We’re continuing our series on globally traded products. Part one was on a commodity - oil. Today we are talking about a manufactured good - integrated circuits.

Chips. Microchips. Computer chips. Semiconductors. Integrated Circuits. These terms are all used interchangeably.

Chips form the backbone of modern electronics across consumer, academic, and military domains. From microwaves to smartphones to military equipment, anything utilizing electronics relies on these chips. They're indispensable in maintaining our modern way of life and are pivotal the in soon-to-be or already existing AI-powered Cold War 2.0.

What is an Integrated Circuits (IC)/Semiconductors?

Fundamentally, chips are small electronic packages containing circuits, transistors, and pathways that perform tasks.

Typically made of silicon, microchips or integrated circuits consist of millions or billions of microscopic transistors etched into them.

At the heart of computing are bits, represented by electrical currents as either '1s' or '0s'. A chip comprises millions or billions of transistors—tiny switches—that manipulate these digits to process data, transforming them into images, sound, and radio waves.

Semiconductors bridge the gap between conductors (e.g., metals like copper) and insulators (e.g., rubber). The American firm, AT&T’s Bell Labs developed the germanium transistor, which could conduct or block electricity. Silicon later replaced germanium due to its higher temperature tolerance and thermal stability. AT&T patented the transistor and offered licenses to companies for $25K in 1955 (~$300K in 2022 money)

How “Global” is the Chip Trade?

Chips are the third most traded product in the world. Various types of chips exist, including processor, memory, radio frequency, WiFi, Bluetooth, and image sensor chips. To put in perspective how highly traded chips are, they are traded more than gold ($478B traded), cobalt ($10B traded), and silicon combined($6B traded). Chips had a total trade of nearly $1T in 2022. There are only two goods on this planet traded more than semiconductor chips - crude oil($1.45T) and refined petroleum fuel ($1.08T).

Despite talk of a “global supply chain”, over 90% of chip trade is concentrated in East Asia & Pacific, Europe, and North America. In fact 85% of all trade is concentrated in those three regions. This is mainly because most trade is trade in intermediate manufactured goods in a supply chain while in other regions like Central Asia, Africa, the Middle East, South Asia and Latin America are struggling to produce internationally competitive companies. Their firms service domestic markets and/or they sell commodities.

Here’s an example of the supply chain in chips (note there are other suppliers, but here’s just one example):

An American company like Open AI utilizes American Microsoft Azure’s data centers. These data centers are full of Graphics Processing Units (GPUs) servers to power Open AI’s Large Language Models (LLM) and create new AI technology. These GPU chips are designed by the American firm Nvidia, which most likely has its blueprint instructions designed by British firm ARM utilizing design software probably from Germany (Siemens’s Mentor Graphics). When the design is complete, it is sent to a facility in Taiwan(TSMC) for fabrication. TSMC buys silicon wafers from Japan (Shin-Etsu Chemical) and utilizes precise lithographic machinery tools from Dutch firm, ASML. The chip is then packaged, assembled and tested in locations like Malaysia, Singapore, or Vietnam , likely under a Taiwanese firm like ASE Group.

Meanwhile, Africa, Latin America, South Asia, Eurasia, Central Asia, the Caucasus, and the Middle East are relatively insignificant in integrated circuit production. Exceptions include Mexico and Israel. Emerging players such as - South Africa, UAE, Brazil. Costa Rica, and India may gain significance receiving FDI or creating new firms in the next coming decades.

One aspect that really hurts Latin America is fear of expropriation, barriers to trade, and currency issues. Unfortunately, Africa has all of Latin American issues plus a brand of armed conflict, inadequate infrastructure, and workforce capital. Even though Africa’s armed conflicts are largely concentrated in 11/54 countries (i.e. Cameroon, Central African Republic, Sudan, Ethiopia, Libya, Mali, Niger, Burkina Faso, Eastern Congo, Northeast Mozambique, and Somalia), if something affects 20% of the continent, media & investors usually extrapolate to the whole continent.

Different Types of Semiconductor Firms

There are different types of firms in this space. America leads in chip design software firms, chip design firms, and some chip equipment tools. But where America lags behind is chip fabrication, with Intel and TI fabricating their own chips, except these firms don’t manufacture at the cutting edge. So what are the different types of firms? There’s multiple, but I’ll go over nine.

Firstly, some semiconductor firms are integrated device manufacturers (IDM). These firms design and fabricate their own chips like Intel ($54B Revenue) or Texas Instruments($18B Revenue). In South Korea, Samsung ($200B Revenue) designs and fabricates chips and makes electronics like TVs, smartphones, and refrigerators. Other firms include German Infineon($17B) and Japan’s Renesas ($11B).

Secondly, we also have “fabless” semiconductor firms that just do design and outsource the fabrication of chips to firms like Taiwanese Semiconductor Manufacturing Company (TSMC) or Samsung Foundry. Some fabless firms include American firms like Nvidia ($61B Revenue), Qualcomm($36B), or Broadcom ($36B Revenue). Even Tesla, Google, Alibaba and Amazon design their own chips as well.

Thirdly, we have foundry firms that are pure play fabrication. They don’t design (or barely design) their own chips but they make chips for fabless firms. In Taiwan, TSMC ($74B Revenue) and UMC ($8B) are a pureplay foundries. South Korea’s Samsung has a Foundry division where it makes chips for other companies. In America, Global Foundries ($7.6B Revenue) is a firm that mostly fabricates, but does some design. China has SMIC ($6.3B) and Israel has Tower Semiconductor ($1.5B). Fabless chip design firms rely on TSMC, Samsung, and etc. to make chips.

Fourthly, there’s chip instruction architecture where firms make the instructions that a computer (microprocessor) understands and executes. The leaders in chip instruction architecture are the UK headquartered ARM Holdings ($3B Revenue) and the American firm Advanced Micro Devices (AMD) ($23B Revenue). AMD is also a fabless chip design firm as well. There’s also open source chip instruction architecture called RISK-V.

Fifthly, there’s chip software firms. They make software for design firms like American Synopsys ($6.1B) and Cadence ($4.1B). If you want to make a chip you need to license IP. Most electronic devices over the past decade use Cadence IP.

Sixthly, there’s assembly, packaging, and testing. This is considered to be the “lowest-value add”. Mainly firms use cheap labor in Southeast Asia and China for this step. American Amkor ($6.5B), China’s JCET, Malaysia has Umisem Group, Singapore has UTAC, and Taiwan has ASE ($19.3B).

Seventhly, there’s Distributors that supply the chips. American firms like RS Electronics & Airrow Electronics are examples. There are many distributor firms in Europe and Asia as well.

Eighthly, there’s Research and Development- R&D. There are research institutes who take the industry to the next level. France has CEA-Leti, Belgium has IMEC, Taiwan has ITRI, China has Tsinghua Unigroup, and America has SEMATECH and Semiconductor Research corp.

Finally, tooling equipment semiconductor firms. These firms make the specialized machines and tools like lithography, wafer processing and etc.

In America there’s firms like Applied Materials and LAM Research. Applied Materials is basically a materials science firm. Applied Materials ($26.5B Revenue) manufactures extremely complicated materials engineering processes for wafer fabrication.

Meanwhile, Lithography equipment projects ultraviolet light with a circuit pattern onto a silicon wafer. This process basically shoves more transistors, and thus data on even smaller chip. Lithography is basically magic for technology, as it allows you to cram down more data on smaller chips. The more transistors you can fit on a chip, the higher the processing speeds and memory. The leading firm on earth by far for lithography is ASML ($30B Revenue) in the Netherlands. ASML is the only company that produces the equipment needed to make the smallest and most sophisticated semiconductors. TSMC, Samsung and Intel buy equipment from ASML to fabricate more chips.

In the 1950s, the industry was basically Intel and through government support, academic breakthroughs, and market forces, the industry expanded.

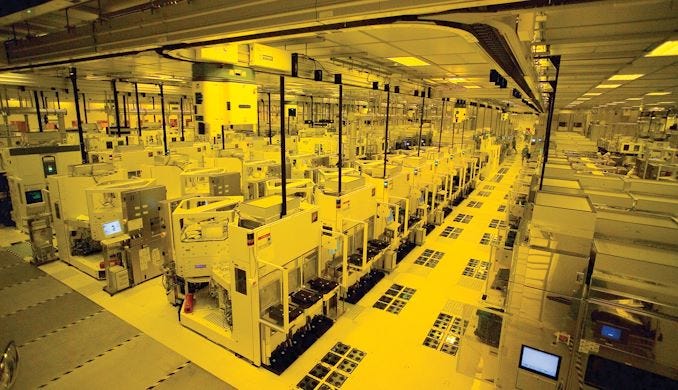

Chip Fabrication

The smaller the chip, the more “cutting edge” it is since there’s more transistors crammed into it thanks to the magic of lithography. The top two companies that can make the most cutting edge chips for firms like Nvidia, Qualcomm, and Apple are TSMC and Samsung. If you look at the chart below, nearly 100% of the most cutting edge chips (<10 nm) are built in Taiwan and South Korea mainly by those two firms.

America stinks at making new fabs because America has many laws that “Not in My Backyard” (NIMBY) people take advantage of to slow down the delay of construction. Examples include weaponizing the National Environmental Policy Act(NEPA), where a group of people or a community can sue and delay the construction of a project. The project will need to pass several years of impact assessment tests before obtaining a permit.

Even with Joe Biden’s $52B CHIPS act, which is mostly tax subsidies for firms to make fabs in America, none of this deals with the issue of people suing projects to death. In addition, Biden’s CHIPS act is filled with all sorts of requirements and regulations that slow production. Besides NIMBYists weaponizing the National Environmental Protection Act, there’s delays on firms receiving the subsidies, a lack of workforce talent for semiconductor fab engineers, and laws including access to high quality child care for workers & community investment. TSMC’s first fab project which started in 2022 in Arizona is already delayed to 2025… It was supposed be done in 2024. The second one which was supposed to be done in 2026 is pushed back to 2028.

As a result, America is a relatively slow place to make fabs. Most of the Association of South East Asian Nations (ASEAN) region (except Singapore), is even worse than America with the time delays due to even worse red tape.

The places with the most streamlined regulations and quickest to make a fab include Japan, South Korea, Taiwan, Europe, and China.

Can Developing countries catch up?

To make a fab, a country needs a combo of land, water, cheap & reliable electricity for 24/7/365 operations , talent, and transportation infrastructure. One state-of-the-art fab uses as much electricity as 50K homes.

India is building a new fab will begin production 2026 with its very own Tata Group.

A fab might be too difficult to start for other developing countries, but the assembly, testing and packaging part has historically been an easier part for developing countries to break into as seen with Philippines and Vietnam.

Also Colombia also seems to be doing something right, as it is the second best chip exporter in Latin America next to Brazil(Colombia exports $80M in chips via packaging & testing).

In Africa, Nigeria is doing a massive industrial policy between Amaltech, the National Agency for Science and Engineering Infrastructure (NASENI), Nigerian Content Development and Monitoring Board, Ministry of Solid Minerals, and the Ministry of Communication and Digital Economy. Can Nigeria make a dent? We’ll see, Nigeria has tried multiple industrial policies with massive subsidies in the past with terrible execution and mired in corruption.

If I had to bet on which African country can emerge next in semiconductors and hit $1B in chip exports, I would bet on Morocco. Morocco is already a third of the way there exporting $322M in chips in 2022. Firms like STMicroelectronics already made a packaging production line in Morocco to export to Europe. Morocco has had great success with cars and aircraft part assembly. I can imagine Morocco becoming a packaging and assembly hub for chips, especially the less advanced chips for cars. My number #2 would be Tunisia.

Links are underlined!

The book Chip Wars was also extremely helpful

Excellent article!

Great Article!