21st Century Arab Monarchies and 19th Century African Kingdoms: A Dangerous Parallel

Some are more prepared than others

As the world moves away from oil, Gulf monarchies like Qatar, Saudi Arabia, and the UAE face an uncertain future. Could their monarchies crumble, much like African kingdoms that collapsed when their key export—slaves—was outlawed?

Why are the Gulf States (potentially) doomed?

The answer lies in history—particularly the fate of my ancestors in the Ashanti Kingdom, which ruled parts of Ghana, Togo, and Ivory Coast. Here’s why this parallel matters.

The Arab Monarchies and African Kingdoms: A Comparison

The Gulf States today, could mirror the West and Central African Kingdoms of the past if the worst-case scenario unfolds.

Why does this analogy make sense?

Kingdom to Kingdom: Consider Kuwait, Bahrain, Oman, Qatar, UAE, and Saudi Arabia as the modern equivalents of the most centralized coastal West & Central African Kingdoms: the Ashanti, Oyo, Benin, Dahomey, Kongo, and the Igbo-Aro Confederacy.

Resource to Resource: In the 18th century, one of the most coveted resources was slaves to make cash crops: sugar in Haiti, cotton in America, coffee in Brazil, tobacco in Cuba, and more. The African Kingdoms traded 12.5 million prisoners, existing slaves, and war captives to Europeans for guns, alcohol, metal, cloth, tobacco, European art, and food, turning into states whose main export was slaves.

Fast-forward to today, and the Gulf monarchies are in a similar position, except their prized resource is oil. Oil is the lifeblood of the global economy, powering factories, ships, and every industrial product imaginable. These Arab monarchies—Kuwait, Bahrain, Oman, Qatar, UAE, and Saudi Arabia—trade oil and gas for manufactured goods like cars, airplanes, and food.

Look below at French & Qatari trade for a perfect example:

But what if this vital resource suddenly lost its value?

The Cataclysm:

In 1833, Britain forced Europe to end the slave trade with the British Slavery Abolition Act. This devastated African kingdoms dependent on the slave trade. While Britain turned to profitable heroin opium sales in China, African economies collapsed.

My tribe’s monarch, the Asantehene or the Ashanti King, was so desperate to revive the slave trade that he tried bribing a British ambassador with gold and prostitutes to restart the business.

Don’t believe me? Here’s a direct quote from the Ashanti King, as recorded in Journal of a Residence in Ashantee.

" Now, I have another palaver (discussion/dialogue), and you must help me to talk it. A long time ago, the great king (British Monarch) liked plenty of trade, more than now. Then many ships came, and they bought ivory, gold, and slaves; but now he will not let the ships come as before, and the people buy gold and ivory only. This is what I have in my head, so now tell me truly, like a friend, why does the king do so? The white men who go to council with your master, and pray to the great God for him, do not understand my country, or they would not say the slave trade was bad. But if they think it bad now, why did they think it good before…

If the great king would like to restore this trade, it would be good for the white men and for me too, because Ashantee (Ashanti) is a country for war, and the people are strong ; so if you talk that palaver for me properly, in the white country, if you go there, I will give you plenty of gold, and I will make you richer than all the white men….

Unless I kill or sell them (slaves), they will grow strong and kill my people. Now you must tell my master that these slaves can work for him, and if he wants 10,000 he can have them. And if he wants fine handsome girls and women to give his captains, I can send him great numbers." — The Ashanti King talking to a British ambassador. Journal of a Residence in Ashantee, (Page 162-164)

The collapse of the slave trade devastated many West and Central African monarchies that had relied on it for European goods like alcohol, clothes, and guns—kingdoms like Kaabu, Ashanti, Dahomey, Oyo, and Kongo. Interestingly, the Igbo Nri Kingdom was one of the few Kingdoms that didn’t practice slavery. Without guns or selling war captives, these Kingdoms suffered from internal issues or outside African empires.

The Kongo Kingdom:

The Kongo Kingdom, long influenced by Portugal since the late 1400s, collapsed after Britain pressured Portugal to end the slave trade. Desperate to maintain trade, Kongo chiefs enslaved their own people to produce palm oil and rubber. The state suffered from so much mayhem and power struggles that by 1856, King Pedro V of Kongo had ceded sovereignty to Portugal, and by 1885, Kongo was split between King Leopold of Belgium, France, and Portugal into the countries we now call Democratic Republic of Congo, Congo-Brazzaville, and Angola.

The Yoruba Oyo Empire:

The Oyo Empire, a major slave trader, crumbled after slavery was abolished, weakened by internal strife and attacks from the Fulani Sokoto Caliphate. By 1861, parts of Oyo fell under British and French control, becoming parts of modern Nigeria and Benin.

African kingdoms that were already diversified beyond the slave trade—like Edo-tribe Benin, Igbo-tribe Arochukwu, Ashanti-tribe Ashanti, and Fon-tribe Dahomey—survived longer by already mobilizing their peasant populations into selling other crops before the slave trade ended such as selling palm oil, kernels, peanuts, kola nuts, ivory, rubber, and gum arabic to other Africans, Arabs, and Europeans.

The palm oil giant, the Fon-tribe Dahomey Kingdom, lasted until 1894 before being conquered by the French (now Benin). The Edo Benin Empire lasted until 1897 before being absorbed into British Nigeria. The ivory selling Igbo Arochukwu Kingdom and gold mining Ashanti were absorbed into British Nigeria and British Gold Coast (Ghana) by 1902.

The point is, the less dependent an African kingdom was on the slave trade prior to the slave ban, the longer it survived before eventual conquest.

Potential Parallel for the Gulf States:

The Gulf States face a similar risk: What if technology, alternative energy substitutes, or global action ends the fossil fuel trade? Three possible scenarios of differing probabilities could mirror Britain’s abolition of the slave trade:

The UN, G7, or G20 enforces a global ban on oil & gas imports.

More countries go the French route, and scale up nuclear

Breakthroughs in battery technology solve the intermittency issue for solar and wind. Thus making them more reliable than fossil fuels

While global oil bans are unlikely, even one of these shifts could make oil obsolete by 2045, plunging Gulf States—still reliant on oil for foreign currency—into economic collapse, much like the African kingdoms after the slave trade.

The idea of moving away from oil isn't far-fetched. Since 2008, oil prices—adjusted for inflation, expressed in September 2024 dollars—have dropped from $200 to $70 per barrel.

Right now, oil is struggling to stay ~$70 a barrel, despite Saudi Arabia cutting production to push prices higher to $100 and Middle Eastern wars. Unlike the 1970s where OPEC can cut production and skyrocket prices, today’s world has more oil substitutes, limiting the Gulf’s ability to manipulate prices.

This isn’t the 1970s anymore. Thanks to the American shale revolution, America produces more oil and gas than the entire Arab World combined. See charts below:

To make you understand how different of a world we are in from the 1970s, OPEC and Russia, now known as OPEC+, have been cutting production, but they can’t bring the prices to $80 let alone $100. America’s shale revolution has changed the chessboard. Meanwhile, demand for alternatives like solar and wind is rising.

Now you might be thinking —”But Yaw, the sun doesn’t always shine and the wind doesn’t always blow.”

You’re right that the main benefit of fossil fuels is their predictability.

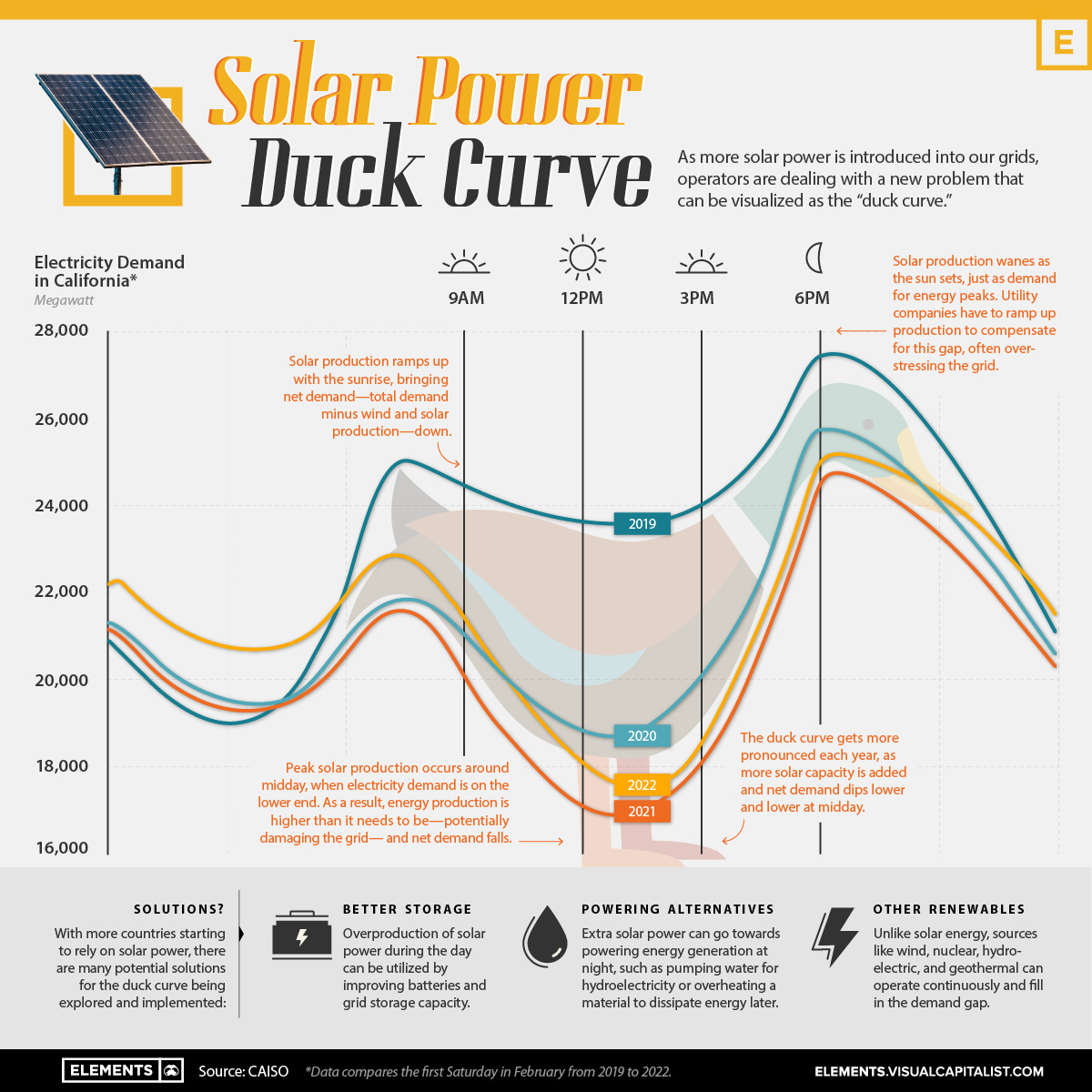

Solar panels peak midday, cutting the need for conventional power like coal and gas plants. But when the sun sets, these plants must ramp up quickly to meet evening demand—a challenge known as the “duck curve.”

Solar changes the economics for coal and gas plants, which are designed to run 24/7. When used only in mornings and evenings, these coal & gas plants become less profitable and inefficient.

To cope, some contracts keep coal and gas plants running even when adding solar or wind overproduces energy. If this generational power exceeds demand, utilities must curtail or 'turn off' some of it to avoid overloading the grid—wasting energy in the process.

The main engineering challenge of renewables is storing excess solar energy to use at night or excess wind energy when the wind isn’t blowing. That’s where improved battery storage tech comes in. It prevents overgeneration and stabilizes the grid by reducing the need for curtailment.

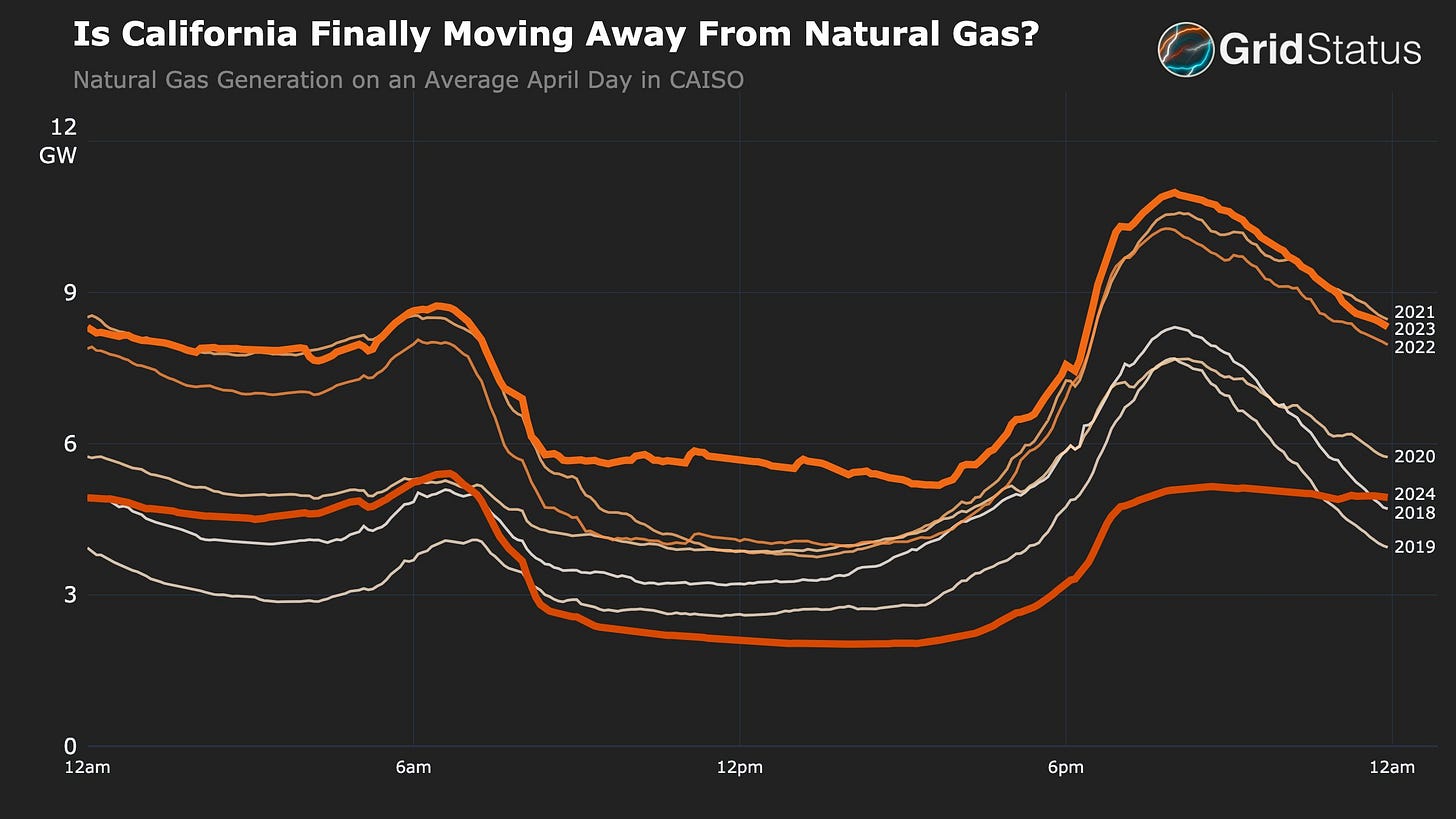

Guess what? In California, the U.S. solar hub, reliance on natural gas for evening and nighttime power is steadily decreasing.

What this chart shows is that in 2021, California used 10 GW of natural gas for evening power. By 2024, it’s down to 5 GW—cut in half thanks to better battery storage.

Meanwhile, China’s nuclear energy growth is exponential, even as the EU de-nuclearizes and the U.S. slows expansion.

Alternative energy sources—nuclear, wind, solar—and advances in battery storage are replacing fossil fuels. So far, peak oil demand was 2012, when the world bought $1.63T of crude oil. It hasn’t increased since. However, natural gas is still growing. In 2022, the latest year of recorded data, natural gas imports hit a new record of $830B.

Future of the Gulf States: If Gulf monarchies don’t diversify quickly, advances in battery storage, climate action, and nuclear energy could collapse their economies—just as Britain’s abolition of the slave trade crushed African kingdoms.

Now, Gulf states aren’t stupid. They know they have to diversify or they will fail. Now, I am not saying the Gulf states will be conquered. It’s a little more complicated than that.

Two types of failure loom:

Scenario 1: Becoming a Dysfunctional Client State to a Middle Power:

Failure in the 21st century means regressing into a failed or dysfunctional state like their non-monarchical neighbors Libya, Sudan, Lebanon, Yemen, Somalia, Iraq, Palestine, Egypt, or Syria.

Instead of these countries being colonized they have functionally become client states of middle powers or big powers like Turkey, Iran, or Russia:

Libya - West Libya in Tripoli (The Government of National Unity) is a client state of Turkey & Italy, while East Libya (Khalifa Haftar) isbacked by UAE, France and Russia

Syria - Assad’s regime depends on Iran & Russia, Turkey occupies Northern Syria, & the Kurdish breakaway region is aligned with The USA

Lebanon - Lebanon doesn’t really have a functioning state, but from 1982 to Present, South Lebanon under Hezbollah, is a client state of Iran

Yemen - The Houthis, which functionally control Yemen, are supported by Iran. Aden and parts of South Yemen are controlled by the Southern Transitional Council which is a client of UAE.

Iraq - Iran influences the Popular Mobilization Forces in Iraq, while the official government under Al-Sudani walks a fine line between Iran & America, which still has an army base there. Then there’s a Kurdish autonomous zone in North Iraq which can be seen as a client of America.

Palestine - Hamas and Palestinian Islamic Jihad supported by Iran, while Fatah in the West Bank is seen by Palestinian people to be a client of Israel, even though Israel views Fatah as terrorists.

To me, Arab clientelism is the modern day equivalent of 19th century African colonization.

Now, you might be saying, “but Yaw, Egypt, Jordan, Morocco, and the Gulf Monarchies are client states of America!”

You’d be right, just as the EU, UK, Australia, Taiwan, and Japan also depend on U.S. backing. Macron always talks about Europe’s “strategic autonomy” but it’s a vision, not something he has achieved. But the difference is, the 8 Arab states I’ve mentioned are so unstable, they’ve become clients of middle powers.

Scenario 2: The monarchy dies

Just as West and Central West African monarchies lost power, the Arab world has seen its share of abolished dynasties:

The Hashemite King of Syria, Faisal, was removed after a few months in 1920

Egypt’s monarchy under King Farouq fell to Nasser in 1952

Tunisia under King al-Amin had a monarchy for 1 year, ending in 1957

Iraq’s monarchy led by King Faisal (same one in Syria) ended in 1958

Yemen’s monarchy under bin Yahya fell in 1962, triggering the North Yemen Civil war

Libya’s monarchy under King Idris was overthrown by Gaddafi in 1969

Several monarchies in the Middle East narrowly survived:

Jordan’s Hashemite Kings faced threats from Nasserists in 1957 & 1958, and Palestinian militants in 1970

King Hassan II of Morocco survived coup attempts in the 1970s from Moroccan rebels.

Communists almost eliminated the Sultan of Oman in the 1960s and 70s

During the 2011 Arab Spring, Bahrain’s Shia majority almost ended the Sunni Bahrain’s monarchy. Saudi Arabia had to intervene to save the Monarchy.

So, will Qatar, Bahrain, the UAE, Oman, Saudi Arabia, and Kuwait become dysfunctional client states? Will they lose their monarchies like African kingdoms of the far past or Arab Monarchies of the more recent past? Or can they escape the crisis through diversification? Let’s find out.

How Dependent Are these Gulf States on Hydrocarbons?

An analysis of their export portfolios shows varying degrees of reliance on oil and gas. Ignoring petroleum-related products (since refineries don’t require domestic oil, i.e. Singapore and South Korea ), let’s see how much the Gulf monarchies have diversified away from being raw commodity exporters like Nigeria.

None of these countries reach the 90%-100% crude oil and gas export levels of Iraq or Libya. They’ve all diversified to some extent, especially compared to the 70s, with exports like aluminum, petrochemicals, plastics, and building materials.

Now let’s look at some of these countries individually.

Bahrain: Looking at this graph, it may seem that Bahrain is already a “post-oil” Gulf State. Data can be deceiving if one doesn’t know nuance. Bahrain has limited domestic oil reserves from its onshore Awali field. However, Bahrain benefits significantly from its share of production from the Abu Safah offshore oil field with Saudi Arabia. Since this oil is exported from Saudi Arabia’s Saudi Aramco, it doesn't appear in Bahrain’s statistics. But we know Bahrain is heavily dependent on oil since oil revenues make up 70% of its government income. However, Bahrain has diversified into aluminum, iron, refined petroleum, and petrochemicals..

Qatar: Qatar’s reliance on oil and gas has dipped slightly below 80%, but the key shift is that it now exports more natural gas than oil — positioning it better if oil becomes obsolete while gas remains in demand. (gas is cleaner than oil)

UAE: The UAE, particularly Dubai, ran out of oil in the 1990s and has since diversified into tourism, logistics, airlines, finance, and re-exporting manufactured goods. Gold trading and other strategic investments have also played a key role. The other emirates still have plenty of oil, but Dubai has diversified.

Oman, Saudi Arabia, & Kuwait: Oman, Saudi Arabia, and Kuwait have made only minimal progress diversifying from oil and gas since the 90s, though they’ve expanded into refined petroleum products and petrochemicals. Oman has also developed a growing export market for iron, steel, and fertilizer.

The outlook may seem bleak, but with massive sovereign wealth funds, ambitious programs, and a focus on AI and talent, there’s a chance these states can build stable economies even as oil fades.

In their respective sovereign wealth funds, the UAE controls nearly $2 trillion, with Saudi Arabia and Kuwait each managing close to $1 trillion. Qatar has about half a trillion, while Oman and Bahrain manage tens of billions.

Saudi Arabia’s Vision 2030 aims to boost tourism, entertainment, financial services, and software while privatizing state-owned firms and attracting foreign investment. The UAE’s Vision 2031 focuses on AI, blockchain, and innovation through zones like Dubai Silicon Oasis. Qatar’s Vision 2030 emphasizes education, sports, and logistics. Bahrain’s Vision 2030 targets software, tourism, and manufacturing, while Kuwait’s Vision 2035 centers on infrastructure and renewable energy. Oman’s Vision 2040 focuses on mining, tourism, and fishing.

Will these visionary programs succeed? Or is this a last ditch hope? The clock is ticking. The Gulf States must diversify faster than nuclear, renewable energy, and battery technologies make oil obsolete—or before global coordination erases the industry. Without swift action & prudent execution, they risk becoming dysfunctional states like some of their neighbors, or worse—suffering the same fate as the defunct African monarchies of the past.

Hi! Thank you fir a great read. Can those countries survive as Kingdoms if they diversify? Control of resources, especially oil, since it is not labor intensive is very good for Monarchies, since the wealth is highly concentrated and they can "buy off" their citizens. Diversified economies don't work like that.

Fascinating article. While I do not believe global oil and gas consumption is going to decline significantly for many decades, it is an interesting thought experiment.

I was also struck by your observation that almost all African kingdoms collapsed after the British abolished slavery. I had not heard that before.

I was wondering if you would be interested in doing a deeper dive to answer the following questions:

1) Just how important was slavery to the African kingdoms economically both before and during the Atlantic slave trade (not just whether it existed)? Was it wealth from slave labor or was it just income from selling slaves?

2) Did the abolition of slavery by British empire cause the societies to collapse or was it just an end to monarchies? Were there other factors?

I have tried to do some personal research on the subject, but there are very few books on the topic.