Crude Oil, Other commodity Cartels, & America's "Rules based Order"

A quick primer on these three

Crude oil stands as a paramount global resource. Since the 1850s when Americans in Pennsylvania pioneered productive oil drilling and Polish chemists developed oil refineries, crude oil’s significance has been unparalleled.

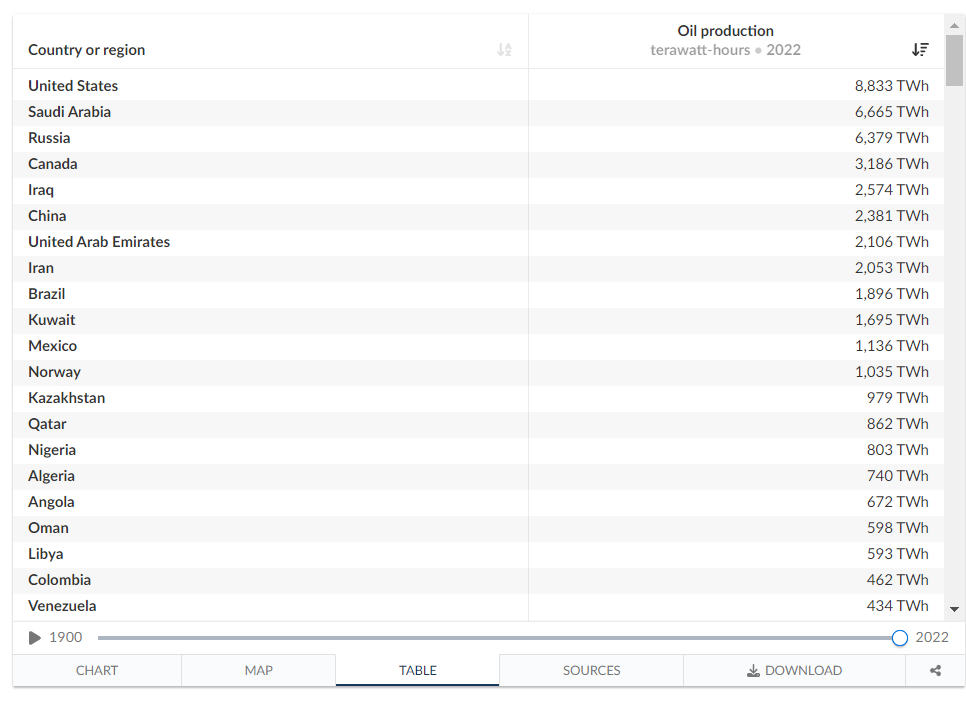

As of 2022, the United States leads as the world's largest producer of crude oil. If Africa was a country, Africa would be the fourth largest producer, at 3704 TWh per year, producing slightly more than Canada.

"Despite America and China being major oil producers due to their large populations (330M and 1.4B respectively), they also consume a significant portion of their own production. A more intriguing aspect to explore beyond production is the global trade of oil.

Crude oil stands as the most traded commodity worldwide, with use cases spanning over 6000 products including roof shingles, ink, transportation fuel(gasoline/kerosene/diesel), bicycle tires, plastics, purses, toothbrushes, shoes, artificial limbs, lipstick, phones, detergents, mops, skis, roads, toilet seats, electricity, automobiles/trucks, and more.

Given its indispensability, oil operates differently than other commodities in economic terms, exhibiting relatively low price elasticity."

What is price elasticity?

Price elasticity measures how demand responds to price changes. Unlike most natural resources, where higher prices lead to lower demand and vice versa, oil is relatively inelastic compared to other commodities. Oil demand remains stable even with price increases due to limited substitutes.

Before electric vehicles, oil was THE transportation fuel. Even now, tankers, ships, and most cars depend on oil. A good rule of thumb is that a change in 10% of oil demand causes a 75% price shift.

Wit the exception of oil’s commodity cartel - The Organization of Petroleum Exporting Countries (OPEC), most commodity cartels struggle to raise prices due to the elasticity of natural resources. Here are some examples:

Attempted Cartels:

Copper Cartel - In 1967, Zambia tried making a copper cartel with Democratic Republic of Congo, Chile, Zambia, Australia, Indonesia, Papua New Guinea, and the former Yugoslavia. It died by 1990 because copper has many substitutes. Wiring firms can use aluminum wiring instead of copper wiring, Telecommunication firms can use fiber optic cables instead of copper, silver can be used in conductive applications instead of copper. Copper ore is a $90B market, 9% of the oil market.

Bauxite/Aluminum cartel - In 1974, Australia, Jamaica, Guyana, Surinam, the former Yugoslavia, Sierra Leone, Guinea, and Greece formed the International Bauxite Association. Unfortunately bauxite and aluminum have numerous substitutes. Iron/Steel, Oil-Plastic, copper alloys(brass and bronze), titanium, manganese, and nickel alloys are all used as substitutes for bauxite for automobile, aerospace, electrical, and electronic company buyers. The cartel failed due to its price elasticity, bauxite/aluminum ore is now a 6B market, a rounding error of the oil market.

Rubber cartel - In 1970, Asia made the Association of Natural Rubber Producing Countries composed of Papua New Guinea, Bangladesh, Singapore, Thailand, Indonesia, Malaysia, Sri Lanka, India, Philippines, Vietnam, Laos, Cambodia, Burma, and China. It’s a very weak cartel. The reason is because oil made- synthetic rubber killed the demand natural rubber market. Rubber is now a $18B market, roughly 2% of the oil market.

Tin cartel - Democratic Republic of Congo, Burundi, Rwanda, Bolivia, Indonesia, Malaysia, Nigeria, and Thailand were part of a Tin Cartel when they all reached independence by 1960. The tin cartel got disrupted by aluminum and recycling. In 2021, the entire tin market is ~$8B a rounding error to the 1T oil market.

Only the Oil Cartel has seen success due to oil's relative price inelasticity and lack of substitutes. Crude oil is the most traded good on Earth, accounting for 4.52% of the $21 trillion global trade volume, approximately $1 trillion in 2021. See the diagram below for all goods traded:

The biggest sellers of oil are in the middle east, with Saudi Arabia selling $136B at #1, Russia selling $113B at #2, Canada selling $81B at #3, Iraq selling $72B at #4, and America selling $68B at #5. The biggest buyers are the European Union, China, America, India, and South Korea together buying over two-thirds of crude oil. Africa, as a continent, would be #2 and sells $131B crude oil, slightly less than Saudi Arabia. You can see the major exporters in 2021 below:

Ten years ago, the oil market was much bigger - $1.4 Trillion. Thanks to nations trying to take climate change more seriously by using less pollutant energy inputs — like natural gas, nuclear, wind, geothermal, corn-based ethanol, and solar — crude oil exports have diminished nearly 30% to nearly $1T.

In terms of nations with the most oil reserves, these are the top 22 nations by oil reserves. Africa as a continent has 19.92B cubic meters of oil, putting its reserves between Kuwait and Iraq. If the Soviet Union were still around (Russia, Ukraine, Kazakhstan, Azerbaijan, Belarus, and 10 other countries), then Moscow would have control of 18.6 billion cubic meters of oil instead of 12.72 billion cubic meters, pushing Moscow’s oil control from 8th place to 6h place. Because of its the most traded good on earth, oil affects foreign policy.

More crucial than total oil reserves is the oil reserves per capita. China, with the 13th largest reserves globally (4.14Billion cubic meters), has a low oil per capita share due to its large population of 1.4 billion - 2.87 cubic meters of oil per person. Meanwhile, United Arab Emirates (UAE) has 9.4M people and 15.55 billion cubic meters of oil, giving UAE an 1556 cubic meters of oil per person. The average Emirati has 542 more oil per capita than a Chinese person.

Kuwait has 4M people but 16 billion cubic meters oil, giving it roughly 4000 cubic meters per person. Kuwait is oil rich. Meanwhile Nigeria has 6 billion oil reserves for 200M people, giving it ~28 cubic meters per person. Nigeria isn’t oil rich, but since oil makes the most of its exports, Nigeria is rather oil dependent.

Crude oil has to be pumped, depressurized, processed, piped, and loaded into tankers to travel through the sea. During WW2, it was fairly common that nations would steal oil fields or block each other from receiving oil barrels. But in the post WW2-era, when America created American hegemony “The rules-based-order”, America has safeguarded oil trade routes for all nations, even those it may not favor. This effectively means America subsidizes trade and container protection worldwide. Here are major oil shipping routes and chokepoints that America protects with its military:

Without American protection, other nations would need to increase military and naval expenditures to secure trade routes. America’s argument is that this could lead to heightened global conflict. Because America defends trade for the entire globe, is why America has the largest military on earth.

In a future article, we will talk about the price of oil over time and other commodities.

Note:

It’s not true that “America spends more than the next 10 countries combined” anymore. China used to say their military budget was roughly $220B. In reality, Beijing’s military was revealed to be $700B in August 2023. America’s military budget for 2023 is $877B. America still has the largest military budget, but the gap is not as big as we once thought.

In my personal opinion, the job of “global trade protection” should be the job of the United Nations…Not the United States. But since we will probably always live in a divided world, America will take up the mantle for the foreseeable future.

Sources: All are linked!

Well researched and written article. I wasn't even aware the Americans provide so much muscle to protect the oil trading route on the high sea. This is an eye opener, and I think it's safe to say American hegemony is not going anywhere for the foreseeable future. Any other alternative to American hegemony that we are told is being created is a dream and will for a long time remain a dream.

Best and most valuable article I have seen in a long time. And the Polish history of oil industry!

Explaining 'price elasticity' is very telling of the real challenge of reducing fossil fuels; it is so much more than 'fuels'!

UN as guardian of trade routes? With military means and costs? Dag Hammarskjöld was a great secretary general, but not much of a military commander. I don't think the UN should go in this direction, even if it could; and we need to be grateful to the US for setting an example, even with it's many questionable shortcomings.