The Global Commodity Cycle's Effect on Africa & the BRICS

This answers the classic question "We have gold, we have bauxite, we have iron, we have gold, we have oil, we have cobalt! Why are we poor?"

Several African nations have abundant natural resources but is mired in poverty. How? I want to give a more analytical and detailed answer than simply “exploitation”.

Typically, countries don’t become high-income from exporting commodities but from adding complexities to their economy: car manufacturing, military weapons, tire production, engine assembly, consumer technology, and etc. (examples: China, Japan, Singapore, South Korea, Poland, Estonia). A mining and agricultural economy isn’t that complicated. The exceptions are the oil & gas rich nations in the middle east, simply because oil goes in everything and is needed everyday: from the rooftop shingles to plastics to lubricants to kitchen spatulas to transportation fuel to wall paint, making fossil fuels a massive market. In 2016, when the oil market was declining, the oil market alone, has been bigger than all the metal markets combined (this is changing as we are transitioning away from fossil fuels).

This is because metals are substitutes for each other, making their price more elastic than oil. Rechargeable batteries can be made of cobalt, or can be substituted for manganese or lithium ion phosphate. Because of mineral compete with each other more than energy resources do, mineral markets are smaller than fossil fuel markets. As of 2021, the crude oil market is ~$1T, petroleum gas is $430B, while cobalt is $8B, manganese ore is $7B, nickel ore is $4B, platinum is $90B, and copper ore is $90B.

There are many perspectives why Africa is underdeveloped, but in my view, here’s the TLDR: After colonialism, African countries tried to fuel industrialization through continuing the colonial legacy of exporting commodities, but commodity prices have been too volatile to raise the incomes swiftly for most African countries. When commodity prices are high, African currencies appreciate, making manufacturing exports too expensive to buy. When prices decline, it happens so abruptly that government revenues decline, currencies depreciate, you get sovereign debt defaults, IMF bailouts, and restructuring. Balancing the between these two extremes has been an issue for African nations. In the 1980s, when the commodity buyers, the West & Japan, entered a recessions due to central banks hiking interest rates to slow demand, commodity demand plummeted so did commodity prices, kickstarting the 1980s-2000 African Debt Crisis. This is fundamentally different from what the successful, former East Asian colonies dealt with (Hong Kong, Singapore, Taiwan, South Korea) since none of them were major commodity exporters, forcing them to pursue city-state financial led growth or manufacturing led growth.

Colonialism created economies that were dependent on the forced labor of subservient, unentrepreneurial, illiterates to export food and raw materials (my grandparents couldn’t read).The Europeans built infrastructure to link mines to ports, rather than connecting countries or cities together. Following independence, these countries had to contend with borders defined by Europeans, fixing infrastructure, illiteracy, and lack of national unity.

The African nations attempted various strategies to industrialize, ranging from import-substitution, mixed market capitalism to African Socialism to Soviet Style Communism. Regardless of the strategy, each country needed to maximize export commodities or food crops for foreign currency (dollars, yen, pounds, euros). With foreign currency, African nations can buy food/oil/consumer goods from the West, obtain loans to develop infrastructure/healthcare/energy production/manufacturing, and pay down debt dominated in foreign money.

The issue is, African countries aren’t the only countries with abundant resources. Brazil, Australia, Indonesia, America, Russia, Mexico, Canada, Kazakhstan, and America are also well endowed, and even produce more commodities or have larger reserves than many African countries. African countries compete with other countries to export, which hampers the ability of a country to control the price of the resource.

Let’s look at some popular resources and see how African nations stack up compared to the world in terms of production and reserves:

Because of commodity dependence, most of Africa (and Brazil & Russia) grow during commodity booms and stagnates during commodity busts. In fact, it was during the commodity boom that began in 2000 and ended in 2014 that brought the rise of the BRICS (Brazil, Russia, India, China, South Africa) to the world’s attention. But when the commodity boom ended, all BRICS stagnated/declined with the exception of India and China, which don’t depend on exporting commodities to grow. Brazil and South Africa peaked 2011, Russia’s GDP peaked 2013, and Nigeria peaked in 2014. Meanwhile, India has grown 50% since 2014 and China nearly doubled its economy.

Sub-Saharan Average Yearly Incomes Per Person, in US dollars

If you never took an advanced econ class I should explain that commodities go through cycles for 3 reasons:

lack of pricing power: Entire commodity industries have one price for the commodity and no individual nation/firm has control over the price

no control of supply: There isn’t one producer who controls supply. When demand weakens, it takes the large players or the whole industry to cut supply to rebalance the market.

Governments cannot set commodity prices… Even if a government tried, a company would just buy gold/corn/rice elsewhere.

Because of this supply and demand problem — small mismatches in supply and demand of corn, wheat or oil lead to big moves in price for a commodity. A good rule of thumb is that a 10% change in demand for oil results in a 75% price shift in either direction. In Econ 101, in a regular industry, a firm has control over the price of his product: whether he sells bread or yachts, if demand weakens the firm can cut prices to see what the right price is to stimulate demand. With commodities, because the corn/yam/palm oil sector is made of hundreds of players with no control over the price of what they sell, the price of the commodity during demand or supply shocks.

For cocoa or oil, too much production leads to crashing prices. Then firms will produce less cocoa or oil in the future to raise prices. This principle works reverse as well. Price uncertainty is the difference between an industry like selling cars vs. a cyclical business like mining or energy. Commodities have unpredictable periods of expansion and contraction.

Also note, I don’t believe colonialism dooms a nation to poverty forever. I believe at least 10 African nations will be high income (yearly incomes exceed $13K) within my lifetime. According to the World Bank, in 1960, virtually all African countries were low income. As of 2021, 25 African nations are low income, 22 are lower-middle income, 7 are upper-middle income. Seychelles is the sole high income African nation. Over 50 years, despite Africa having the most impoverished nations of any continent, Africa transformed from a majority impoverished continent to a majority middle income continent. Unfortunately, if you don’t look at World Bank data, read The Economist, or watch economics conferences on Youtube, you probably didn’t know that. Unfortunately, bad news brings more attention than good news.

The two examples I’ll use that show how volatile commodity prices are cocoa & oil. The mega volatile, commodity boom-bust cycle is true for virtually all commodities except diamonds. If you want to know why diamonds, haven’t suffered a commodity boom-bust cycle, please check out my article on Botswana.

Cocoa Prices (1960-Present)

Oil (1960-Present)

Why was 1970s a commodity boom and why do booms end? The 1970s commodity boom came for a couple reasons:

Oil price used to be kept stable due to the 7 Multinationals (Anglo-Persian Oil, Shell, Standard Oil of California, New Jersey, and New York, Gulf Oil, and Texaco, who fixed the oil price. Once Saudi Arabia, Venezuela, Kuwait, and etc. took the price of oil away from the multinationals and in the power of the new oil commodity traders and petrostates, making the price controlled by supply & demand instead of global petrogarch firms.

OPEC Oil Embargo of 1973: The Arab States retaliated against the West for helping Israel in the Yom Kippur. The Arabs embargoed the West and the Suez Canal was closed…. 66% of oil that Europe consumed came through the Suez, and had to be redirected around Africa. 15% of all maritime trade passed through Suez in 1966, the year before it closed.

Iranian Revolution: Iran stopped producing oil for a bit, lower supply leading to increased prices.

Great Grain Robbery: The Soviet Union and other communist planned economies started to import large amount of grains on the international market (they weren’t able to produce enough food for themselves which is insane because the Soviet Republics of Russia, Ukraine, and Belarus were massive wheat producers), this spiked up grains, cocoa, corn and etc.

By 1973, the Bretton Woods System, the system where currencies pegged their currency to the dollar which was pegged to gold, died. This destroyed the stability of value to many commodities and caused currencies to float in value compared to commodities.

By 1980-2000s commodities declined due to mainly demand destruction. The West dealt with stagflation due to the high oil prices and eventually recessions which dropped commodity demand. The nations producing soybeans, wheat, oil, and etc. didn’t foresee this leading to overproduction of commodities and price drops

Due to the rising inflation, America increased interest rates in the 1980s. This caused capital flight from emerging markets to the US dollar, making many countries have balance of payments & debt crises and recessions in the 1980s, killing commodity demand in many emerging markets: Ivory Coast (1981-2000), Mexico (1982), South Africa (1982-1983), Brazil (1987), Nigeria(1987-1992, 2000) ,Argentina (1989-1991), DR Congo (1979-1990), Philippines (1983-1985), Kenya (1980-2000) Turkey (1994), and almost every African country except Botswana, where diamond prices still increased.

By the time of the 2000s, Africa’s growth emerged again because one country was now rich and big enough to demand massive commodities to fuel its population and business sector, China. Now, it’s no longer the West being a big buyer of commodities but China as well.

2000-2014 Commodity boom:

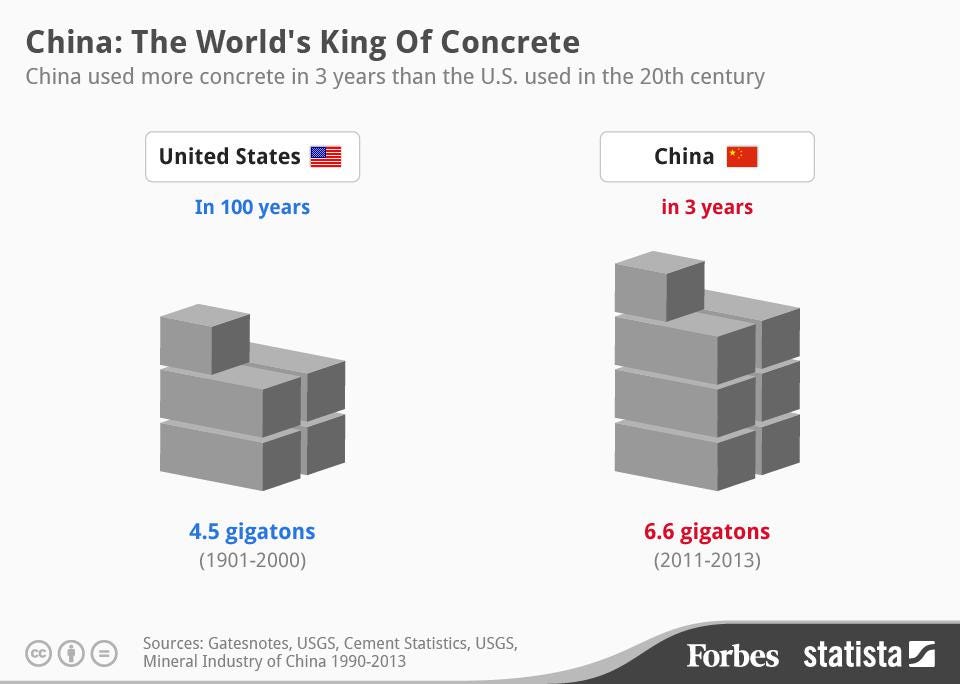

China was having the most insane economic growth ever. The economy, multiplied over 8 times, in these 14 years. China averaged 16% growth year after year, for 14 years. From a $1.2T economy in the year 2000, to an economy over $10T by 2014. In the year 2000, China was still a low income nation, many areas were still underdeveloped and rural, with your average Chinese person made $940 a year (~$3000 adjusted for local purchasing power). By 2014, China was an upper middle income nation with your average person made ~$7500 a year (~$12,500 adjusted for local purchasing power). Between 2000 to 2014, China’s real estate sector grew from 10% of GDP ($100B) to 30% of their GDP ($3T). That’s a 30x growth! This massive growth led to a huge surge of raw materials for Chinese businesses and consumers around the globe. Between 2011 to 2013, China used 6.6 gigatons of concrete — that’s more than what America used in the entire 20th century. Through all the highways dams, and skyscrapers, America built, that’s only 4.5 gigatons. They built 200 cities with over 1M people.

While America and Europe were suffering a financial crisis, China escaped the crisis with more construction. Brazil, South Africa, & Russia were having explosive growth providing the oil, meat, iron copper, diamonds, and soybeans for China. By this point, China was absorbing all the manufacturing investment from the rest of the world as well.

Financial speculation of commodities: The Federal reserve was lowering interest rates. (Between Sept 2001-May 2005, rates were under 3%, then under 3% to near 0% post Feb 2008 to 2016). Western boomers, the wealthiest people of human history, were in their 40s and 50s. With their money deposited in banks and investment firms on low interest rates, hedge funds and other institutional investors will buy futures contracts for commodities (corn, wheat, oil) with cheap debt, believing that the commodity future contract will appreciate in value. Massive demand and cheap credit pushed up demand for commodity futures contracts.

2014 commodity bust -2020:

Post 2014, China slammed the breaks on its economic growth. From 2014-2021, it grew from on average, 7% year over year, instead of nearly 17%. The Chinese Communist Party purposely directed their economy to growth through domestic consumption instead of exports in order to become high income. The CCP planned this but the rest of the world didn’t know. Commodity suppliers expected Chinese demand would continue to push prices up, instead most commodities had an oversupply. Oil, food exporters, and metals experienced significant increases in production leading to 2011-2014, and this resulted in a glut of supply that exceeded demand. This lead to prices falling as producers were forced to compete for market share & profits

The shale revolution in America: massive expansions in horizontal drilling and fracking exploded production in oil & gas in Texas. As a result, OPEC boosted production to compete. OPEC wanted to boost production so much to drop the price of oil and make fracking unprofitable… This contributed to the oversupply of oil.

In 2020, Covid made things worse killing demand all together

As shown, Africa only grows fast during commodity booms. Unfortunately, resource extraction leads to Dutch disease. Dutch disease is when demand for raw materials is so large that buyers of those raw materials push up that nation’s value of the currency. By pushing up the value of the currency, it fundamentally makes their manufactured exports too expensive in the international markets. Also, with stronger currency, it also artificially increases the wages of the citizens, which discourages foreign investment for manufacturing assembly plants. People would rather buy cheaper exports or build assembly factories somewhere else that’s cheaper. DRC can’t build it’s own version of South Korea’s Samsung or LG, when the DRC’s currency is pushed up by cobalt buyers, it makes manufactured products from DRC too expensive and people will look for good quality, cheap manufactured goods elsewhere. Commodity booms are good for growth over 10-14 years, but this plus China absorbing manufacturing investment, has caused premature deindustrialization.

Countries combat Dutch disease by reducing the value of their currency. For example, a country’s central bank will change their exchange rate from 80 of their currency to dollar to 100 of their currency to dollar. The issue with currency depreciation is that makes imports of fuel and food more expensive, causing inflation and riots in the country. So Central Banks need to find the right balance.

Governments need to be counter-cyclical with the commodity boom & bust cycle

This is harder than it seems since no one can predict when commodities will peak or bottom up. But if governments had the forethought they could save during commodity booms and invest during commodity busts. Politically it’s very hard to limit spending during commodity booms due to the enormous development needs of the country. Most African nations saved too little and borrowed during commodity booms, leading to debt crises and deep recessions once prices collapse. Other African countries should take note from Botswana, which has successfully created a sovereign wealth fund to save during booms and invest during busts.

The best way commodity exporters has cushioned the blow from oil price drops have been using the funds from their sovereign wealth funds. Kuwait made their wealth fund in 1953, Saudi Arabia in 1976 UAE’s Abu Dhabi made their wealth fund in 1976, and Qatar in 2005. African countries finally made their SWFs in the 2010s. Ghana made sovereign wealth fund in 2011, and Nigeria, Senegal, and Angola made theirs in 2012.

You are right about the problems with being dependent on commodity exports and how countries get rich by doing complex things, but you are wrong about this problem being caused by colonialism. The problem is caused by low human capital.

In order to have a complex economy capable of producing and exporting products with high added value, you need a lot of human capital*, if you don't have enough of that, then you end up depending on simple and dumb activities like agriculture and mining. Of course, there is a lot of technology evolved in agriculture and mining, but you can always import the machines and other technologies to dig the ground in your country.

This is clearly the pattern when one looks at the world. What do Poland, Finland, Hungary, Sweden, Slovenia, Switzerland, Slovakia, Ireland, Israel, the US, South Korea, Japan, Taiwan, Hong Kong, Singapore and China have in common? It's not that they were colonies, or weren't colonies, or had colonies, it's that they have high human capital, enough to have complex economies.

The only countries that achieve a high GDP per capita without a complex economy are countries with huge amounts of natural resources per capita, and it is almost always oil, although countries like Botswana benefit from high density of other resources, and small countries that receive a lot of tourism and finance.

As someone mentioned, it's important to understand that the whole world was poor before the Industrial Revolution, albeit with some variation, and Europe started to get relatively rich in the 1300s, but that's relative to that time. Before the Industrial Revolution, people in sedentary societies mostly did subsistence agriculture everywhere. It is the explosion in technical and scientific innovation that created the possibility of prosperity as we know it, and it is differences in the ability to recreate and create those advances in technical and scientific fields that distinguish countries in their incomes today.

Much of Africa's mineral wealth and that of other commodity exporters only have value because they are bought by industrialized countries. If industrialized countries were to stop buying primary products from poor countries, those countries would just get poorer, and exporting primary products to the international market doesn't stop anyone from getting rich, see Canada and Australia for examples. Income from primary products is fine, what poor countries need is to add to their economies complex manufacturing and services, and in enough quantity to make a difference.

* Human capital can be measured by international tests like PISA. The World Bank has an article on this where they converge the scores of all kinds of international tests.

Overall I like the article, but I disagree with your TLDR summary "Colonialism made economies dependent on export commodities." This seems to be a restatement of Dependency theory, and your article really does not give evidence of it.

Sub-Saharan Africa (like most of the rest of the world) was poor long before the Europeans arrived. The disparity in wealth was in fact the main reason why Europe could conquer Africa in the first place.

I believe that the reason for the discrepancy in development was mainly geography, not colonialism. The geography came long before the colonialism.

Europe clearly founded commodity export industries for their own good, and then after independent the Africans learned how to run those industries themselves. This clearly created the problems for their economy that you outline so well, but having those industries is better than pre-colonial times.

I do not agree that exporting commodities makes it impossible to create higher value-added export industries.You mention that commodity prices drive up currency, which is true, but it is not as if this drove up the price of African manufacturing exports. In general, those industries just did not exist.

I think that it is possible for Africa to follow the path of East Asia in developing high value-added export industries. During times of increasing commodity prices, those commodity exports may in fact give the capital to build new industries.

Unfortunately, commodity exports often lead to kleptocratic governments that do not want their country to become rich. The leaders would rather be rich in a poor country than middle-income in a middle-income nation.

Anyway, you know far more about the economics of African countries than I do. That is my take.