Namibia's Economy & Geopolitics in the Modern Day (Part II)

A Country embracing Clean & Dirty Energy Simultaneously

For audio listeners click on the link below. For this article, I think it’s better to read the article though so you can see the graphs and pictures.

Intro

We previously spoke about Namibia. We discussed German colonialism, Herero & Nama genocide, South African colonialism, and the fight for independence. Since then, land reform remains slow in Windhoek (“Vin-hoke”) due to concerns over Zimbabwe's failures and the economic collapses in Angola and Mozambique after skilled whites left. To read part one click on the link below.

The Economic & Geopolitical History of Namibia: Part 1

Namibia, a 33 year old, Southern African country, boasts vast deserts and a sparse population, ranking as the world’s 2nd least densely population nation. It gained independence from South Africa in 1990. The country is as big as Western Europe and the population is 2.8M

Now, Namibia, led by President Hage Geingob (“Ha-hay Gen-gob”) from 2015-2024, seeks to address its colonial legacy by making his country better.

#1 Eurobond borrowing:

Namibia issued its 2nd eurobond in 2015. A 10-year $750M loan from private international investors at a 5.75% interest rate. President Hage has been allocating these funds to the “Harambee Prosperity Plan”. The loan with its principal payment included is due next year, 2025. The economy hasn’t even grown much since taking the loan.

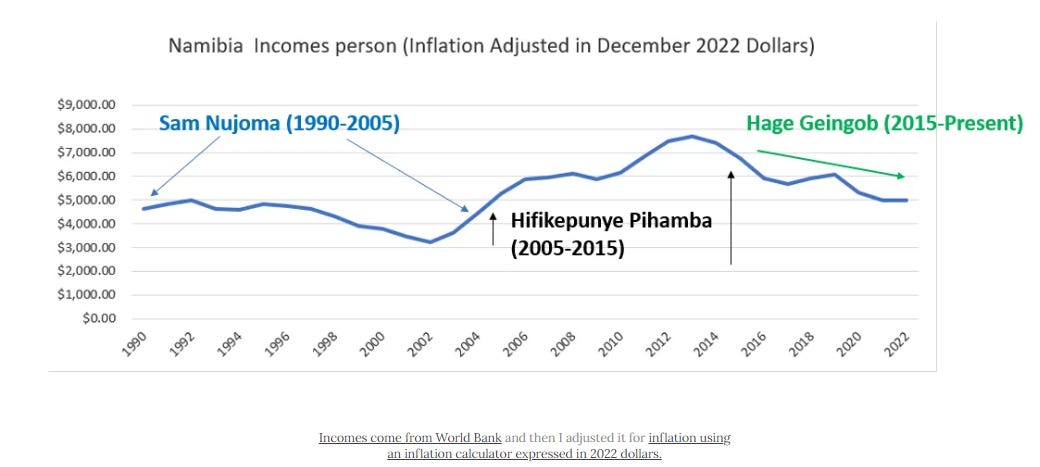

Also real incomes (real means “inflation adjusted”) have decreased in Namibia since 2015…

#2 Reparations:

There are talks of reparations of 1.1B euros ($1.2B) in genocides reparation from Germany for the deaths of 60K Nambians.

#3 Resource Utilization:

Rare Earth mineral deals: Namibia sealed rare earth mineral exploration pacts with the EU and Japan to fortify their supply chains, benefiting automakers like Volkswagen, BMW, Mercedes Benz, Nissan, Toyota, and Honda in ramping up electric vehicle production.

Found Oil & Gas: In 2021, British Shell and French Total found oil in Namibia’s Orange Basin —three sites (Venus oil well, Graff1-X and Jonker-1X) hold a collective 12 billion barrels of oil. The Venus site alone is the 8th largest oil discovery this century.

Post oil discovery, Namibia established the Welwitschia Fund in 2022, currently holding $20M (as of December 2023). The fund plans to accumulate oil revenues and allocate 2.5% of its portfolio annually to address infrastructure needs.

Potential oil extraction by Shell and Total could transform Namibia into the world's 15th largest petrostate by 2035.

Moreover, French Total, Qatar’s QE, British Impact Oil & Gas, and Namibia’s government owned energy firm, Namcor, found natural gas at the Venus site in 2022, along with discoveries in the Kudu gas field.

As a result of discovering oil & gas, Namibia is trying to raise $2B to expand its port infrastructure to streamline trade.

Selling enormous oil & gas will bring a windfall of government revenues to invest in infrastructure, healthcare, education, and welfare. However, oil & gas production is a very capital intensive industry, so it won’t bring many jobs.

#4 Chinese Backed Infrastructure:

China’s massive construction includes a 40-baseball-field sized artificial peninsula at Walvis Bay to expand Namibia’s ports, primarily built by China Harbour Engineering, with half of the workforce comprising Namibians. Alongside ports, China is constructing highways, a shopping mall, a $400M fuel depot, and a granite factory, aiming to boost trade — China can sell clothes, cement, and machines to Namibia while Namibians can sell oil & gas.

Chinese infrastructure loans often stipulate that most of the employment and the profits are given to Chinese firms, while benefiting Namibia with infrastructure development. The hope is that the increased growth helps pay off the loan, which is usually financed at below market rates, aiming for a “Win-Win” outcome.

Aside on Understanding Commodity Markets

Namibia stands out in Africa due to its potential in both dirty and clean energy. Oil is still the most traded commodity in the world, with nearly $1T traded in 2021. The recent oil discovery could propel rapid growth, similar to Guyana, yet concerns persist about corruption similar to Equatorial Guinea, Angola, Nigeria, or Gabon.

Oil:

With Namcor, the state-owned energy firm, set to receive 58% oil revenues from royalties, taxes, and dividends, coupled with the government’s 10% stake oil/gas licenses, Namibia ensures a significant share of profits from oil and energy firms. The fear is that the revenues will go inside government ministers instead of the people, but only time will tell!

Here’s how big the oil market is compared to other resources.

Oil is a huge market, and lithium is small but growth rates in another story.

Oil 2011 —> 2021: $1.54T to $951B, The compound annual growth rate (CAGR) of the oil market is -5%. If thistrend continues to 2031, the oil market will decline to $590B.

Petroleum Gas (Liquified Natural Gas & Natural Gas) 2011 —> 2021:

$310B to $335B, the gas market CAGR is .8%. If this continues to 2031, the gas market is $360B.

Copper Ore: 2011 —> 2021: $53B to $91B, the CAGR of copper is 5.6%. If this continues to 2031, the copper market will be $156B.

Lithium: 2011 —> 2021: $380M —> $1.5B, the CAGR of lithium is 14.7%. If this continues to 2031, the lithium market will be $5.92B.

Nickel Ore: 2011 —> 2021: $4.27B —> $4.24B CAGR of nickel is -0.1%. If this continues to 2031, the nickel market will be $4.21B.

Rare-earth Metals: 2011—> 2021: $880M —> $590M CAGR of Real Earth Metals is -4%. if this continue to 2031, the rare earth mineral market will be $400 million market.

Cobalt ore: 2011 —> 2021: $1.06B —> $118M, CAGR of cobalt is -20%. If this continues to 2031, cobalt will be a $10 million market. Unless the Congo can control its cobalt market, the cobalt market will continue to diminish… Firms like Panasonic & Samsung have figured out how to not use cobalt at all.

It will take until 2029/2030, until Namibia is able to unleash the oil. By that time the oil export market will be around $600B instead of the $1T market today.

Climate Change & Demand for Nuclear Energy:

Demand for uranium is expected to increase due to the fact that energy firms are preparing for the energy transition, and nuclear energy is significantly more reliable than renewables, due to the intermittency issue with wind and solar (reduced electricity generation when it isn’t windy or sunny).

In 2012, China’s state owned firm China General Nuclear (CGN) has been investing and operating the Husab Uranium Mine in Namibia. It’s a $5B investment where China owns 90% and Namibian owns 10%. It’s the 3rd largest uranium mine on earth that gives Namibia export revenues from selling uranium. It also provides the uranium that China needs to turn from the #3 largest nuclear energy producer to #1, so China can reduce its dependence on coal.

Australia’s Uranium firm, Paladin, is reopening mines in Namibia. Other Australian firms like Deep Yellow Limited and Bannerman also extract uranium and invest in new projects in the country. Consequently, uranium prices are rising. In 2019, uranium wasn’t even $30 per pound, now in December 2023, its over $90 per pound. Getting to net zero will require quadruple the production of uranium we currently do to get to net zero, so if prices rise that will benefit Namibia.

Climate Change & Demand for Lithium:

In Uis(“oi-ees”), Namibia, there was lithium discovered, which is critical for electric vehicle batteries. The Namibian mining firm, Andrada Mining, plans to mine out the lithium. Right now, the only lithium producers in Africa are Zimbabwe and Ghana, but by this year, 2024, Namibia is expected to be the 4th largest producer. Lepidico, an Australian firm, will extract lithium from Karibib, Namibia, but will process battery grade lithium in its hydrometallurgical plant in Abu Dhabi, UAE.

In terms of the lithium supply chain: Australian and Chinese dominate lithium mining, China dominates lithium processing, cell component manufacturing, battery manufacturing, and EV production. Australia and China are and will continue to be big investors in Namibia.

By 2030, lithium demand is projected to surpass 2.5M tonnes, while production is expected to reach 1M tonnes, causing a significant supply-demand gap and driving global lithium prices upward.

However, the threat of substitution poses a major risk for Namibia. Similar to cobalt, where companies like Apple are shifting to recycled or University of Tokyo making cobalt-free batteries due to concerns about artisanal mining Congo, synthetic alternatives developed through R&D could crash natural commodity prices, as seen with synthetic rubber and lab-created diamonds. Many companies are actively exploring substitutes for lithium-free batteries.

Climate Change & Demand for Green Hydrogen:

Sovereign Wealth Fund (SWF) #2

Namibia is creating a second SWF called SDG Namibia One, funded by green hydrogen revenues. It will be created through the combo of Namibia’s Environment Investment Fund, Netherlands’ Climate Fund Managers BV and Invest International BV. The point of a sovereign wealth fund is to serve as a buffer against future economic shocks (a pandemic, tornadoes, a commodity bust, etc.) and manage the wealth generated from its natural resources for future generations.

Climate Finance: Secured $544M concessionary financing (super low interest loans) in climate finance from the Dutch government and European Investment Bank, Namibia plans to produce green hydrogen. Part of the funds will go to the SWF.

The German government also is backing the construction of Namibia’s $13M, first green hydrogen-powered iron plant (instead of coal!), which will hopefully generate zero-emission 15K tonnes of iron per year. The plan should be made by 2024. Germany will use the iron to make green steel for wind turbines.

ArcelorMittal, a steel multinational, is piloting a project to produce green sheet steel using green hydrogen from Namibia.

Green hydrogen is hydrogen made from harnessing wind or solar energy to separate and distill the hydrogen atoms in desalinated water instead of producing hydrogen from fossil fuels (blue hydrogen). Namibia is very windy and sunny, making the country perfect for this energy source. The European Union is helping Namibia build solar panels, wind turbines, desalination plants to supply fresh water, and a deep water port to ship green hydrogen and a brand new town. The European Union is eager to find alternative energy sources to loosen its dependence on Russian natural gas. Starting 2026 by the firm, Hyphen Hydrogen Energy’s $10B project is projected to produce 750K tonnes of green ammonia annually, increasing to 2M tonnes by 2030. The Namibian government wants to use its climate fund to acquire a 24% stake in the project.

The issue with green hydrogen is that it is a moonshot technology. European Union’s green hydrogen targets according to the Corporate Europe Observatory in Brussels is “unrealistic from a cost and an energy perspective.” Transporting it from Namibia to Europe would require an extensive pipeline network through North Africa.

Export Ban of Raw Minerals

Namibia has already attracted many mining firms for crucial minerals projects - Australian firms like Prospect Resources, Arcadia Minerals, Askari Metals, & Celsius Resources and Canada’s Namibia Critical Minerals are developing cobalt & rare earth projects in the country. After attracting all this investment, Namibia made a killer move.

In June 8th 2023, Namibia has just recently banned exporting raw lithium, cobalt, manganese, graphite and rate earth minerals. It is hoping to copy Indonesia’s “resource down-streaming” strategy of nickel. Indonesia, possesses 21% of humanities nickel reserves and produces half of humanity’s nickel right now, when President Joko Widodo in Indonesia banned nickel in 2014, it destabilized markets so much that multinational firms, mainly from China invested $15B to process nickel in Indonesia. Ford and Hyundai are also making nickel processing facilities in Indonesia. The EU hated this so much that they challenged them in the World Trade Organization(WTO), but Indonesia appealed, and frankly Indonesia, doesn’t care about the WTO.

There are two concerns I have with this strategy in Namibia. Many African countries have tried export bans before, but export bans don’t work unless you are a monopoly producer like Indonesia is for a nickel. An export ban of cobalt would help Congo since it sells 60%-80% of cobalt, but a lithium ban wouldn’t help Zimbabwe since it has half of a percent of the world’s supply of lithium. Foreign investors wouldn’t just flock in if they have other options to chose from.

As for Namibia, has one tenth of the lithium Zimbabwe has. It wouldn’t get Indonesian level investment since the world does not depend on Namibia or Zimbabwe for lithium like the world depends on Indonesia for nickel. Most lithium reserves are in Bolivia, China, Australia, Chile and Argentina. Over 50% of lithium is produced in Australia, with Chile, China, and Argentina combined making up another 45%.

The concern with this strategy is that in order to process raw lithium into lithium hydroxide, you need a hydroxide plant. That plant needs power, chemicals and lithium for processing. If the enterprise can’t get consistent electricity and source all the chemicals then it won’t happen. Most African countries aren’t great at producing consistent electricity, which makes it difficult to process in Africa. Hopefully Namibia won’t have that problem.

Conclusion:

Through oil & gas discoveries and green hydrogen deals with the EU & Japan, the country may finally have a chance to provide a better life for the Namibians who live in destitution. Hopefully Namibia will use the oil & gas to be more like a Saudi Arabia/UAE/Qatar/Kuwait instead of a Angola/Nigeria/Gabon/Equatorial Guinea.

Links are attached!

Great finish after Part 1. I had wondered about how the country itself could maintain the fruits of its mineral wealth and you addressed that in this part. I had thought restrictions on exports might be an option and you addressed that well. Thanks. I’m gaining knowledge.

I really appreciated learning how to correctly pronounce Windhoek.