea alone selling $3.2B. Guinea alone exports over half of the global bauxite market, with China being the biggest buyer.

Calcium Phosphates ($4.05B market in 2021, 35% growth from 2020): Africa sold $2.34B (servicing 58% of global demand). The largest contributor was Morocco providing $1.62B. India & EU are the biggest buyers.

Titanium Ore ($2.72B market in 2021, 14% growth from previous year): Africa sold $1.57B (58%). With South Africa and Mozambique leading the contribution selling $840M. The biggest buyers are EU & China.

Chromium Ore ($2.63B market in 2021, 28% growth from 2020): Africa sold $2B (~75%). With $1.8B coming from South Africa alone. The biggest buyers are China and Mozambique.

Niobium, Tantalum, Vanadium, Zirconium Ore ($1.83B market, 30% growth from last year): Africa sold $1.02B last year (servicing 56% of global demand), with South Africa being the largest contributor selling $410M

Tin Ore ($1.21B market in 2021, 87.4% growth from 2020): Africa exports $766M (63%) where the two Congos dominate selling nearly ~$450M together. China and Thailand are the biggest buyers.

Uranium & Thorium Ore ($172M market in 2021, 57% decline): Africa sold $60.8M (47%). The largest contributors were Niger providing $36.5M and Madagascar providing $21.9M. $172M is an absurdly small market

Sources:

All sources are tagged!

Very detailed analysis disintangling much of the myth and hyperbole that Africa is a resource giant. It looks better at country level.