U.S. Debt Part 1: The Background Info

China owning American treasury bonds isn't going to cripple America's kneecaps anytime soon dawg....

Basics

According to the U.S. Treasury as of October 2022 (and still holds true in November), America currently has $31T in debt. Relax…

$31T is the gross amount of government debt. $6.8T is money the government owes to itself.

How does the government owe money to itself?

Mainly two ways: The U.S. government’s Medicare and Social Security agencies buy government debt instruments. AKA it’s government agencies purchasing government debt.

If you are a W2 earner, every paycheck you receive has taxes deducted from it due to the FICA taxes, the taxes that go to Social Security & Medicare.

The social security taxes collected from the social security administration(SSA) is then deposited to the Old-Age & Survivors Insurance Trust Fund and the Disability Trust Fund — Collectively known as the “Social Security Trust Fund”. The Social Security fund then takes tax deposits and invests them in to treasury bonds (explained later).

The Center for Medicare & Medicare Services (CMS) takes Medicare taxes. Then deposits the funds in the Hospital Insurance Trust Fund and the Supplementary Medical Insurance Trust Fund — “The Medicare Trust Fund”. The Medicare trust fund takes tax deposits and invests them in treasury bonds as well.

So the SSA & CMS , U.S. government agencies, are lending to the U.S. government by buying U.S. treasury bonds.

How does the government make and spend money?

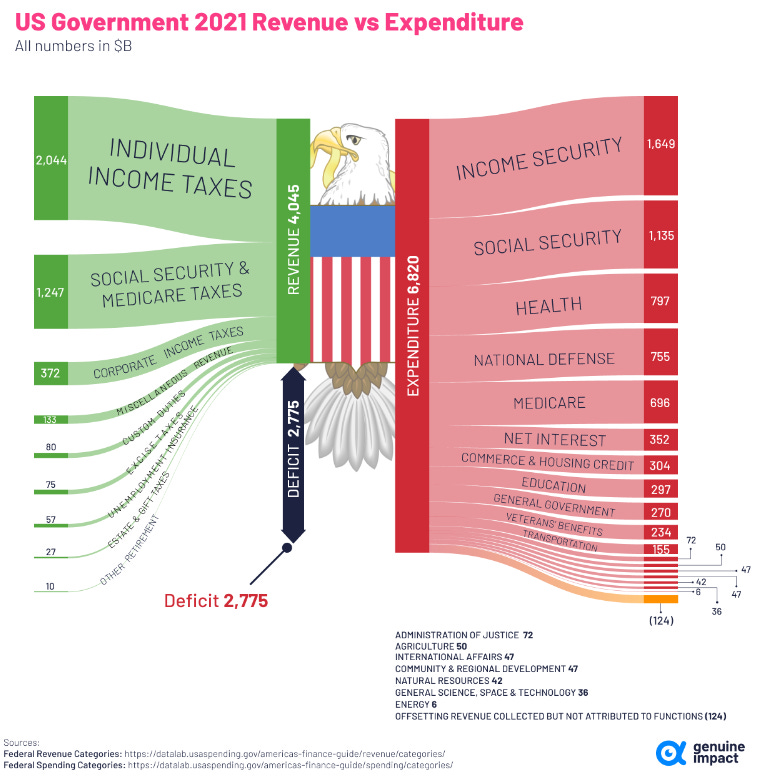

The U.S. government makes money through levying taxes and then spends it on stuff like military, healthcare for elderly, and giving grants to science research. When the government makes more than it spends, we have a budget surplus, and when it spends more than receives we have a deficit. So if the government makes $4T in one year and spends $6.8T the same year, we add $2.8T to the deficit (like the US did in 2021), to pay for the deficit, every week, the U.S. government borrows money by selling its debt to anyone willing to buy it in an auction. Governments find lenders by issuing (creating) treasury bonds, treasury bills, treasury notes, floating rate notes, and treasury inflation protected securities. If you want, you can go buy them right now in the U.S. Treasury’s website. Individuals, small businesses, large corporations, family trusts, foreign governments, banks, investment firms, pensions, foreign central banks, and foreign investment firms buy U.S. Treasuries everyday. If you buy a treasury bond from the U.S. government, you are a lender to the U.S. government. You can check out yield(the interest rate that the government pays on its debt instrument) here.

The auction works by having a primary market and a secondary market. As of 2021, there are 24 Wall Street firms that buy U.S. treasury securities on the primary market. Every week when the U.S. government auctions out treasury bonds, the securities divisions of firms like Goldman Sachs, Wells Fargo, Toronto Dominion, Barclays, Morgan Stanley, and etc. buy these securities, and then these firms sell these securities on the secondary market.

How the Treasury auction works:

The treasury bond market works like a Dutch auction - where the auctioneer asks a high asking price to sell something, and then the price is lowered until some participant accepts the price or it reaches a price floor. It’s called the Dutch auction because this is how Dutch Tulips were auctioned…

This is how the bond’s interest rate is determined:

Let’s say the treasury auctions $25B in financial treasuries at 3.01% interest rate, first the non-competitive bids go first (bids for smaller retail investors), and if you add all their auctions, it adds up to $1B. They will get a rate set by the competitive bid.

That leaves $24B leftover for competitive bids. In these bids, the winners are the ones who are willing to receive the lowest interest rate. These banks can’t bid for more than 35% of the offering auction. These wall street firms position themselves to gauge how much risk they are willing to take on. These firms plan to sell the debt to the secondary market (the place where investors buy bonds over an exchange).

Let’s say the 24 bids put an auction they put a dollar amount of bonds they want at an interest rate, once they are done putting their bids, the banks willing to take the lowest rate gets their money first. The last firm that gets money determines the interest rate for all bidders.

Here’s an example if that went over your head:

____________________________________________________________________________

So let’s say these are the bidders for the $24B:

So let’s say: Goldman Sachs bid $6B at 2.95%; JP Morgan bid $7B at 2.95%; Wells Fargo bit $6B at 2.97%; UBS bid $1B at 2.99%; RBC bid $8 billion at 3.02%; TD bid $3B at 3.09%

Goldman & JP get their money first since they asked for the the lowest interest rate. ($24B - ($6B+$7B)) = $11B remaining

Wells Fargo then gets their bid ($11-$6 = $5B remaining), then UBS ($5B-$1B = $4B remaining), and then RBC gets $4B instead of the $8B it asked for, and TD gets $0. TD was locked out. The locking rate was the rate where the treasury ran out of money, which was when RBC’s bid at 3.02%. Now Goldman, JP, Wells, UBS, RBC and the non competitive bidders receive their money at the 3.02% interest rate.

Then in the secondary market, these firms act as market makers in the U.S. credit markets.

____________________________________________________________________________

Who lends to the U.S. government?

The biggest lenders to the U.S. government can be put into a few buckets:

Federal, state, & local and government accounts (i.e. The Federal Reserve, Social Security, Medical Insurance Trust, etc.)

American Citizens & American Firms

Foreign Institutions

Sovereign Governments

Banks

Insurance Companies

Pension Funds

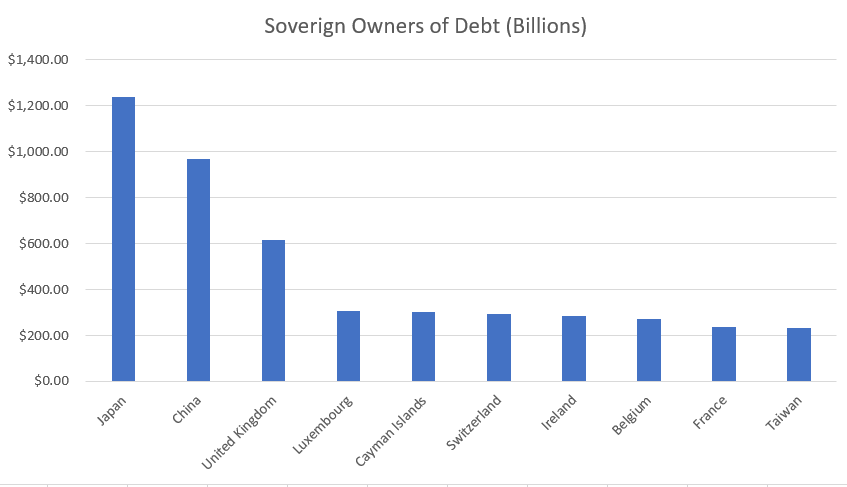

If you look at that chart, you notice that Foreign governments own around $8T of the $30T debt. As you can see, our debt is not mainly by foreigners like CHINA! as Fox News would make you think. In fact, as of October 2022, China is not even the biggest foreign owner of American debt instruments. They don’t even own $1T of America’s $31T dollar debt (so less than 3%). Next time you think about a politician or pundit claim that Chinese owning American debt will bust America’s kneecaps or something vacuous like that, I want you to seriously question if the person has examined foreign ownership of American debt or if they are financially numerate.

The reason China and Japan own so much American debt is that China and Japan sell more to America than we sell to them.

The US buys Chinese stuff (The US company, Whirlpool, sources its appliance products from Chinese suppliers in Suzhou. Timex sources parts for watches from firms in Shenzhen, China. Toys, glasses cases, water bottles, etc. all are imported from China)

Or Japanese stuff (Sony & Nintendo video game consoles, Toyota cars, Canon’s cameras, Hitachi shavers in dollars, etc.)

When dollars come to the Chinese or Japanese central bank, they buy American treasury bonds to get some return on their dollars.

If you ever go on who wants to be a milliomaire and you are asked “Who is the largest foreigner creditor to the United States”, for the time being, it is Japan, the country that Americans worried that they were going to take over their place on the world stage a generation ago. Japan was quite literally the “China” of the 70s,80s, and 90s. One of the main reasons why we don’t fear Japan anymore is because Japan has not been growing at absurd 10% growth rates year after year anymore. But we will get into Japan and Chinese growth in another article… Also, I don’t blame you for thinking China was the largest owner of American debt. Japan just beat China for largest foreign government American debtholder this year. From 2010 to 2021, the largest owner was China.

Government Spending

Fun fact, from 1863 to 1913, 90% of U.S. government revenue came from taxes from alcohol & tobacco… Not a joke, straight from the IRS itself. For the exact line, look at year 1867. Our first permanent income tax came from the flaming racist, Woodrow Wilson.

In the fiscal year of 2021, according to U.S. Congress’s Budget Office. The government spent ~$6.8T and received ~$4T, leaving a ~$2.8T deficit. This was during covid people calm down. Below you see a fantastic visual from visual capitalist.

Here’s the Government Budgets each year from 2019 (pre-Covid) to 2022 (Covid recovery). The 2022 fiscal year starts October 1st, 2021 and ends September 30th 2022.

U.S. Government Spending

U.S. government spending can be put into 3 outlays.

Firstly, we have Mandatory spending - This is spending the U.S. government must spend on by law: Social security, Medicare &Medicaid, and welfare (food stamps, earned income tax credit, child nutrition, Section 8 housing assistance, unemployment insurance). During the pandemic (2020-2021), unemployment insurance and tax credits received massive boosts of government spending, making income security temporarily the highest spent government program in 2020 & 2021.

The current outlays as of 2022 for mandatory government spending are:

Social Security: $1.22 T

Health (Medicare & Medicaid): $1.67B

Income Security: $870B

Secondly there’s Discretionary spending — spending that Congress votes on every year. We can put this into two categories

Defense spending is $770B which is the highest portion of spending of one department in the discretionary budget, not the entire government budget. Prior to the pandemic, the Department of Defense received more money in the discretionary budget than the Department of Health, Transportation, Housing, Education, VA, Science, NASA, NIH, and etc. combined. But since 2020, the non- defense spending budget, in the aggregate, exceeds defense spending.

Non-Defense spending: Health, Transportation, Housing, Education, some veterans benefits, science and environmental organizations = $1.3T

*Non-defense spending received a temporary boost in funding partly due to programs like the Payment Protection Program, increasing government spending in the Small Business Association, an agency in the discretionary spending, non defense category.

Net Interest = $480B

Net interest is: the amount the government spends on debt - the income the U.S. government earns in interest & investment income. As you can see the U.S. government is no where near going bankrupt when it earns almost $4.9T in 2022 to pay for net $480B to creditors. Almost 10% of America’s income. America is not going bankrupt any time soon. I’ll expand more on this in another article:

Join me next time as I am working on the following articles:

Why does the U.S. spend so much on The Military? (The answer is more than just Military industrial Complex stuff)

Is U.S. debt a bad thing? (I’ll explain why America isn’t and won’t turn out like the Weimar Republic, Venezuela, Greece, or Zimbabwe)

How the Federal Reserve Works

Great read!

Excellent writing!! Interesting and easy to digest. Thanks!!