5 Answers to Questions You may have: Guyana, Somalia, Egypt, Libya, and African History(Part 5)

Get ready to learn about Carry trades

Part 1 is here:

Part 2 is here:

Part 3 is here:

Part 4 is here:

#1 Guyana claps back on BBC Journalist

Since 2019, Guyana has been selling oil and a BBC journalist was about to lecture him on that.

The fact is, oil has turned Guyana from a poor country to the fastest growing country on earth. Formerly akin to Haiti in the early 2000s, Guyana now approaches Poland's economic level.

One thing to note is that oil is a capital intensive industry, oil doesn’t employ many people so the wealth distribution is unequal. But in 2019, Guyana made a sovereign wealth fund. and it has over $1.4B in assets for its 800K people.

Oil saved Guyana because everything it did in the past was not helping.

In 1966, at independence, Guyana was a socialist state that believed that the government should be the steward of the economy to mobilize development. It nationalized bauxite, sugar, and other commercial enterprises from American, Canadian, and European firms. It also tried import substitution industrialization and put a wall of tariffs on foreign goods, as Guyana tried to develop domestic manufacturing with government owned enterprises. By 1980s, over 80% of Guyana’s economy was run by government owned enterprises. As we have seen over and over again in Africa, Guyana had the same issues. The state owned enterprises were unprofitable, corrupt, functioned as an employment absorber, and the state owned firms lived and mooched off subsidies from the state. The country was increasing foreign borrowing to make these unprofitable state owned firms stay afloat. Unfortunately, there was an international commodity price crisis that lowered commodity prices world wide, bankrupting most of Africa and other commodity dependent economies like Guyana.

The economy collapsed, went nearly bankrupt, sought aid from the International Monetary Fund, and then started heeding their advice - removing price controls, cut food/fuel subsidies, cut government spending, and started auctioning off unprofitable companies to foreign firms. Needless to say the Guyanese people were upset by these policies.

By the mid 90s, the Paris Club (most EU nations, Brazil, Australia, Israel, Japan, America, Canada, Russia & UK) started forgiving Guyanese debt. In the late 90s, Guyana also applied for the IMF’s Heavily Indebted Poor Countries initiative. In addition the Inter-American bank in Washington DC, forgave Guyanese debts as well. Guyana’s debts were reduced from a peak of $2.1B in 1995 (over 3 times Guyana’s GDP at the time) to $850M in 2007.

By Mid 2000s, with debt relief and a new capitalist/socialist mixed economy, Guyana was growing past Haiti, but it was still an unimpressive economy.

In 2015, Exxon found massive amounts of oil offshore. Guyana found 11 billion barrels of oil (that’s more than other oil states like Azerbaijan, Angola, and Norway) and Guyana only has 820K people as of 2024! It took 4 years to extract it, and starting in December 2019, Guyana became an oil producer. Since then, Guyana’s GDP, income per capita, and government spending shot up like a rocket. It’s sad to say this because climate change is very real, but oil is transforming Guyana from a Jamaica to a Poland. Should Guyana stop selling oil to protect the planet? No, Guyana should keep pumping oil for its people. They are tired of living in poverty. Poor people should not be sacrificed on the Altar of Climate Change. The only solution to climate change in my opinion is innovation with other energies, because no one is going to actually stop oil production just because people say they want to. As of 2022, crude oil is still the most traded product on earth.

#2: Turkey is looking for Somali oil

Somalia has a deal with Turkey to look for oil. Turkish oil firms are now allowed to explore, exploit, develop and produce Somali onshore and offshore oil blocks. Seismic studies have determined that Somalia has 30B barrels of oil.(That would put Somalia as 12th in the world for oil reserves - more than Qatar, Algeria, Norway, or Guyana). No serious exploration has begun since Somalia has been in its decades long civil war in 1991. It takes three to five years to explore, and then production could start. By 2030, Somalia could become a Kuwait in the Horn of Africa. We could see Guyanese levels growth in Somalia by 2030 if all goes well and oil is still needed.

Turkey under Erdogan has been bolstering its relationship with Somalia, building homes for poor Somalis, training Somali soldiers to stop Somali piracy, and signing a defense pact (which could protect Somalia from Ethiopia). It’s like a “neo-Ottoman” relationship. It reminds me of the 16th century, where Ottoman Turkey funded the Somali Adal Sultanate to destroy Ethiopia, who received funds from Portugal.

In return for all this help, Turkey will receive 30% of the revenue from the Somali exclusive zone.

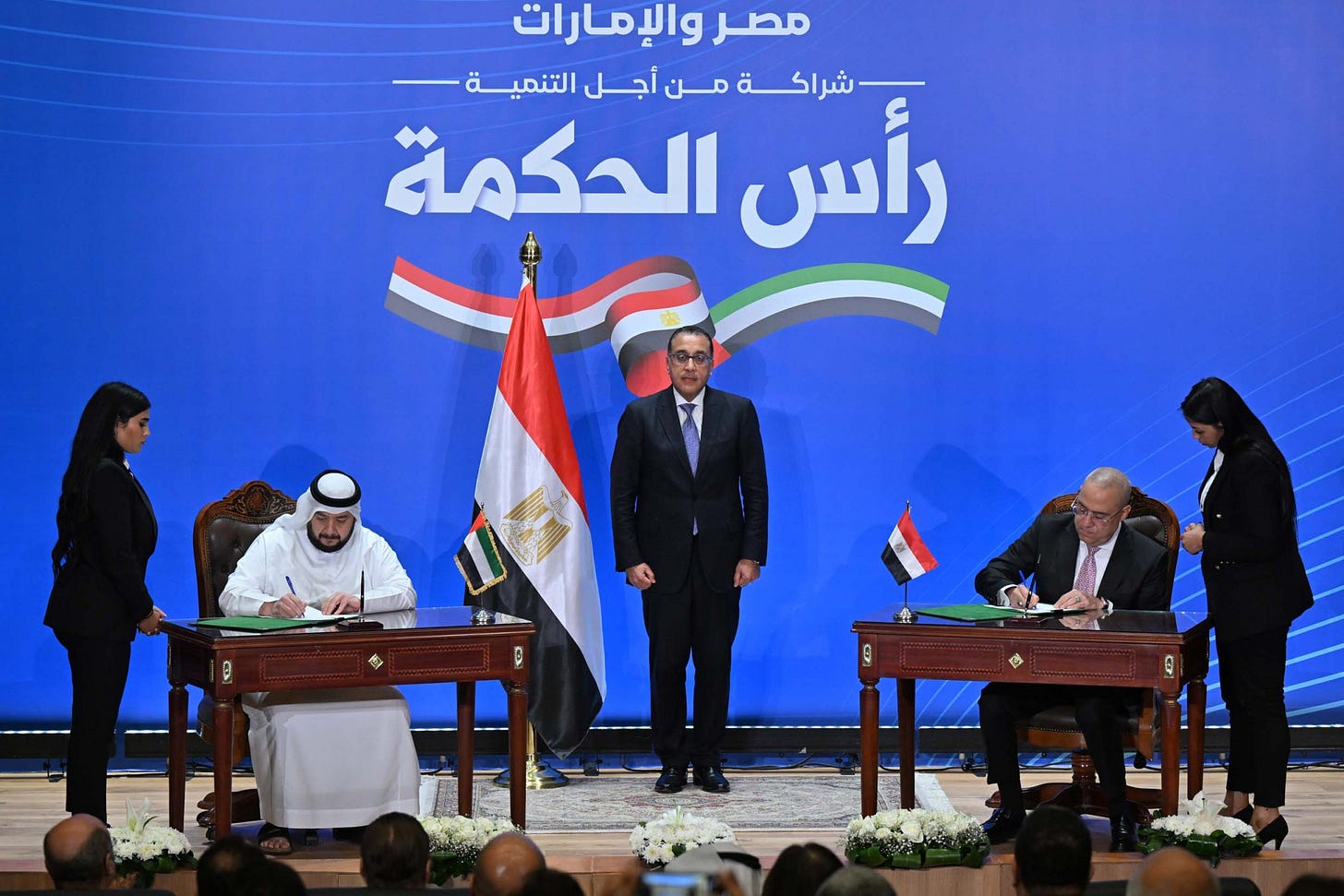

#3: UAE’s $35B Investment in Egypt

Egypt, a few weeks ago was on the brink of default. Thanks to Arab investment, Egypt has enough currency reserves to survive. UAE provided $35B to Egypt to make new real estate for tourism. ($35B is 7% of UAE’s 2022 GDP).

Much of this money is going to purchase a coastal city in Egypt called Ras Al Hekma.

Let’s explain the issue with Egypt.

Egypt by African standards, is a decent country. But Egypt by Middle Eastern standards, is a poor country.

Egypt is an unequal country where the military has control over enterprise. The wealth and income inequality in Egypt is huge.

The average Egyptian makes $4100 a year ($15K in purchasing power parity), which is better than most of Africa and almost double the average incomes of Nigerians or Kenyans). But Egypt is poor by Middle Eastern standards - the average Kuwaiti, Emirati, and Qatari makes over 10x the average Egyptian (in purchasing power parity its more like 4 to 8x times the average Egyptian).Many Egyptians work as migrant workers (high and low skilled) in these countries for better wages.

Egypt was on the brink of a crisis. It had multiple shocks: COVID, the Russia-Ukraine wheat crisis, middle eastern regional instability (Sudan, Libya, Gaza, and Houthis disrupting trade near the Suez. It is also over budget and behind schedule building its new capital. In 2015, Sisi’s government declared the new capital was supposed to be worth $40B and completed by 2022. Egypt has spent ~$60B so far and its still on phase 1.

In 2016, Sisi’s Egypt had a deal with the IMF as the country was in dire straits. Egypt devalued its currency (so Egypt was no longer spending foreign exchange reserves to prop up the value of the Egyptian pound), it removed expensive fuel subsidies, and opened up its financial sector.

Investors and hedge funds could make substantial money doing a “carry trade”. A carry trade is a financial strategy where an investor borrows money in a currency with a low interest rate (So imagine you borrow $1M USD at a bank at 4% in 2016) and invests that borrowed money in a currency with a higher interest rate (Egyptian bonds yielding 19%), profiting from the difference aka “capturing the carry”. If Egypt already did devaluation, you don’t have to worry about losing money on the exchange rate because the currency probably won’t devalue again for some time. Since Egypt was getting all this “hedge fund hot money”, Egypt decided to anchor the currency again to the dollar at the new devalued exchange rate instead of letting the currency float (let supply and demand handle the value).

From 2016-2022, Egypt used “hedge fund hot money” to maintain that exchange rate.

In case you are wondering the math on how you profit from the trade. You can look below:

You borrowed $1M USD and exchanged it for Egyptian pounds in 2017. That’s roughly is ~18M Egyptian pounds. (1 USD = .055 Egyptian pounds)

Then you make 19% off via buying Egyptian bonds. 19% of 18M Egyptian pounds = ~3.4M Egyptian pounds by 2018

So in total you made 21.4M Egyptian pounds. Then you convert the pounds back to dollars because you have a US loan to pay (1 USD = .056 Egyptian pounds in 2018) = $1.2M.

You pay back the 1M you borrowed plus 4% interest (40K). You pocketed $160K from that trade ($1.2M - $1.04M, money you made - money borrowed).

We call these inflows for Egyptian bonds, “hot money”, because investors can pull out easily. It’s super easy to sell bonds.

Unfortunately, Egypt made some policy mistakes. It relied on “hedge fund hot money” for dollar inflows to finance Egypt’s continuous deficits. Sisi has continued letting the army control the economy which investors don’t like (but it keeps Sisi in power). This prevented more stable flows of money from coming in(like foreign direct investment and joint ventures in companies), and also Egypt wasn’t exporting significantly more to get more reliable forms of foreign exchange. Also Egypt fixed the currency to the dollar at that .056 level after the devaluation instead of letting the currency float more.

Why didn’t Sisi let the currency float after the devaluation? We have to consider the political economy as well. The currency devaluation was already painful for the population, so Sisi wasn’t going to let the currency float. Unfortunately, long term, all theses issues (reliance on hot money, currency anchorage, weak exports growth, maintaining army control of enterprise, continuous deficits for the new capital) set this country up for a shock during COVID.

#1 COVID-19

COVID-19 ransacked the Egyptian economy, as Egypt’s largest foreign currency generators - tourism and oil & gas - were wrecked by COVID-19. Both started rebounding in 2022, but they still aren’t at pre-COVID levels. Why does foreign currency matter? Egypt doesn’t make enough food for itself, so it imports food. In 2022, Egypt imported ~$17B in food. Also, even though Egypt has oil refineries, they still need to import refined petrol, crude oil, and gas to meet domestic demand.

#2 High Wheat Prices at the start of the Russia-Ukraine War

Wheat prices hit over $10 per bushel a few months after the Russia-Ukraine war emerged in 2022, draining Egypt’s foreign exchange with a high import bill (although prices have come down now in March 2024 to under $6 per bushel). Egypt was the largest importer of wheat in the world as of 2022.

#3 The Conflicts Surrounding Egypt

Egypt is surrounded by wars/conflicts - Sudan in the South, Libya still has issues in the West, and Israel-Gaza in the East. The Houthis of Yemen’s sea attacks have crushed Egypt’s revenues in the Suez Canal by almost half and Egypt just defeated the militants in the Sinai after a decade long struggle.

The currency has deflated again, which makes imports more expensive. Since March 2023 to March 2024, has had Egypt over 30% inflation.

43% of Egypt’s government revenue was spent paying interest payments on debt in 2023. So far in 2024 in Q1, Debt service interest payments is 60% of Egypt’s budget. It was only a matter of time before default happened as a government can’t just continue to pay over have its budget to investors. That number was expected to hit 70% due to the fact that the pound could depreciate more to the dollar. Egypt’s currency is Egyptian pounds and borrows in dollars. If Egypt’s pound weakens then the dollar denominated debt explodes. To prevent this, Egypt sells dollars and buys back pounds to maintain its strength to the pound - Egypt artificially strengthens the value of its pound. The result of artificial strengthening is that here’s a triff between what the central bank exchange rate is and the free /black market rate. By selling dollars, Egypt is draining its foreign reserves. Without enough foreign reserves, Egyptians can’t import food.

After getting $35B from UAE, Egypt’s central bank allowed the currency to float (stop selling dollars to by back the pound), cut government spending, and then hiked interest rates.

Because Egypt listened to the International Monetary Fund (IMF)’s advice on letting your currency float and cutting spending, The IMF provided its next tranche from its “Resilience and Sustainability Fund” to Egypt. The IMF increased its loan to Egypt from $3B to $8B.

Since Egypt has gotten more money from the IMF and from Arab states and already devalued its currency, more hot money is piling into Egypt for carry trades.

Will Sisi make more reforms from here? At the very least he avoids default. We will see. But, at the end of the day, UAE saved Egypt.

#4: Populist Misremembering of Libya

I am increasingly seeing posts that just don’t understand what happened at Libya. I spoke more about the Libyan war in my article on Libya but I’ll repeat some stuff. Some people actually think the West killed him because he could have “unified Africa with a gold backed currency”. If you think countries were going to unite with Gaddafi, I have a bridge to sell you. Taking his money (which African countries loved doing) and uniting with him (which African countries had no interest in doing) are different stories.

Gaddafi used to have a very anti-Western Foreign Policy during the Cold War and people like Ronald Reagan and Francois Mitterrand of France were hell bent on containing/killing Gaddafi. For example, the United Nations condemned him after suspected Libyan agents planted a bomb that blew up Pan Am Flight 103 killing 270 people (mostly Americans), in Scotland.

By 2000s, after the Iraq war, Gaddafi decided to chill out and tried to become pro-Western. He accepted responsibility for the bombings and paid $3B to victims. He let the UN dismantle his nuclear weapons program, and he acted as a first line of defense for European Union to stop Africans from migrating to Europe. At the same time, he revived the African Union and funded many ventures in African countries (He gave free tractors for Gambian agriculture, telecom deals in Chad, funding the fees of other African Union members who were too poor to pay., etc.)

Everything changed during the Arab Spring. For those who don’t remember, in 2011, a Tunisian self-immolated himself as he was tired of the corruption. This led to huge protests in Tunisia, Egypt, Libya, Bahrain, Syria, and Yemen. The Tunisian President fled to Saudi Arabia over mass protests, then 1000s protested in Egypt and the Egyptian President, Mubarak resigned. Bahrain also had protests, but the government brought order.

In the same day, Bahrain had protests, so did Libya. In February 2011, Gaddafi decided to kill peaceful protestors. The killing of peaceful demonstrators led to a full scale uprising against Gaddafi in Benghazi. As Al Jazeera wrote, “Gaddafi pledged to hunt down the “rats” opposing him”. The rebels made a government called the National Transitional Council. Gaddafi didn’t really let journalists in, so people exaggerated how much Gaddafi was bombing the protestors. For example, the media exaggerated Gaddafi’s ordering of mass rapes, anti-aircraft machine guns on crowds, and Hilary Clinton’s declaration of “virginity tests”. To be fair, much of this information was given from Libyan officials who defected from Gaddafi.

At the time, people thought Gaddafi was going to mass murder the population so in February 26th, the UN Security Council threw sanctions at Libya (travel bans, US and European denominated asset freezes, and an arms embargo). These sanctions were a unanimous decision from the UN Permanent Security Council (US, UK, France, Russia, and China) and the non Permanent members at the time (Brazil, Germany, India, Lebanon, South Africa, Portugal, Bosnia, Nigeria, Colombia and Gabon).

By March 19th 2011, the UN voted whether to impose a “No-Fly Zone” on Libya. A No-Fly zone is a designated area where aircraft cannot fly. Governments will do preemptive strikes. You had 10 “Yeses” and 5 “Abstains”. This isn’t the West doing an illegal intervention the representatives of the world agreed to this with zero veteos/opposition.

All the African countries in the UN Security Council - Nigeria, Gabon, and South Africa said yes to intervention as well.

Now you can say “those African countries are pawns!”, but if they vote for it that’s on them. Also you could argue that the intervention went too far, which I am very respective to.

Also, it wasn’t just NATO who invaded, many Arab states as well.

By October 20, 2011, the rebels captured and killed Gaddafi. (Click here to see images and the video of rebels killing Gaddafi).

I say all this because the Libyan invasion was legal under international law. However, the aftermath has brought horrific terror across the Sahelian region of Africa. It all started with Tuareg rebels and militants using weapons from Libya to kickstart a civil war in Mali in 2012.

#5: How underdeveloped was Africa when it was approaching independence?

One of the reason why I dislike “monolith Africa” narratives, is because many of these countries are quite diverse in living standards. By Western standards all African countries are poor, but obviously there are gradations of poverty.

In 1955, you could split Africa between “3rd world” and “2nd/2.5 world”. Roughly 70% of Africa was third world and 30% of Africa was 2nd world.

Look below to see 3rd world countries, were the average person made less than $1000 a year in 1990 prices. I included non African countries as well highlighted in yellow.

On the super 3rd world countries. It is mostly African countries.

Botswana was the poorest country in the world and now its an upper-middle income country. Libya was also a poor third world country until it found oil in 1959.

As for 2nd/2.5 world Africa, its mainly sparsely populated island countries, North African countries, settler states at the time (South Africa, Algeria, Mozambique, Angola), Liberia, and “star colonies” (the petro-state Gabon, Ghana, Senegal, Ivory Coast, and Congo-Brazzaville).

In 1955, Ivory Coast was ahead of Egypt. Congo-Brazzaville was ahead of Angola(which had many white Portuguese settlers), Ghana was ahead of Taiwan & South Korea. Senegal was ahead of Philippines. Liberia was ahead of Turkey, Singapore, and Iran.

So what happened?

In a nutshell, Sub-Saharan Africa had failed/neglected policies on farming, had failed import substitution policies (In Ghana, Nkrumah’s shipping firm failed, Nigeria failed to make a big steel producing firm, etc.), and a commodity price crunch which lead to two decades of stagnation in Africa from 1980-2000.

Between those two decades, many countries that were poorer than African countries caught up and blew past the continent including South Korea, Taiwan, and China.

Now, Africa on the aggregate, in another “lost decade” since 2014. Now countries like Vietnam, Indonesia, Philippines, India and Bangladesh are surpassing many African countries too. Obviously there are pockets of growth in Africa (Rwanda, Kenya, Ethiopia, Ivory Coast, etc.), but this is just an aggregate picture, see chart below:

I bring this up because the issue of Africa was more of an issue of failure to compound over years rather than starting at a lower base compared to other formerly super poor places - India, China, Indonesia, etc.

None of this diminishes the impact of colonialism: (burning people’s homes, no political rights, forcing Africans to build infrastructure, creating new tribes, creating colonies over groups that used to enslave and hate each other).

Like, Comment, Share, Restack!

Another interesting post. Especially interesting was your comprehensive look at the Libya situation. There has been so much misinformation about that, a lot I suppose to discredit Hillary which really wasn’t all that necessary. She did a good job of that herself.

I also enjoyed the look into Egypt. I am an avid diver and was fortunate to dive the Red Sea off Egypt and the Sinai. I was planning another trip this year but with the situation as is have sort of been holding back.

Anyway I always enjoy reading your posts. I learn so much.

Beautiful