The Future of the Chinese Belt & Road Initiative in Africa

The 2020s era will be very different than the 2010s era

Note: This article was initially part of a 10K Monthly Views Special, but I felt it would be better for this article to stand on its own. You’ll see a slew of shorter posts over this month.

I should probably explain what China’s Belt and Road initiative is first and why China is doing it.

The “One Belt, One Road Initiative” is a set of transportation projects (rail, roads, ports) that aim to link China to Central Asian, East African, Indian Ocean, Turkish, Persian, Southeast Asian, and European trade.

To finance this, Xi Jinping made the $40B Silk Road Fund from China’s own budget and from the Chinese-created Asian Infrastructure Bank. Note, Japan made a Asian Development Bank in the 1960s, but Japan’s Bank has Japan & America as the largest shareholders, while China’s bank neither has Japan nor America as shareholders. China also has its policy banks and the “BRICS Bank” officially known as the New Development Bank.

China’s Strategy

After China deviated from orthodox Marxist-Leninism, China has been getting richer using the same strategy that Germany, Japan, Taiwan, and South Korea used in earlier times, only with a heavier role of the state. First China pushed agricultural yields up, implemented protectionist policies (tariffs), and required technology transfer if a country wants to invest & sell to China. After that, the Chinese government provided foreign technology to Chinese manufacturing firms to get a boost. Then the government subsidized their manufacturing industry with financial repression - instill capital controls, cheap loans and a relatively weak currency to undercut Western markets so Chinese firms have more breathing remove to learn, make mistakes, and try to dominate markets. Lastly, China ensured that labor productivity growth exceeds wage growth, by encouraging employers to slow down the rate of wage increases.

By ensuring that wage growth is lower than productivity growth, China artificially transfers income from workers to businesses, dampening household consumption.

By doing financial repression - purposely lowering interest rates and weakening currency, China artificially transfers wealth from savers (people who deposit money in a bank) to borrowers (businesses).

By keeping its currency, the renminbi, within a range relative to the dollar, it prevents the renminbi from appreciating significantly against the dollar as a result of China’s current account surpluses (exports exceeding imports). As a result, China is artificially weakening its currency, making imports more expensive for Chinese consumers while making its currency weak so Chinese firms can undercut global markets on price. China artificially transfers income from consumers who want to import goods to businesses who want to export goods.

These three interventions (low wage growth, low interest rates, weak currency) artificially tax Chinese household wealth and consumption while subsidizing Chinese exporting firms. Consequently, Chinese firms must export the excess not absorbed by the domestic market. These measures bolster Chinese manufacturing exports by offering cheap labor, loans, and currency, enabling Chinese manufacturing firms breathing room to learn, grow in capacity, and dominate global markets.

If you are wondering why African nations haven’t done this strategy yet, it’s because in most African nations, their agricultural yields are terrible. The strategy can’t even start until agricultural yields are boosted.

As a result of China’s strategy, Chinese firms must export their goods. The Belt and Road Initiative aims to access new markets, with China assisting in building infrastructure and ports where needed. China has been actively investing and trading with regions including Africa, South Asia, Southeast Asia, Central Asia, and the Middle East.

Why does Africa accept Chinese infrastructure?

A couple of reasons that I have observed:

Lack of colonial history: China has never colonized an African country, leading to a lack of mistrust from African leaders compared to Westerners.

Absence of bias against Africa: Some Chinese firms think the West has been biased against underwriting infrastructure projects in Africa, and that many African projects actually have a positive net present value. Many Chinese firms thought Western firms work with shorter time horizons and underestimate African growth. In the 70s, 80s, & 90s, many western firms got burnt investing in Africa through African countries nationalizing or expropriating industries and defaulting on debts when you lend to them. As a result, Western firms basically left Africa (unless you are a corrupt Swiss trading firm like Glencore) and the West just gave social aid programs instead. African nations were basically wide open for China to invest in at the 2000s, when China was finally on the growth mode.

Industrial strategy: African countries possess resources vital for China's strategic goals, motivating investments even in non-profitable projects. (Cobalt in Congo, Oil in Angola, Bauxite in Guinea, Manganese in Ivory Coast).

Soft power: Chinese leaders starting with Mao had genuine love for Africa. In fact the whole “Third World” idea was invented by Mao. He saw America, UK, France, Canada, Australia and NATO was “1st World”. Soviet Union, Poland, Czechoslovakia, Hungary, and Warsaw Pact was “2nd World”. Africa, Latin America, Middle East, and Asia were “3rd World”.

Those I believe those are the four reasons why China invests in Africa in its “Belt & Road Strategy”.

Is Debt Trap Diplomacy Real?

I also think the memes of “debt trap diplomacy” or “Chinese colonialism” are nonsense. The idea originated from a meme that China took control of a port in Sri Lanka under a 99-year lease after the government defaulted on Chinese debt, and then China cancelled debt in exchange for the port. This narrative is full is misconceptions and errors. While a Chinese firm does hold a 99-year lease on the port, Sri Lanka defaulted on eurobonds to various international private investors not solely Chinese loans. Additionally, the Chinese port firm had to buy a 70% ownership stake of the port for $1.12B from Sri Lanka for the lease. While the end result of Chinese ownership is the same, the narrative of how China used debt to trap Sri Lanka is very misleading, and the details reveal a different story than this narrative.

After that event, no more “asset grabs” continued. Instead people made up claims about debt traps in Uganda Entebbe Airport. In addition, China isn’t even the biggest lender to most African countries. Most African countries borrow from private investors via syndicated loans or through the eurobond market (Eurobonds are debt instruments dominated in dollars or euros). There’s only 6 African countries where China is the largest lender (Cameroon, Comoros, Congo, Djibouti, Guinea, and Zimbabwe).

Chinese loans in Africa

Between 2000-2022, John Hopkins Africa-China Research Initiative has uncovered that China has lent 1243 loans totalling $170B to the continent. While there may be more loans, this is the most comprehensive data available. On average, China lends $140M per African country per year. ($170B divided by 54 countries divided by 22 years). However, the loans aren’t evenly distributed across Africa. Over a quarter of all loans go to petrostate Angola.

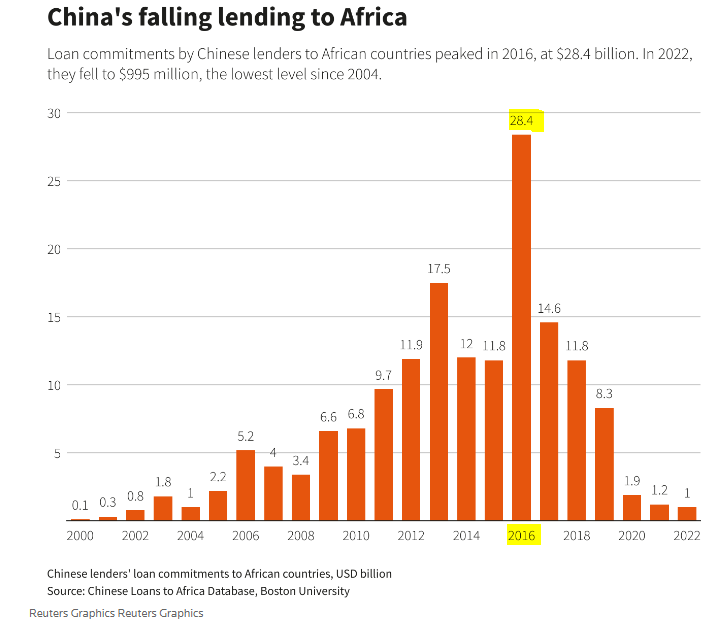

Peak Chinese lending in Africa was 2016, and in 2022, China didn’t even lend Africa $1B. This is mainly because China itself was experiencing slower growth and more domestic issues in the mid 2010s.

As Chinese lending decreased, the World Bank, based in Washington D.C., has regained its position as the largest lender to Africa. Additionally, in 2022, the African Development Bank surpassed Chinese lending, despite having lent relatively little to Africa over the past two decades. See graph below:

China seems to be shifting away from extensive lending to Africa and focusing more on debt relief and restructuring. Chinese institutions have been forgiving Angolan debt, Ethiopian debt, Congolese debt, and etc. This shift suggests that Chinese entities may have overextended their lending to Africa and are now adopting a more responsible approach to minimize potential losses for Chinese banks. In other words, China is learning the same lesson Western banks learned about lending to Africa in the 1980s & 1990s.

I think what will probably happen next is that China will continue to lend in Africa, but just in smaller amounts and more to countries it previously overlooked in the past (i.e. Namibia, Botswana, Benin, and Uganda). Decreased Chinese lending activity gives more room from Japan, India, UAE, and Turkey to compete to loan money in Africa.

Summary

China follows the East Asian model for rapid growth by restraining household wealth to drive export-led manufacturing. It lends to governments for infrastructure development to facilitate trade, notably in Africa. However, mounting losses have led to increased debt relief and restructuring efforts by China.

Links are attached!

Like, comment, share and subscribe!

Well written and informative as usual!

RE: China's "financial repression", America used to do the same for decades. The US used the old Regulation Q, which placed a cap on interest rates for savings accounts at a rate below the rate of inflation and thus effectively transferred wealth from savers to banks and borrowers (both public and private). That's not one of the old "New Deal Era" policies I espouse BTW, it was one of the more technocratic policies pf the era whereas the ones I'd like to bring back tend to be the populist ones. However, as far as the technocratic polices of the era went, it was one of the better ones, in my view.

"I also think the memes of 'debt trap diplomacy' or 'Chinese colonialism' are nonsense." - thanks for saying that, it needs repetition to overcome the propaganda.

I landed at Entebbe in 1999. On the drive to Kampala, during which my driver paid 3 bribes (something he considered normal), we past the old Entebbe airport, then abandoned after the famous hijacking (and successful counter-operation by Israel). Later, the military took it over.