How Global Trade Works In Practice: Examining Modern Trade Disputes

Instead of Game of Thrones, it's a Game of Tariffs & Trade

With Trump shaking up global trade, it's worth stepping back to clearly understand exactly what he's challenging. After this breakdown, you might conclude Trump was spot-on, completely off-base—or perhaps simply decide the whole system was inherently flawed.

Today we have the World Trade Organization(WTO), but before its creation in 1995, trade was governed by the GATT — the General Agreement on Tariffs and Trade. In my opinion, GATT/WTO wasn’t some meticulously planned blueprint handed down in Washington D.C. Instead, I think of GATT/WTO more like a "Game of Tariffs & Trade": a long-running drama series with recurring characters (countries, blocs, industries), surprise plot twists (farm subsidies! intellectual property battles! lost cases!), intense haggling sessions, occasional deadlock, and climactic compromises. Each negotiation round was like a new season, continuously reshaping the global economic script.

Both GATT and its successor, the WTO, grew more powerful as more nations joined, thanks to network effects. But the system was riddled with contradictions and carve-outs. Consider, for instance, the rules on subsidies: on one hand, the WTO aggressively limits subsidies that distort global markets—like Boeing vs. Airbus subsidies; on the other hand, it explicitly allows substantial agricultural subsidies, often benefiting rich countries at the expense of poorer ones.

Broadly speaking, GATT/WTO rules fall into a handful of categories:

Free Trade Principles

Tariff Talks

Protectionist Carveouts

Developing Country Carveouts

Transparency, Fairness, and Customs Procedures

Procedural Stuff

1. Free Trade Principles

Article 1: The Most Favored Nation (MFN) provision:

Member Countries must treat the products of every other member no less favorably than they treat the products of the “Most Favored Nation”. In plain English, this means equal treatment for all trading partners in the WTO—any trade advantage given to one must be extended to all.

Interestingly, this rule is often misunderstood/not-clarified in many podcasts and commentaries. Many people mistakenly think that America granting MFN status to China meant special perks for China. In truth, when China joined the WTO in 2001, it just received the same trade conditions as every other WTO member.

A perfect example of MFN at work was the notorious “Banana Wars” Dispute of the 1990s.

The European Community (the proto-EU) offered preferential import terms to its former colonies in Africa and the Caribbean to help their markets. However, this preferential treatment disadvantaged banana firms in the Americas. This violated MFN rules, prompting America, Mexico, and other Latin American countries to challenge the European Communities’ preferential treatment towards Africa and the Caribbean, arguing they violated GATT Article I. This was one of the longest trade issues in GATT/WTO history.

Article 3: Nondiscrimination of Imported Goods

Simply put, once imported goods clear customs and tariffs, they must be treated the same as local products—no backdoor domestic favoritism. A memorable showdown happened when America and Australia took on South Korea over beef. In the 1990s and early 2000s, South Korea tried to segregate imported beef, requiring separate store displays to disadvantage foreign producers. The South Koreans lost the fight, and imported beef had to share shelf space equally.

Article 11: No Random Import Quotas/Restrictions

Countries can't arbitrarily limit how much of a product can cross their borders. Back in 1986, Japan got in trouble for capping semiconductor chip exports as part of a deal with Reagan-era America. Europe's trading bloc quickly protested this maneuver, taking their complaint to GATT. Europe won the battle, and Japan had to remove the restrictions.

Article 13: Fair Quotas & Restrictions

If quotas are used, they must be transparent and fair. In 1962, America and Europe's Economic Community famously locked horns over poultry imports in the colorful "Chicken War." Europe's quotas disproportionately hurt American poultry exporters. GATT stepped in, forcing Europe to revise their quotas and calm the feathers.

Article 15: Exchange Arrangements:

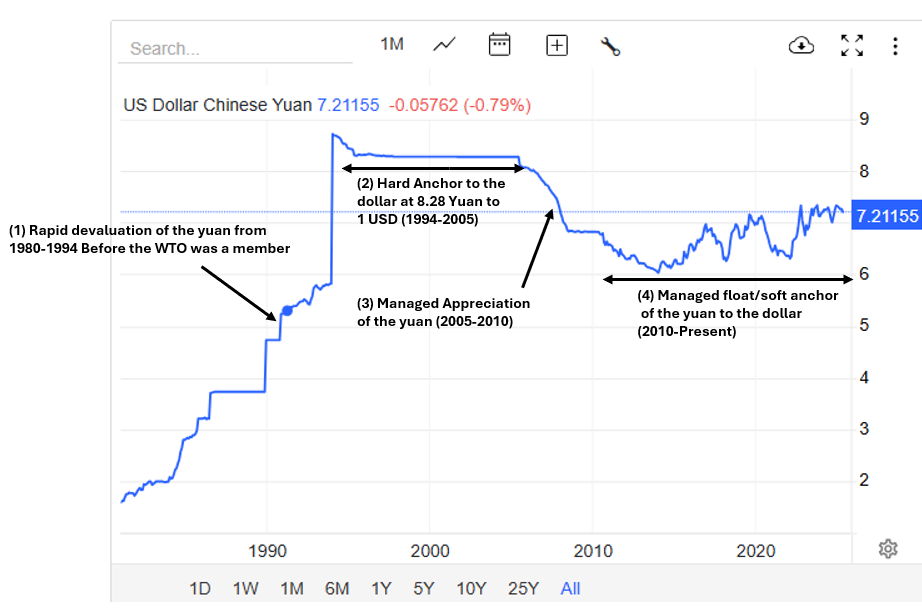

GATT/WTO Countries aren't supposed to keep their currencies artificially weak just to boost exports. Presidents from Bush to Biden have repeatedly accused China of playing dirty by undervaluing the yuan, labeling them a "currency manipulator." While China never officially got caught breaking rules, they eventually let their currency appreciate somewhat.

The WTO does not label countries as currency manipulators; rather, this designation is made by individual governments—most notably, the nation’s Treasury Department. The U.S. briefly labeled China as a currency manipulator in August 2019 under Trump’s administration but quickly reversed this decision following his phase 1 trade deal. Besides that brief moment, China has not been officially labeled a currency manipulator since joining the WTO; in fact, most of China’s major devaluations took place before China was a WTO member (see graph below). After entry, China revalued the yuan by roughly 35% between 2005 and 2010 and then shifted to a managed-float regime.

Being a managed-float regime means that China’s yuan isn’t a free market currency. China’s persistent current-account surpluses would typically put upward pressure on the yuan’s value. To moderate the appreciation, the People’s Bank Of China (PBOC, China’s Central Bank) actively intervenes to smooth the exchange rate. When the yuan threatens to appreciate too quickly, the PBOC intervenes by printing yuan to buy dollars (increasing foreign reserves and weakening the currency). Conversely, when the yuan risks depreciating too sharply, the Chinese central bank will sell dollar reserves to buy back yuan. Both actions help keep the dollar/yuan exchange rate pinned near 7.

Article 16: Subsidies:

GATT/WTO countries can’t unfairly support their domestic industries through subsidies in ways that distort international competition or harm other countries’ exports. The longstanding Boeing-Airbus rivalry showcased this vividly. Starting in 2004, America and Europe accused each other of lavishly subsidizing their aircraft giants—Europe with cheap loans & export subsidies for Airbus, America with federal, state, & municipal tax breaks and government contracts for Boeing. The WTO found BOTH SIDES guilty of improper subsidies, authorizing mutual tariff retaliation. It wasn't until Biden's era in 2021 that they finally called a truce.

Article 17: Government Trading Enterprises:

If a GATT/WTO member government owns an exporting company, it must operate transparently and fairly—no secret advantages allowed. The government owned business must operate transparently, fairly, and commercially - no political favoritism or hidden advantages. China’s rare earth minerals saga during Obama's presidency is a prime example. The U.S., Europe, and Japan challenged China's export restrictions that inflated prices and favored domestic industries. China loosened some controls in 2014, but the dispute simmers on.

2. Tariff Talks

Article 2: Concession Schedules:

Member countries agree upfront on tariff ceilings—no sneaky hikes allowed. Predictability is the key. Argentina learned this the hard way in 1997 when it tried raising footwear tariffs above agreed limits. America sued and the WTO intervened, forcing Argentina back into line.

Article 27 and 28: Adjusting Tariffs

Countries can tweak tariffs, but must follow strict procedures and compensate affected partners. For example, when the EU reshaped its chicken trade rules with Thailand in 2006, they had to carefully negotiate terms to keep everyone happy.

These articles sparked famous negotiation marathons like the Kennedy(1964-1967), Tokyo(1973-1979), and Uruguay rounds(1986-1994)—epic diplomatic showdowns shaping trade for decades.

3. Protectionist Carveouts

Article 4: Cultural Quotas

Sometimes, protecting local culture means reserving space for domestic films. Countries like France require cinemas to dedicate at least 40% of their screen time to locally produced films—a notable exception to open trade rules.

Article 6: Anti-Dumping and Countervailing Duties.

This rule allows tariffs against imports unfairly priced below cost—"dumped" onto markets. Obama's solar panel standoff with China illustrates this perfectly. In 2011-2012, the U.S. slapped tariffs on Chinese solar panels, accusing them of flooding the market at unfairly low prices. China protested, but the WTO largely backed America's claims.

Article 12: Exemption to Safeguard Balance of Payments:

This rule lets a member country temporarily curb imports to avoid running out of foreign reserves—a desperate shield against national bankruptcy. A dramatic example was India in 1990-1991, teetering on the brink of bankruptcy with 3 weeks worth of reserves. India urgently imposed import controls, licenses, and tariffs to stabilize its finances and prevent economic collapse, kickstarting a wave of major economic reforms.

Article 19: Emergency Safeguards:

If imports suddenly surge, seriously threatening domestic industries, a country can temporarily raise trade barriers. In 2002, President Bush famously invoked this to shield American steelmakers with tariffs. But Europe and China protested loudly, arguing no true emergency existed. The WTO sided with complaints from the EU and other countries, authorizing them to impose retaliatory tariffs. Facing economic and political pressure, Bush subsequently withdrew the steel tariffs—a notable failure in trade defense.

Article 20: General Exceptions:

Member countries have the right to impose trade restrictions for critical reasons like public health, safety, environmental concerns, or even morality. Qatar, for instance, legally bans pork imports because pork is considered haram in Islam (forbidden).

Australia boldly required tobacco packaging with graphic health warnings, neutral colors, and no branding for public health. Indonesia, Cuba, Honduras, the Dominican Republic, and other nations challenged this, but Australia won at the WTO.

Meanwhile, the European Union banned foreign seal products, declaring seal hunting unethical and harmful to ecosystems. Canada and Norway fought back at the WTO, but Europe’s ban stood firm by WTO rules.

Article 21: National Security Exceptions:

Countries can restrict trade citing national security—but this carveout is often abused. Trump’s infamous steel and aluminum tariffs in 2018 sparked controversy, and Biden even doubled down on these tariffs in 2024.

4. Carveouts for Developing Countries

Article 14: Developing Countries' Balance-of-Payments Crisis

This is basically the same as article 12.

This provision gives developing nations extra leeway when facing bankruptcy threats, allowing them to restrict imports more aggressively. In the mid-1980s, plunging global oil prices left Nigeria desperately short on cash. The country was almost bankrupt. Nigeria’s central bank had 1 month of foreign reserves to cover imports.

Article 18: Developing Country Provisions:

Developing nations get extra breathing room under trade rules to protect infant industries through tariffs and quotas—as long as they transparently justify these moves. Take Malaysia in the 1990s: to nurture its young petrochemical industry, Malaysia restricted imports of plastic materials like polyethylene & polypropylene. Singapore challenged this at GATT in 1995, but Malaysia prevailed, thanks to its developing-country status.

Articles 36, 37, & 38: Market Access for Poorer Nations

GATT/WTO explicitly commits to helping developing countries grow by enhancing their access to global markets. Think of it as global trade’s affirmative action—the “Generalized System of Preferences.” I’ll give three examples.

Example #1: Canada

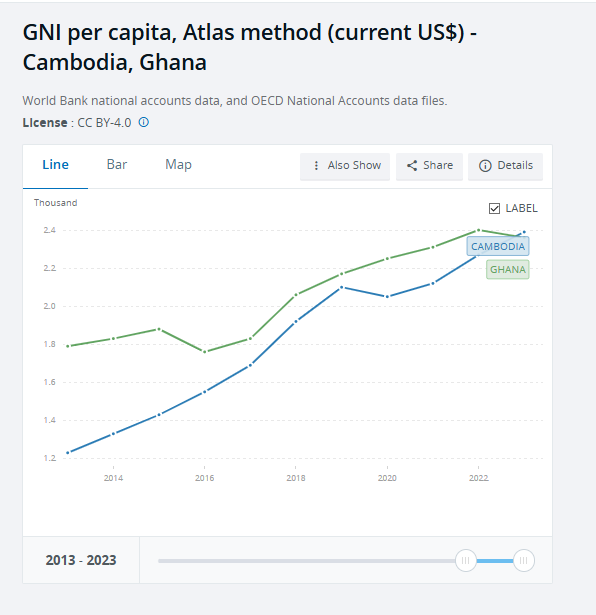

Canada’s Least Developed Country Tariff Program, launched in 1983, gave poor nations duty-free, quota-free access to Canadian markets. Cambodia seized this golden opportunity, becoming a textile player that now exports over $1 billion worth of textiles to Canada.

Cambodia, once significantly poorer than my country Ghana, now boasts a higher per capita income. See graph below:

Example #2: European union:

Europe's famous "Everything But Arms" (EBA) offers complete duty-free access to its markets for the world’s poorest countries.

Sadly, most African nations missed this opportunity. But Bangladesh didn't waste a moment—leveraging EBA, it became a leading textile exporter. Historically trailing far behind Nigeria, Bangladesh now comfortably surpasses Nigeria in per capita income ($2,530 vs. Nigeria's $1,600 in 2023). Unfortunately, Nigerian living standards have been declining since 2014. See graph below:

In 2023, Bangladesh basically sells just as much textiles and footwear as Nigeria sells in oil, gas, and gold. Bangladesh is selling low-value manufactured goods while Nigeria is selling raw materials.

The typical path upward from textiles includes electronics—phone parts, circuit boards, consumer gadgets—a path already traveled by Vietnam and Malaysia. Bangladesh is poised to follow. Nigeria, however, remains stuck exporting the same raw resources as it did in the 1960s.

Example #3: America's African Growth and Opportunity Act (AGOA)

In the Clinton Administration, America permitted African nations tariff-free exports of textiles, garments, and manufactured components to the U.S. Yet, only South Africa has significantly capitalized on AGOA, selling over $10 billion in manufactured goods annually to America. Other African countries haven't yet matched this success. None of the other Sub-Saharan African countries even sell $1B of manufactured goods to America.

5. Transparency & Customs Fairness

Article 5: Freedom of Transit

Goods must flow freely across borders without unnecessary delays, charges, or discrimination. After Russia annexed Crimea in 2014, it tried choking off Ukrainian goods headed to Central Asia through Russian territory, citing national security. Ukraine took the fight to the WTO and won. But Russia stubbornly held its ground, continuing restrictions by invoking national security carveout clauses.

Article 8: No hidden Fees

Member countries can't secretly pile on complicated fees or licensing hurdles just to block imports. Argentina learned this lesson harshly between 2012-2015 when America, Europe, and Japan challenged its overly intricate import licensing system. The WTO forced Argentina to simplify and clarify its trade processes.

Article 9: Marks of Origin

Products must clearly state their origins, but this rule can't become a disguised barrier to trade. The U.S. faced backlash from Canada and Mexico (2008-2015) for overly complicated labeling rules that demanded details on where livestock were born, raised, and processed. Canada and Mexico won their WTO challenge, forcing America to backtrack and simplify its labeling.

Article 10: Transparency in Regulations

Member Countries must openly publish and clearly implement trade regulations. In 2009-2012, America, Europe, and Mexico accused China of opaque export restrictions on commodities(bauxite, zinc, magnesium, and more). China was ordered by the WTO to clarify its rules and complied.

6. Procedural Stuff

GATT/WTO outlines how members consult and resolve disputes (Art 22 & 23), form customs unions & free trade areas (Art 24), make collective decisions & regulations (Art 25 & 26), amend rules (Art 30), withdraw (Art 31), participate (Art 32), or join the organization (Art 33). It also says that annexes, including detailed schedules and supplementary rules, are fully binding (Art 34).

Interestingly, GATT was originally intended as just a temporary measure while countries awaited the creation of the more ambitious International Trade Organization (ITO) that America proposed in Havana, Cuba in 1947 (Art 29, and this was before Cuba had a communist revolution). The ITO was expansive, covering trade, employment, commodities, labor standards, and even investment practices. U.S. Congress balked, fearing loss of economic sovereignty, so the comprehensive ITO never came to life. Even today's WTO, which succeeded GATT, is far narrower—focusing mainly on tariffs, quotas, intellectual property, and disputes.

Article 35: Opting Out

Countries can explicitly choose not to apply WTO rules to new members. During the Cold War, America refused GATT rules for Soviet Union puppet states like communist Romania and Hungary. Similarly, Morocco and Tunisia invoked this opt-out for Israel, and Portugal did the same against India during disputes over Goa. When cost-competitive Japan joined GATT, a large group of nations—including Australia, Brazil, France, Belgium, Austria, India, UK, and Apartheid-era South Africa—initially invoked Article 35 to keep Japan at bay.

Concluding Insights

In my opinion, our modern, American-led trade framework (GATT & its successor the WTO), accomplished two key objectives:

Locked in key American commercial advantages

Included enough exceptions and special clauses so other nations would willingly join the system

This dual approach worked brilliantly. The United States has been both the primary beneficiary and biggest target of the GATT/WTO dispute system—filing over 120 complaints, being sued 176 times, yet boasting an impressive 84% win rate at the WTO.

America has used the system that it has created to pry open markets (India), shield key industries (steel, solar panels), and block rivals’ special deals (European banana preferences). Yet it has also lost enough cases—China forcing Bush to drop its steel safeguards in the 2000s, India crushing Obama’s “buy American” government procurement rules for solar panels, Brazil forcing Obama to reform America’s cotton subsidies program to farmers, or the EU beating Clinton in America’s export subsidy scheme for “foreign sales firms”—that member states trust the WTO as an impartial umpire rather than merely an instrument of American power.

This careful blend of power and fairness—the famed "rules-based order"—keeps developing nations engaged and confident in the system as well. Nigeria shielded its currency reserves during the 1980s economic crisis, India can beat America in trade cases, and Malaysia protected its emerging industries in the 1990s.

Frankly, the system can seem highly contradictory, and which cases actually move forward often depends heavily on the influence of powerful lobbying groups. For instance, America had no issue with Europe’s “Everything But Arms” initiative, which aimed to support African textiles, yet Europe’s preferential trade rules for African bananas were considered completely unacceptable.

Regardless, both Trump’s & Biden’s moves to cripple the WTO appeals court and disregard rulings threatens to unravel that balance. Can a system built on U.S. dominance, yet reliant on American respect for its own rules, endure when America itself rejects the order it created? The answer could determine whether global trade remains a predictable cooperative endeavor—or plunges into a chaotic free-for-all.

No matter the rules, every country tries to gain an advantage somewhere. Think Trumps gambit has opened eyes and minds around the world and the unfairness of many markets. Hope the U.S. doesn't destroy the principles of the WTO's founding basis because over the years it has been around, as you point out, its rules have been effective. By the way, my daughter is currently in Ghana trying to rescue persons in economic slaveholder conditions. A few weeks ago they rescued 74 families from these conditions in Pakistan.

Take first ppt, by Carlos Correa of the South Centre, for an overview of TRIPS

https://drive.google.com/drive/folders/1zifN02NuGJKlr-Ib5NK-QRfLsOPMoMnr?usp=sharing