The International Monetary Fund (IMF) is one of the financial agencies of the United Nations. There’s 190 nations that are IMF members, examples of non-members are Cuba and North Korea. Below are the biggest IMF borrowers with Argentina, Egypt, and Ukraine at the top.

The New American-Led Order

During WW2, America was pretty certain that it would beat Nazi Germany, Japan, and Italy. So in 1944, in Bretton Woods, New Hampshire, America created an international conference with its 44 allies on how America would restructure the world. The nations that attended were:

East Asia & Pacific: Australia, Republic of China, New Zealand, Philippines

Europe: Belgium, Czechoslovakia, France, Greece, Iceland, Luxembourg, Netherlands, Norway, Poland, United Kingdom & its colony British India, Yugoslavia, Soviet Union

Latin America: Bolivia, Brazil, Chile, Costa Rica, Dominican Republic, Ecuador, El Salvador, Guatemala, Honduras, Mexico, Nicaragua, Panama, Paraguay, Peru, Uruguay

North America & Caribbean: Canada, Haiti

Africa: Egypt, Ethiopia(Abyssinia), Liberia, Apartheid South Africa

Middle East: Iran(Persia), Iraq

If you are wondering why there isn’t more countries in Africa and Asia attending the conference is because most of the nations were colonies in 1944. Ghana, Singapore, Korea, Nigeria and etc. did not exist as sovereign nations yet. Japan, Germany, and Italy were axis powers so they weren’t invited.

History of IMF

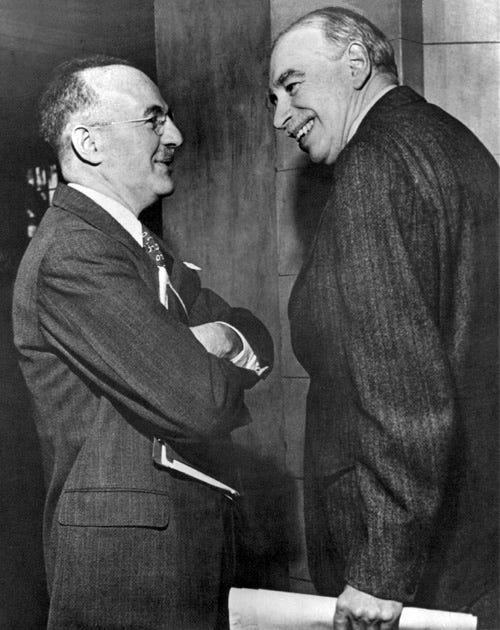

In this hotel, America created an international financial monetary system for humanity in 1944. America made the International Bank for Reconstruction & Development (IBRD) which became part of the World Bank and the International Monetary Fund (IMF). The idea of the IMF was conjured up by Harry Dexter White, the U.S. Treasury Department Official, who was also a spy for the Soviet Union, and John Maynard Keynes, the man who invented Keynesian Economics!

America wanted to ensure that WW2 would be the last hot war fought amongst big powers, so America wanted to create a financial system that would make war more politically stupid. Before WW2, the United Kingdom controlled the world’s financial system. During WW1, UK, Italy, France, Germany, and etc. temporarily removed the world standard to pay for WW1, by issuing bonds. Ultimately all of Europe experienced massive inflation, including Germany. After WW1 ended most countries returned to the gold standard. Between WW1 and WW2, nations had high tariff barriers (taxes on imports to protect the domestic economy), nations would devalue their currency on purpose to flood rival nations with cheap imports to destroy the nation’s domestic business, and etc. These trade wars exacerbated the Worldwide Great Depression. What’s the best way to end a trade war if you need access to a nation’s resources? Start a real war .

In 1944, America told all of its allies that they need to anchor their currency’s value to the US dollar within a range. In turn the US dollar would be anchored to the price of gold ($35 per ounce). A country’s currency price is dependent on the supply and demand of goods of that' nation’s services, so if let’s say Belgium was not exporting a lot and its currency fell, then Belgium’s central Bank would sell it’s US dollars (its foreign reserve) to buy back its own currency, the Belgian franc, to make sure Belgium’s currency stays within its accepted currency value range.

Why was America able to tell its allies what to do? For two reasons, in WW2, continental America was basically untouched by the wars. Britain, France, and everyone else was virtually destroyed in terms of industrial production and their economies. In addition, during WW2, since America entered the war late, UK, France, and other countries were borrowing money from United States (UK would issue treasury bonds, and America would buy them) and in return America would provide Europe weapons. This was called the lend lease program. As a result, of France, UK, Soviet Union, France, China, Brazil, Turkey, and other allies were borrowing from America to purchase weapons. America owned 75% of the world’s supply of gold by the end of the war. The allies were so indebted to America, that America could tell the world what to do. America could have colonized Europe if it wanted to, but since America knew the Soviet Union would be a problem, America invented a “indirect colonial system”: instead of America oppressing colonies, America would provide security and protect its allies ships to trade goods in return for alignment on American values. Examples of this are the Marshall Plan, NATO, changing Japan’s constitution after the cold war. Technically between 1945-1991, America replaced and innovated on Britain’s world empire.

The Soviet Union saw the IMF as an expansion of global capitalism, so the Soviet Union did not join. Communist Poland left the IMF in 1950. Communist Czechoslovakia was ejected in 1954 for not providing data, and Cuba left in 1964. After the 1989-1991, revolutions and revolts against communism, Eastern Europe abandoned communism, Soviet Union split into 15 nations, Czechoslovakia split in 2, and all of those nations joined the IMF.

The End of the Gold Standard

In 1971, Nixon ended the gold standard. Why? There wasn’t enough gold to match the amount of trade that was happening on earth. If America runs trade deficits (which it did), which means America buys more goods from the world, than it sells to the world, then America will eventually run out of gold. France infamously, replaced their dollar reserves for gold as a policy. In 1960, world trade was $348B(25% of World GDP: $1.392), by 1971, world trade was more than 2x! $828B! Because of the deficits America was running during the Vietnam War, America was going to run out of gold, so instead of exchanging gold for goods, America removed the tie on gold to the dollar, so instead of America buying goods with gold, America could buy goods with dollars or treasuries (on credit). The world system went from a system where every US ally had currency was backed by the US dollar, which was backed by gold, to a fiat currency system. This means a country’s currency is no longer backed by gold, but on a country’s ability to pay back its debts.

How the IMF is Organized

America has a board of governors who represent the 190 member states. The governors are finance ministers/ central bank directors. There are 24 executive directors who meet 3x a week. Eight directors represent individual nations: America, UK, France, China, Germany, Russia, Japan, and Saudi Arabia. The other 16 directors represent the rest of the world, grouped by world regions. The directs make decisions by consensus and is managed by a managing director who is appointed for 5 years. The Director is either a European or an American.

Each member contributes a sum of money called a “quota subscription”. The richer the country, the larger the quota. The top 10 biggest contributors & nations with the biggest voting share are the European Union(EU), United States, Japan, China, the United Kingdom, India, Russia, China, Brazil, and Saudi Arabia respectively. The EU nations are in green:

Conclusion:

America lent weapons to the allied forces in WW2 before participating and America was untouched from the war (except pearl harbor). By WW2’s end, all of Europe was destroyed and America owned 75% of the globe’s world reserves. As a result, America was able to re-write the global financial system with the IMF being a key institution. We will get into what the IMF actually does next time.

Sources are underlined! Also..

Quota Subscription:

https://www.imf.org/en/About/Factsheets/Sheets/2022/IMF-Quotas

How much indebted countries owe to the IMF https://www.imf.org/external/np/fin/tad/balmov2.aspx?type=TOTAL

End of the World is Just the Beginning, Peter Zeihan

Somehow I missed this post. Just getting to it now. Very interesting and informative.

I am glad that you are continuing the series.