Evaluating the Legitimacy of the "50-Year US-Saudi Petrodollar Deal"

More noise than signal

This has been one of my most requested posts. This is a great opportunity to explain some concepts and tease out some nuance about this “US Saudi-Petrodollar deal”.

Someone shared me an article from Eurasia Review about "Saudi Arabia ending the petrodollar deal." I’ll Summarize the article:

_________________________________________________

The article argues that Joe Biden made a mistake saying that he would make Saudi Arabia a “pariah” state.

Saudi Arabia is retaliating against Biden by revoking the "American-Saudi petrodollar agreement."

After the gold standard collapsed, the US arranged for Saudi Arabia to sell oil exclusively in US dollars and invest surplus dollars in US treasury bonds, in exchange for American protection. This deal ensured a stable oil supply for the US and a buyer for its debt, helping the dollar remain the world’s reserve currency, keeping it strong and maintaining low interest rates.

Now, Saudi Arabia's departure from the 50-year petrodollar deal could reduce global demand for the US dollar, leading to higher inflation, higher interest rates, and a weaker bond market. Saudi Arabia is now working with China on cross-border trade, potentially shifting the global power dynamic.

_______________________________________________

Now let’s tease out the truth from the nonsense.

It is true that America’s reserve currency status is declining. For those who aren’t privy to finance, financial institutions don’t usually hold dollars, but invest most of those dollars in safe debt instruments called bonds to earn some return. Instead of Central Banks and financial institutions loading up on American debt instruments, they are diversifying their portfolio to buying debt denominated in other currencies.

It is also true that Saudi Arabia is open to accepting other currencies for trade.

However, losing reserve currency status, doesn’t necessarily mean that America must charge higher interest rates for investors to buy America’s debt. In fact, there’s a weak relationship between sovereign bond yields (the return a country offers to investors for buying its debt) and a country’s global reserve currency status. Observe the scatterplot below.

The scatter plot shows a weak relationship between bond yields and a country’s reserve currency status. The correlation (R value) between 10-year bond rates and reserve currency status is 39%, indicating a weak correlation. The coefficient of determination (R² value) is 15%, meaning only 15% of the differences in bond interest rates between countries can be explained by their reserve currency status. This suggests that reserve currency status has weak predictive power for determining interest rates.

From the chart, you can see that the dollar is used 12x than the pound, yet both have similar 10-year bond yields. Similarly, the Chinese renminbi and Canadian dollar are less used than the dollar, but China has lower rates than both of them. Factors like the central bank's monetary policy on its mandates (inflation, unemployment, economic growth, etc.) play a bigger role in determining interest rates than its reserve currency status.

What is the petrodollar? Can you explain Saudi-American trade?

The petrodollar refers to selling oil for US dollars. Countries like Saudi Arabia have usually generated current account surpluses by selling more oil than they import goods.

Saudi Arabia’s population (and significantly more so with Kuwait, UAE, & Qatar) is relatively small compared to its oil & gas production. These countries’ consumption of foreign goods usually pales in comparison to its oil exports, leading to significant surpluses unless oil prices are low (e.g. 1983-2000 or 2014-2017, 2020-2021). For example, in 1974, Saudi Arabia’s current account surplus was equivalent to 50% of its GDP.

In 2022, Saudi Arabia sold $362B (over half was oil), and Saudi Arabia buys $169B in mainly manufactured goods, medicine, and food. With the excess cash, Saudi Arabia’s central bank often invests in U.S. treasury bonds because the U.S. is the world's largest borrower, with many bonds available for auction.

As of 2023, 80% of oil is sold in US dollars. 20% of oil is sold in other currencies.

Ok what is this so called “50 year oil deal”?

The Eurasia article argues that Saudis signed an “exclusive contract to only buy US dollars” in June 8th 1974. There was an agreement; however, no exclusive contract to buy oil only in US dollars existed. Saudis sell oil in dollars out of convenience.

What was the 1974 agreement?

Whenever these articles say that an agreement with Saudi Arabia was signed June 8th, 1974 they are referring to this document here:

His Royal Highness Prince Fahd bin Abd al Aziz met with Henry Kissinger, the Secretary of Defense, Treasury Secretary Simon, and President Richard Nixon.

If you want to read the longer report by the Comptroller General of the United States on the U.S.-Saudi Joint Commission Economic Cooperation you can read it here.

If you read the document, in 1974, America and Saudi Arabia signed the Joint Commission on Economic Cooperation(JCOER), which encouraged stronger political ties via economic cooperation (technology transfer, infrastructure, highways, data collection, solar energy research, etc.). There were statisticians from the University of Maryland training the Saudi government to compile a consumer price index and take an accurate census. The point was to help Saudi Arabia modernize their bureaucracy.

In the doc, you do see “recycling petrodollars” - meaning after Saudi Arabia sells oil and receives dollars, not only could Saudi Arabia by U.S. assets (which they were already doing prior to this 1974 agreement) but also the Saudi government would sign commercial deals with American companies to build infrastructure, buildings, and other projects. This agreement was renewed in five year intervals, but it expired February 12, 2000. Here is the final renewed agreement.

But the agreement never mentions that Saudi Arabia formally agreed to exclusively sell oil for U.S. dollars. Even when the deal is referenced in government documents, it’s referred as the technical assistance project to help the government. We know that there was no agreement to sell exclusively in US dollars because Saudi Arabia continued accepting other currencies for some time, like the British pound for payments after the agreement was signed.

For a second example, Saudi Arabia accepted pound sterling for the BAE Systems oil-for-weapon systems barter deal in the 1980s. When Saudi Arabia bought BAE Systems weapons, with oil, the contract was priced in pound sterling.

Ok so it wasn’t exclusive, but did the 1974 agreement create the petrodollar system?

This document didn’t create the petrodollar system, because Saudi Arabia already was selling oil for dollars before 1974. In 1973, a year before the 1974 deal, the oil rich North African & the Middle Eastern states possessed billions in U.S. dollar denominated assets. You can see Saudi Arabia’s existing preference for selling oil for dollars in this archived document.

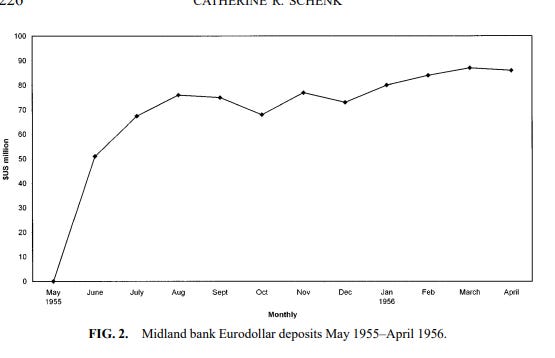

The usage of petrodollar predates the 1974 agreement. In addition, the dollar is used out of convenience due to the internationalization of the dollar during the 1950s with the creation of the Eurodollar.

Why would Saudi Arabia do deals primarily in US dollars if there wasn’t an exclusive agreement to use US dollars? What is the Eurodollar?

The US dollar was more convenient for most oil traders, who were already accustomed to using it. Essentially, trading oil in dollars was a matter of economic inertia. By 1954, the US dollar surpassed the British Pound Sterling to become the most traded currency. In 1955, the Eurodollar market was created, which is essentially the offshore market for US dollars.

By 1956, over half of all international reserve assets were dominated in US dollars. See the table for composition of gross foreign exchange assets below:

This proportion only increased over time. Even before Saudi Arabia and America had an economic cooperation agreement, by 1970, 82% of global foreign exchange reserves were in US dollars. This means that most oil was already traded for dollars before the 1974 Saudi economic cooperation deal!

Dollars dominated because its more widely used than other currencies, we call this network effects.

By the 1970s, America already had the largest bond market. Central banks typically don't hold dollars directly; instead, they buy treasury bonds to earn a return on their reserves. When selling resources for a currency, it's prudent to seek a safe asset to invest in, and bond markets are often the best option for obtaining returns. Given that America has been the largest borrower since the 1970s, purchasing US debt was a logical choice.

How was the Eurodollar market made?

It was made by “accident”. The U.S. Federal government had no idea this would happen.

In the 1950s three things happened:

1. In the 1950s, the interest rate difference between government bonds in pound sterling and US dollars widened. In finance, this difference is called 'the spread,' and it was around 2%, with pound sterling offering a higher interest rate. London banks, such as Midland Bank, would borrow in dollars, exchange those dollars for pounds, and purchase British government bonds. As long as the pound sterling's exchange rate didn't depreciate, the difference between the payouts from British bonds and the debt service paid in US dollars resulted in free profit for London banks, known as a 'carry trade' or 'interest arbitrage.' This practice of holding dollar deposits in European banks led to the creation of the Eurodollar market. Below, you can see Midland's dollar deposits surge between 1955 and 1956.

2. The Soviet Union sold oil and gas to Western Europe, Canada, and America. After World War II, most major economies anchored their currencies to the dollar under the Bretton Woods system, which was itself tethered to gold until 1971, when Nixon ended the gold standard. Consequently, when the Soviet Union sold oil to Western Europe, they typically received dollars in return. However, after the Soviets rolled tanks in Hungary to quash the anti-communist rebellion in 1956, they feared their dollar deposits in New York banks might be frozen.In response, the Soviets moved their deposits to their banks in London and Paris, specifically the Moscow Narodny Bank Limited and Commercial Bank of Northern Europe. These European banks held dollars and issued loans in dollars, further establishing the Eurodollar market, or the internationalization of the overseas dollar market. Bankers favored the Eurodollar because these overseas dollars were beyond the regulatory reach of the Federal Reserve, the Bank of England, and other authorities. At that time, Eurodollars were not subject to the Federal Reserve's reserve requirements or interest rate ceilings, leading to a rapid expansion of the Eurobond market.

3. In 1957, UK banned British banks from using or providing trade finance denominated in British pounds for transactions between non-British firms. (E.g. British Banks could no longer provided pound denominated loans to French and Japanese firms). Why? This policy was implemented because the British pound was weakening. By restricting the supply of pounds, the UK aimed to prevent them from being exchanged for yen, dollars, or francs, which would further devalue the pound and strengthen foreign currencies.

Banning British loans to foreign countries prevented the exchange of pounds for foreign currencies, thus mitigating the weakening of the pound. But, London banks would still lend overseas, but in dollars instead. This increased the dollar deposits in European banks, further bolstering the Eurodollar market. Eventually due to convenience and fear of missing out, other European, Canadian and Japanese banks observed that Britain was lending overseas in dollars, and began expanding their assets and liabilities in dollar denominated assets as well. Look below to see how even in 1963, European and Japanese banks held most of their assets dominated in US assets.

Ok so the expansion of the Eurodollar market made it more convenient to use dollars, and it wasn’t an exclusive petrodollar deal. But I’m curious did the “recycled petrodollar” scheme reduce inflation in US?

This misunderstanding arises from mistakenly linking the end of the gold standard in 1971 with the U.S.-Saudi agreement in 1974, following the Organization of Arab Petroleum Exporting Countries’ (OAPEC) oil embargo after the Yom Kippur/Ramadan War in October 1973. The idea is that ending the gold standard caused U.S. inflation which worsened after the OAPEC oil embargo, while Nixon’s Saudi deal ended U.S. inflation and ensured American hegemony by exclusively backing dollar with oil.

This misconception starts off with truth sprinkled with conspiracy. It is true that in 1971, President Nixon ended the Bretton Woods’ gold standard, where currencies were anchored to the dollar, which was tethered to gold. This move addressed America’s widening trade deficits (importing more than exporting, which drained its gold reserves) and prevented a balance of payments crisis (running out of gold). Now America no longer can default by running out of foreign exchange (gold), but it can only default by not collecting enough tax revenue to pay an interest payment. After cutting off the gold standard, American inflation did rise as the “exclusive petrodollarists” claim. However, American inflation was multi-causal. In addition to ending the gold standard, Nixon imposed price and wage controls & freezes, which initially lowered prices in the short term but ultimately caused shortages by reducing production incentives. This made inflation persistent over the long term (around ten years). Nixon also put slapped double digit tariffs on foreign goods, also contributing to inflation.

After Egypt & Syria lost the Yom Kippur/Ramadan War and failed to retake the Sinai & Golan, the Arab OAPEC countries were so mad at the West for supporting Israel that they embargoed the West, and cut oil production, raising oil prices and fuel inflation. Expressed in 2024 prices, before the October Israeli-Arab war, in September 1973, global oil prices were $30 per barrel. After the war, due to embargoes and production cuts, by January 1974, oil prices more than doubled to $68. American and Saudi relations were worsening, so Nixon brokered a deal with the Saudi’s in June 8th 1974 to improve relations and make a joint cooperation where Saudi’s petrodollars would be used in projects in Saudi Arabia. Where the exclusive petrodollarists jump into conspiracy is when they say that this deal said that oil states can only sell oil for dollars and when they say this deal stabilized the dollar and reduced inflation.

Indeed, the Nixon administration brokered a deal on June 8th 1974 which improved relations with the Saudi King, but there was no exclusive currency deal and inflation persisted. Even after this “petrodollar deal” was signed, American inflation was not under 3% until 1983 and under 2% until 1986.

This is because inflation stability in a country with a mostly independent central bank & has relatively free flows of capital is mostly a monetary policy phenomena. When President Jimmy Carter appointed Paul Volker, Volker purposely raised interest rates to 20% in 1980 & 1981, which caused two brief, but massive recessions between 1980-1982 to crush inflation via demand destruction. The idea that so called exclusive petrodollar scheme reduced inflation requires a misunderstanding of American economic history.

Ok so the petrodollar agreement isn’t exclusive, nor did the 1974 deal create the petrodollar system, but isn’t oil crucial for holding the dollar? Why was there so much conspiratorial thinking behind this?

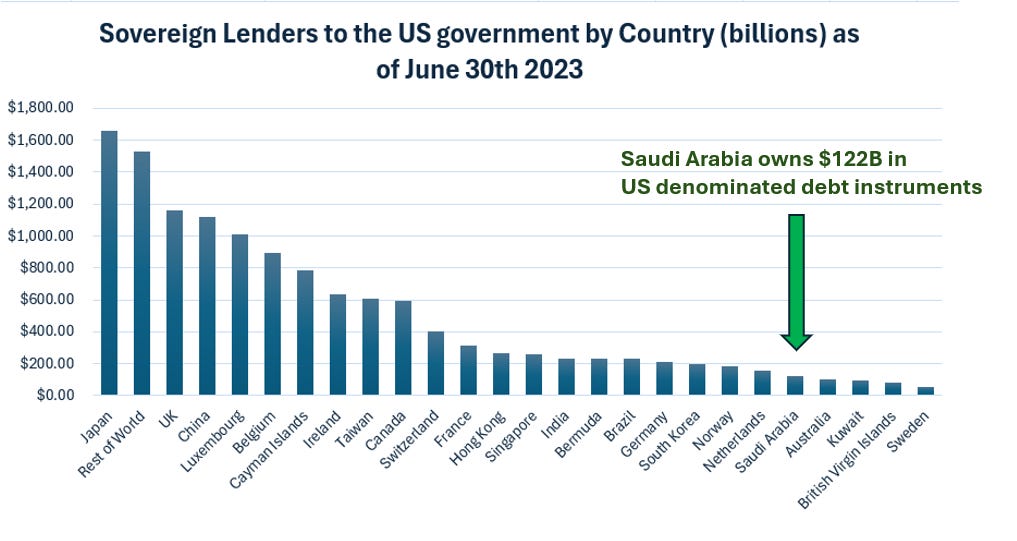

King Faisal requested the purchase of Saudi Arabia’s US treasury holdings a secret. For the longest time, this made some people believe that Saudi Arabia & the other Middle Eastern oil states owned a huge proportion of U.S. Treasuries and that the Arab Kingdoms are crucial for America to finance deficits. There’s no reason to believe this anymore because Bloomberg News requested the US Treasury to disclose Saudi Arabia’s treasury holdings under the Freedom-of-Information Act in 2016. .

How much in bonds do the Arab Kingdoms Hold? Would the US Bond market collapse if Saudi Arabia ditches the dollar?

While it's true that oil is the most traded commodity, Saudi Arabia is the largest oil exporter, and that Saudi Arabia buys military equipment and U.S. bonds, the notion that America's currency and bond market is propped up by Saudi Arabia is mathematically incoherent.

Saudi Arabia has never been the largest buyer of U.S. treasury bonds. In 1980, Saudi Arabia’s US government bond holdings were $12.2B, only 1.3% of America’s $908B federal debt at the time. Even if I add other oil states like Bahrain, Iraq, Iran, Oman, Kuwait, Qatar, UAE, Libya, Nigeria, and Gabon’s holdings as well, that’s $16.3B, just 1.8%. This minimal percentage indicates that the dollar isn’t propped up by these holdings.

Currently, Saudi Arabia ranks 22nd in buying U.S. treasury bonds, with $122B out of the $13.1T total foreign owned debt, ~1%. Kuwait owns more U.S. treasuries than Saudi Arabia. The largest holders are Japan, the UK, China, and Luxembourg, each with over $1T. Thus, the idea that Saudi Arabia's bond holdings uphold American supremacy is unfounded.

Does the US even depend on Saudi Arabia?

America's trade with Saudi Arabia has been declining. The graph below illustrates Saudi Arabia's crude oil exports to five major countries: America, China, India, Japan, and South Korea. While America was once the largest buyer of Saudi oil, its imports from Saudi Arabia have decreased. Meanwhile, China, Japan, India, and South Korea now import more oil from Saudi Arabia than the US does.

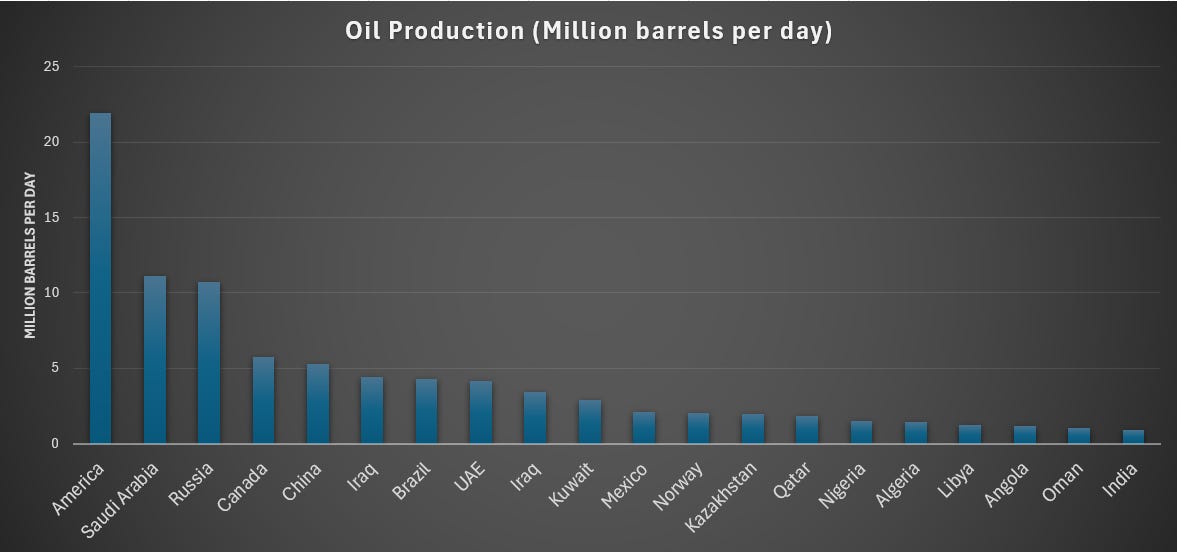

How did this happen? Ever since the shale revolution with fracking, America has managed to rapidly increase its fossil fuel production.

America is now the largest producer of oil.

Look below to see the top 20 oil producers in 2023:

In fact now America is energy independent. America not only is the biggest oil producer on earth, but also America produces more oil than it consumers.

In Summary

There is no exclusive petrodollar deal in 1974, Saudi Arabia still traded oil for pound sterling even in the 1970s and 1980s. Saudi Arabia mainly sells oil for dollars because the dollar was already the most used international currency since the 1950s due to the Eurodollar. America had the largest bond market for investors to deploy their dollars. The dollar was mainly used for its convenience & its size not because governments told Saudi to do it.

There’s a weak relationship between a country’s global reserve currency status and its bond yields. Swiss Francs are used less than the Japanese Yen internationally, yet Swiss Franc 10 year bonds give out lower returns. This is because interest rates are determined by monetary policy not reserve currency status.

The usage of petrodollars predated the 1974 US-Saudi deal, which was mainly a bureaucracy modernizing agreement, expired in 2001.

The 1974 petrodollar isn’t even the reason why America was able to stabilize inflation in the 80s & 90s. Thank Paul Volker’s rate hike induced recession.

Saudi Arabia doesn’t own a significant amount in U.S. debt instruments nor is America dependent on Saudi oil anymore.

Like, comment, restack!

Yaw, this is pretty good summary. Will assign to my students in International Business class as reading.

Been catching up on some posts that I missed recently; glad I didn't skip this one. Tremendous work, succinct but full of information. I would not have guessed Japan as the biggest holder of US bonds. China's up there, so I wasn't too far off, but still interesting to see.