How African countries borrow: Kenya Edition

I don't envy the job of an African finance minister

Kenya is a lower-middle income country (Average annual income is between $1136 to $4465 as of 2023-2024). Kenya like most African countries, suffered from the 1980s & 1990s Africa debt crisis. But since the 2000s, Kenya has had remarkable growth compared to its neighbors. Look at the graph below on how Kenya is outperforming its peers like Uganda & Tanzania.

Kenya, unlike other African countries like oil-rich Nigeria & Angola or copper rich Zambia or Democratic Republic of Congo, is not a major commodity based exporter. Kenya is a services oriented economy. Kenya is closer to an India than a Nigeria.

Kenya’s billion dollar sources of foreign exchange are remittances, tech services (Information & communication technology), transport services (airlines, ports, freight) and tea. See Kenya’s exports below:

Kenya would like to be a rich country. In the beginning of the 2000s, Kenya was given a good slate. In 2000-2004, the Paris Club - a group of sovereign lenders including America, UK, France, Japan, Israel, Brazil, Australia, South Korea, Russia, and others - decided to forgive some of Kenyan debt.

Kenya received its first credit rating from Standard & Poor (S&P) in 2006 (B+), Fitch gave it the same rating in 2007. These credit ratings enabled Kenya to borrow internationally for development.

Ideally, the Kenyan government would just issue bonds that Kenyan banks and investment firms would purchase in order to raise funds to develop infrastructure— Self Financed Development. Unfortunately, Kenya, doesn’t have that luxury. Kenyan banks get their money from Kenyan depositors and firms, but Kenya has a very low savings rate, which means Kenya can’t raise enough money domestically.

Compared to other lower-middle income peers, Kenya's savings rate is lower at around 16%, making it challenging for banks to have sufficient capital for domestic financing. Other countries in its income bracket save over a quarter of their gross income. See Kenya’s savings rate below:

In adjusted net savings per capita, the average Kenyan saves $25, meanwhile other lower-middle income countries like Mauritania saves $426 per person, Nicaragua saves $365 per person, India $348, Vietnam $247, and Nigeria: $175 per person.

Why don’t Kenyans save more?

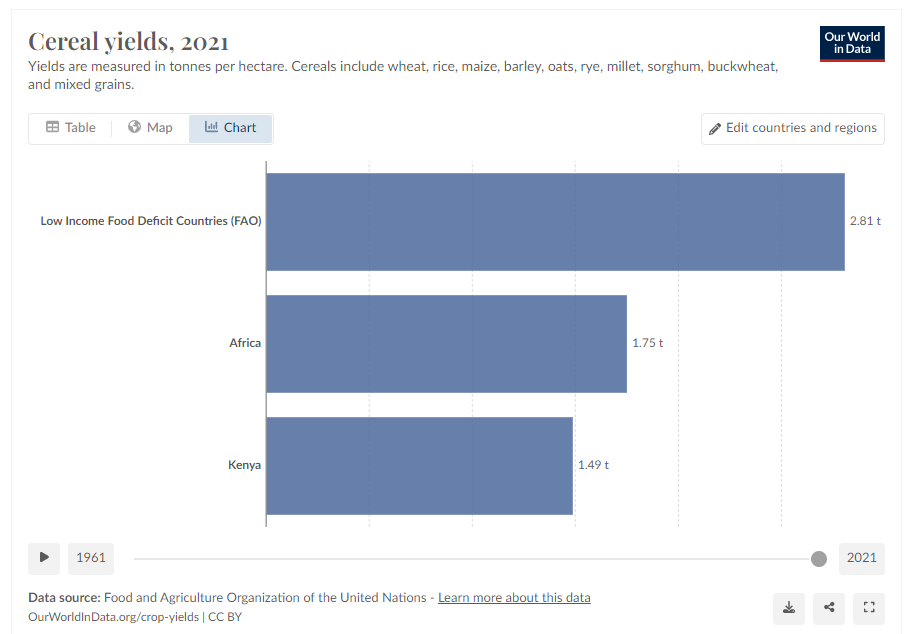

40% of Kenya’s population are farmers. Unfortunately, Kenya has very low farming productivity, farmers depend on rainfall over irrigation systems and farming is barely mechanized, which is sad because Kenya has abundant of arable land. Kenya produces less tons of food per hectare than the African average or Low Income food deficit countries. See chart below:

Limited savings among Kenyan farmers, coupled with low financial literacy, insufficient quality jobs, and restricted access to financial services beyond mobile phones, contribute to the country's low savings rate.

As a result Kenya has to raise money to build infrastructure from borrowing externally. Look at Kenya’s external debt below:

Also, Kenya unlike Nigeria or other countries didn’t have big access to resource-backed loans from China, where loans use a commodity as a collateral. So Kenya finances development with a combination of:

1. Syndicated Loans

2. Eurobonds

3. Multilateral financing

4. Chinese financing

5. A small amount of Self Financed Development

Definitions:

What is a syndicated loan?

A syndicated loan involves a group of banks lending to a nation.

Pros: It offers flexibility in payment extensions.

Cons: It often carries higher interest rates and lacks transparency compared to other forms of debt.

What is a Eurobond?

Kenya borrowed funds from the Eurobond market, which involves borrowing in euros or dollars. Various global entities like banks, hedge funds, investment firms, and corporations, including those from North America, the Arab world, China, Europe, Japan, India, Brazil, participate in buying these bonds.

Pros: African countries can access significant capital through the Eurobond market, enhancing their financial reputation if they can repay the debt. Investment funds prefer instruments that yield dollars over shillings in Kenya.

Cons: If the Kenyan shilling weakens, the dollar-denominated debt becomes costlier, potentially leading to default. This currency depreciation risk is a concern unique to developing nations, not faced by Western countries.

How does China lend money?

In 1994, Chinese President Jiang Zemin established three government-owned "policy banks": China Export-Import Bank, China Development Bank, and the Agricultural Development Bank of China. Then sometimes the China Ministry of Commerce offers zero-interest lending. These banks offer loans at concessional rates (below market).

Then there’s “commercial banks”: The Industrial and Commercial Bank of China (ICBC), China Construction Bank, and the Agricultural Bank of China. Then there’s SINOSURE which is China’s export credit agency that provides credit insurance against non-payment risks. SINOSURE has insured most of China’s Credit to Africa. These banks offer loans at commercial rates (market based).

Infrastructure projects often involve a combination of Chinese and local African contractors, with Chinese firms providing equipment and labor. China emphasizes "win-win" growth. Most Chinese lending to Africa is in US dollars, requiring a 10 to 20% down payment. China offers grace periods, extended maturities, and sometimes, below-market rates. Critics argue that there are insufficient social and environmental safeguards in Chinese-funded infrastructure projects.

What is multilateral financing?

Multilateral financing involves loans from international institutions like the World Bank or International Monetary Fund (IMF). Or even taking a loan from African Institutions like the the African Development Bank or (the Eastern and Southern African Trade and Development Bank (TDB). They are called multilateral because they are funded, owned and operated by multiple countries.

The World Bank has a financing arm called the International Development Association (IDA) which offers the most concessional loans & charitable loans you could receive besides grants. The IDA offers zero to low interest rates with extended repayment schedules. Then the World Bank has another financing arm called International Bank for Reconstruction & Development Assistance (IBRD) which offers market based interest rates.

The IMF offers multiple types of lending: Stand-Buy arrangements (SBA), extended fund facility (EFF), and structural adjustment programs (SAPs). IMF loans have lower rates than syndicated loans but higher than concession rates by the World Bank.

How Kenya has been financing development over the past decade

Post 2009, tea prices were crashing from $5 per kg to $2 per kg, which is Kenya’s main export. This meant Kenya needed to it foreign currency through external borrowing.

In 2012, after Kenya received its credit ratings, Kenya borrowed $600M for a two year term syndicated loan at a 4.75% interest rate above the London Interbank Offered Rate (LIBOR). The loan was arranged by Citi, Standard Bank, and Standard Chartered Bank who coordinated between 13 international lenders to make the syndicated loan. Unfortunately, by 2014, Kenya needed a three month extension. During the extension, Kenya raised a $2B Eurobond in a five year term which Kenya used to pay the $600M syndicated loan. This gave Kenya the remaining money to use for infrastructure, the government budget, and other expenses.

Around that same time, Kenya signed a $3.6B infrastructure loan with China’s Export Import Bank to finance railroad construction to connect Nairobi to the Mombasa port.

More borrowing:

In 2015, Kenya borrowed again and received another syndicate loan by taking on a $600M, seven year loan, from the China Development Bank Corporation.

In 2016, Kenya borrowed again took a $500M loan from African Export Import Bank and Trade Development Bank. One was a $200M loan amortized over 10 years and the other was a $300M 5 year loan.

By 2018, Kenya realized it has taken on too much debt. Did Kenya default? No in 2018, Kenya raised its second Eurobond, raising $2B in two equal tranches in 10 and 30 year tenures. This Eurobond was used to pay off the other syndicated loans to TDB and African Export Import Bank.

In 2019, Kenya raised its third Eurobond issuance, borrowing $2.1B in two tranches of 7 and 12 years. The first tranche is paid at a 7% interest rate and the second tranche pays at a 12% interest rate. This third Eurobond was used to pay off the 1st Eurobond.

Unfortunately, during covid, demand for the Kenyan shilling declined. Also, by 2023 due to poor irrigation systems, Kenya was unprepared to suffer from a massive drought. In 2021, 109 Kenyan shillings equaled 1 dollar. By 2023, the Kenyan shilling weakened by over 30%. In 2023, the shilling to dollar ratio is over 145 Kenyan shillings to one dollar.

As a result of dollar denominated debt becoming too expensive due to Kenyan Shilling. The “ponzi scheme” of borrowing new debt to pay off old debt has become unsustainable. In 2022, Kenya’s debt servicing costs now take 60% of Kenya’s government revenue…. The Highest proportion in over a decade.

In August 2023, Eurobond yields has surged now that Moody’s is flagging default risk.

What does “Kenya Eurobond yield soars” mean? It’s finance speak for “Kenya’s bonds are so bad, that if you own them, you have to sell at a steep discount for me to buy your Kenyan bond”. For bonds, yields and prices have an inverse relation, if yields rise, it means bond prices are falling.

As of July 2023, Kenya is now borrowing $1B from the international monetary fund, receiving an extended credit and fund facility of immediately $415M for the first tranche. As a result, Kenya must implement IMF reforms as a condition. Part of these IMF reforms include doubling the value added tax on fuel, slowing civil sector wage increases, adding new taxes., and selling of government owned firms & assets. All of this will overwhemingly burden the population who was rioting in July 2023 over tax hikes.

Kenya refuses to default, the finance minister is prepared to use its $7.5B in foreign reserves to pay off its latest Eurobond which matures in 2024.

So let’s judge — Has Kenya’s strategy of issuing new debt to fund infrastructure and healthcare, and then using issuing new debt to pay old debt help Kenya since starting the borrowing binge in 2006?

Food Productivity: In 2006, Kenya was producing 1.65 Tons of food (rice, wheat, maize) per hectare, in 2021, food productivity decreased to 1.49 tons which is below the African Average.

Education: In 2006, less than a third of Kenyans completed high school, in 2020, now half of Kenyans finish high school.

Coverage of Essential Health Services: The World Health Organization rated Kenya a 37% in health services in 2005, in 2019, Kenya scored a 56%.

Electricity Access: In 2006, a quarter of Kenyans had access to electricity. In 2020, 71% of Kenyans have access to electricity.

Infrastructure: Kenya now has more railroads, roads, and ports from its borrowing.

Income Growth, inflation adjusted: In 2006, Kenyans made $868 a year, adjusted for inflation in 2022 USD. In 2022, the average Kenyan made $2170 a year. Averaging 5.9% income growth per year inflation adjusted (See Chart Above)

Overall, after over $34.5B of borrowing from 2006-2021, there has been progress in some areas and lackluster performance in other areas. Let’s hope Kenya doesn’t default on its debt like Ghana and Zambia did this decade.

Sources: “Where credit is Due” by Gregory Smith was a big help in this article

Thanks - very informative read. Just a note on the Chinese lenders: the "policy banks" are China Development Bank and China Export Import Bank, which offer concessional lending. I believe China ExIm Bank provided the loans for the SGR in Kenya. ICBC, Bank of China, Construction Bank etc are commercial banks with majority govt ownership. Their loans are offered at commercial rates. And Sinosure is primarily a state owned insurer, rather than lender, for overseas projects.

Very good piece, Yaw. You deserve more comments.

_____

In view of contemporary events . . .

A brief history of the genocides and Scientific Racism of The Anglosphere.

The present is written in the past. Including in Africa which receives some attention.

https://les7eb.substack.com/p/genocide-and-economics

___________

Free to subscribe.