The 1980s & 1990s African Sovereign Debt Crisis: A Primer

The longest debt crisis you never heard of unless you are a macro-finance nerd

“Unless and until some broad agreement on the debt issue is reached, the prospects of an increasing number of countries defaulting will become larger and larger” and “the prospect of a sustained and sustainable African recovery will be in jeopardy.” — Adebayo Adedeji, Executive Secretary for United Nation’s Economic Commission for Africa

In 1987, in Addis Ababa, Ethiopia, Adedeji spoke about the ongoing African Debt Crisis. Lasting until the 2000s, it involved defaults, rescheduling, and restructurings. Western activists pushed the IMF to erase debt, while China’s economic boom lifted commodity prices by buying commodities from Africa, ending the debt crisis.

Unless you are a macroecon/finance nerd like me, you probably never heard of the African Debt Crisis. The African Debt Crisis caused two lost decades from 1980 to 2000, resulting in stagnating and declining living standards when adjusted for inflation.

In 1984, Africa’s external debt (dollar denominated debt) was $150B. By 1988, it was $230B. The debt was growing, while at that time African economies were shrinking.

To put in perspective how poorly performing the continent was back then, Nigeria’s external debt equaled Venezuela’s in 1990. They are both petrostates that mainly earn foreign currency (FX) through oil. Venezuela’s debt was 285% of its export earnings, for Nigeria, it’s external debt was 370% of its export earnings. However in 1990, the average Nigerian made 20% of what a Venezuelan made.

What were the Moving Parts of the Crisis?

Like mainly crises, you can start this in the middle east due to oil.

#1 The Oil Rich Middle East - Petrodollar Surplus

A Petrodollar is a U.S. dollar earned after selling oil.

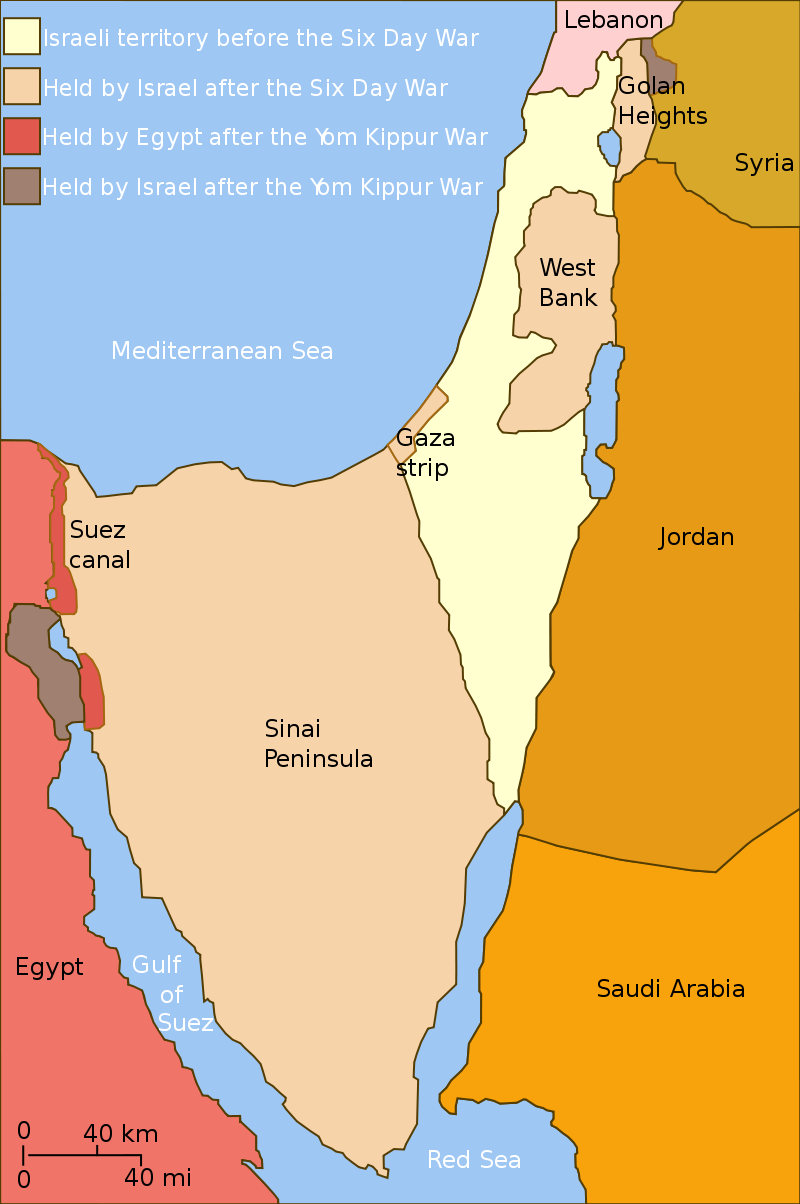

In 1973, Egypt, Syria, and other Arab states attacked Israel in the Ramadan/Yom Kippur War to get back the Sinai, Golan Heights, and possibly destroy Israel. You can see the map of the territory back then below:

America & its allies aided Israel and the Soviet Union & its allies aided the Arabs.

King Faisal of Saudi Arabia became angry at Western intervention. He organized the oil cartel, Organization Arab Petroleum Exporting Countries (OAPEC) to launch a one year oil embargo on the West and cut production, which increased oil prices by over 2.5x in inflation adjusted dollars.

- In 1979, another oil price spike occurred. A major oil producer, Iran, had a revolution and stopped producing oil for a bit. The production cut made prices rise an additional 2.2x. (Also Israel gave back the Sinai to Egypt and dismantled their settlements there thanks to Jimmy Carter. But this is irrelevant.)

During this time, the oil rich Middle Eastern Arab states, especially Saudi Arabia, Iraq, Libya, Kuwait, Qatar, Bahrain, UAE, and Oman were making killer profits. The countries total current account surpluses were over $450B by 1981. ($1.4 Trillion in 2022 dollars)

Below you’ll see a chart on how oil prices moved back then:

#2 Recycled Petrodollars from Western Commercial Banks:

Between 1973-1980, the Gulf states used their oil revenues to buy U.S. treasury bonds and kept their money in Eurodollars (U.S dollar denominated deposits in non-American banks or American subsidiaries in Foreign banks) in American, Japanese, and Western European banks like Lloyds, Barclays, Dai Ichi Kangyo, Citigroup or Credit Suisse.

By depositing their oil revenues to Western commercial Banks, this gave the Western Commercial Banks more money to lend out. Especially “FAFO” money to do risky lending in developing countries.

#3 Developing Countries wanted to borrow to grow

Developing countries in Latin America, and the recent independent nations in Asia and Africa wanted to borrow more money to grow their economies and invest in new industries, education, infrastructure, and healthcare. The developing countries were eager to use the money to leapfrog growth and catchup with the West or just steal. The Japanese and Western banks wanted to get sweet huge returns lending to projects in the developing world. So it was a match made in heaven.

Over 70% of the debt was borrowed by Brazil, Mexico, Egypt, Pakistan Argentina, Peru, Democratic Republic of Congo, South Korea, Philippines and Nigeria.

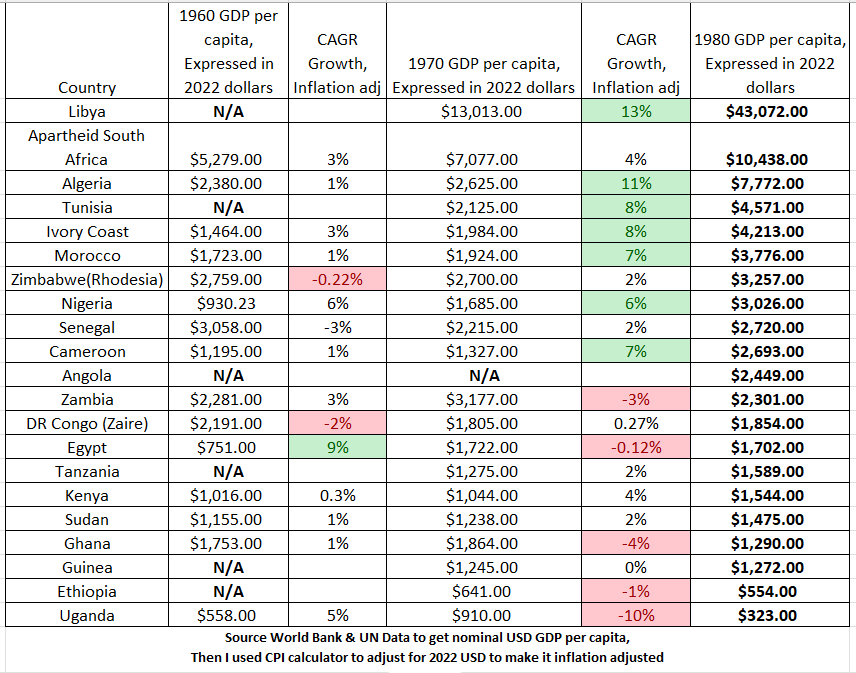

Overall the 1970s-1980 was a decent time for developing nations’ growth. Tunisia, Ivory Coast, Nigeria, Morocco, Libya, and Cameroon had great growth. While Senegal, Congo, Uganda and Ghana weren’t doing so well. Below you can see how certain countries were doing.

These 21 African countries’ economies represent nearly 90% of the GDP in Africa. AKA, 40% of the economies represent 90% of the total output of Africa.

*Note there are some countries we don’t have data for in some years.

As for the emerging market projects that Western banks lent to, some projects & companies were failing and some projects were winning.

A success story was in South Korea. Entrepreneur, Chung Ju-Yung borrowed money Western banks and Korean state owned banks to expand Hyundai. South Korea used to be a poor backwater, but Western Banks lent to Hyundai and because of the company’s great execution, the Hyundai chaebol helped Korea turn into a automotive, electronics, shipbuilding, and construction juggernaut. South Korea leapfrogged from third world to 1st world.

Some examples of failure and corruption was in Nigeria. The government tried utilizing government owned enterprises (GOE) to develop a ship manufacturing industry as well. Before independence, Nigeria made the GOE - called the Nigerian National Shipping Line (NNSL). Nigeria borrowed hugely from Western banks for the GOE and had rich Nigerian businessmen operate it. However, there was extensive corruption and theft in the Nigerian shipping firm. In the late 80s and early 90s, many people and assets in the NNSL were arrested in European ports in Livepool & London, UK and Rouen, France for drug trafficking. By 1995, the company dissolved. Nigeria resorted to paying and borrowing shipping services from foreign firms.

#4 Western Central Banks raised interest rates to start a recession, boost unemployment, and curb inflation

In the mid to late 1970s, the central banks in America, Western Germany, Japan, Canada, Belgium, and etc. increased interest rates to curb the inflation caused from the OPEC oil production cut and then later the Iranian Revolution oil production disruption.

#5 Western Commercial banks stopped lending to Developing Countries

Due to Western Central Banks raising the overnight lending rate for commercial banks, this pushed up the floor rate from single digits to mid-high double digits,. All interest rates increased in the West. When Western governments were auctioning treasury bonds (debt instruments governments sell to raise revenue with interest to pay back), the rates went from 5% to over 10-17% for 10 year bonds.

Here how high the rates got in a few countries. Look below to see:

By the time Western governments were offering double digit returns for 10-year bonds, western commercial banks decided to buy more safe Western, 10-year government bonds than do risky lending to developing countries.

Developing countries could no longer borrow new loans to pay off old debts. Africa was now suffering from a capital stoppage.

#6 The Commodity Bust

Eventually, the West and Japan experienced recessions between 1980-1983 which reduced commodity demand. America had a decrease in 1.8%, Canada 5%, and Western Germany had a 1.3% decrease. The result was that industrial firms were reducing their volume of purchasing commodity imports. The prices for commodities from gold, silver, oil, copper, platinum, and etc. declined post 1980. This ruined the commodity exporting developing countries’ balance of payments because if commodity prices decline, so does foreign reserve inflows and government revenues. This led to a balance of payments crisis where developing economies in Latin America and Africa lacked foreign reserves to import fuel, food, industrial goods, and medicine since their export revenues were declining. This led to Latin American and African governments and businesses defaulting or restructuring their debts and sharp economic declines. This kickstarted the Latin debt crisis which happened between 1982-1989. The African debt crisis also commenced but it lasted much longer… Lastly, the commodity drop also helped kill the Soviet Union, which relied on natural resource exports after Soviet industry starting stagnating in the 1970s.

Below you will see a Washington Post article on how the oil commodity crash killed Nigeria’s economy in 1982.

This didn’t just happen with oil. Almost every commodity crashed in the 1980s and recovered in the 2000s. Same story with uranium, platinum, gold, tin, copper prices, and etc. We are talking about over 70% drops in prices, which led to massive declines for African government revenues.

The more industrialized an economy during the 1970s borrowing splurge, the less steep their decline since they didn’t rely on commodities as much.

Every African economy, except Egypt got poorer from 1980 to 2000s. Adjusted for inflation, by the late 90s/early 2000s, Ghana, Uganda, Zambia, Sudan, Guinea, Congo, Tanzania, Kenya, Angola, Zimbabwe, Senegal, were poorer than they were at independence. Apartheid South Africa was sanctioned hard.

These countries sought IMF loans for support, which required selling unprofitable state owned enterprises, removing fuel subsidies, cutting government spending, and letting the currency float, which would result in a currency devaluation. Due to falling commodity prices, very few IMF structural adjustment programs led to a rebound in real economic growth.

The former middle income and growth stars of Black Africa — Nigeria, Ivory Coast and Cameroon declined to 1960s levels by the late 90s/2000. These countries were drowning in debt, interest payments with declining revenues and low FX to buy medicine all at the same time.

The fact is, that despite rapid growth in Nigeria, Ivory Coast, and Cameroon in the 70s and early 80s, their nearly 20 year rapid decline & stagnation after the commodity bust demonstrated that the type of growth matters. Their growth came through mainly increased production of raw materials like oil, gas, manganese, and cocoa. None of these formerly fast growing middle income African countries were able to conjure up World-competing textile, oil refinery, electronics, cars, ship building, or toy making industry like formerly poor nations of South Korea, Taiwan, or Singapore was at the same time.

This period was so abysmal for Africa that, NYT was writing articles like “In Poor, Decolonized Africa, Bankers Are New Overlords” and 'Lost Decade' Drains Africa's Vitality” in the 90s. Look below to see how Africa was declining.

Botswana left the debt crisis unscathed. Egypt was one of the few economies that had some growth. Part of that was because Egypt was loyal to United States for fighting in the Gulf War. America, Saudi Arabia, and Kuwait forgave $6B of Egyptian debt.

#7 90s Soviet Collapse

In 1990 to 1991, the communist Soviet Union split into 15 independent countries. All the former communist countries, including the super resource-rich ones such as Russia, Kazakhstan, Uzbekistan, Azerbaijan, and Turkmenistan, fully integrated themselves into the international commodity markets for the first time. Their vast reserves flooded markets with diamonds, natural gas, metals, and minerals, causing prices to plummet. Their inclusion continued to damage African economies that depended on high natural resource prices to grow and gain foreign exchange since they had new well-endowed competitors. This extended the African debt crisis in until the 2000s.

#8 Shake ups in the 2000s

Two things occurred which ended the debt crisis:

1. Debt Erasure via IMF or Paris Club

A) IMF Debt Relief:

Western Activists and the Pope pressured the IMF to wipe out developing countries’ debt under the early 2000s “heavily indebted poor countries’ initiative”.

B) Paris Club Debt Restructure

Countries like Morocco & Egypt were too rich, by gross income per capita standards to qualify for the poverty initiative, so instead of total debt forgiveness, these nations restructured their debt with the Paris Club where some debt was forgiven while other pieces of debts were renegotiated - interest rates were lowered and/or the period of the loan was lengthened.

2. China’s rise

China's ascent under Deng Xiaoping began with market reforms in 1978, gradually liberalizing its economy and abandoning economic communism that his predecessor, Mao Zedong pursued. He initially allowed village-township enterprises to compete with state owned enterprises and made some market reforms to agriculture. By the 1990s, Deng's Southern Tour ushered in greater openness— opening up coastal cities for investment, fostering the Shenzhen & Shanghai stock markets, increasing FDI allowances from Japan, Taiwan, Hong Kong and the West, and promoting private entrepreneurship. As China's industrial expansion surged in the 2000s, it became a major consumer of commodities, boosting prices and aiding African economies until 2014.

Note:

I noticed thanks to hOser’s youtube video, I increased my subscribers significantly. Thanks hOser!

Like, Comment, Share, and Subscribe!

Links are attached!

Nicely written. I really like how you break up all the reasons for the crisis with clear headers. This enables the reader to skim or read each section as they so choose.

I wish more writers did the same.

Thank you