World Bank Data 2022 Update

Which nations are having an economic miracle and which nations are more hype than growth

It’s July! Every July, the World Bank updates GDP, income, FDI investment, and other economic statistics from the previous year from its member nations. We finally have 2022 data here.

So which countries are richer than they were 10 years ago in 2012? I’ll list countries based on their compound annual growth rates (CAGR) in USD income since 2012. Some nations have experienced rapid growth, some have stayed the same, and some are declining.

NOTE: Please note that all these figures are denominated in USD, using the 2022 market exchange rates. For which have free floating currencies, some of the economic growth, decline, or stagnation has to do with the depreciation/appreciation of the nation’s currency to the dollar due to commodity crashes/booms or America’s central bank lowering or raising interest rates. For instance, Canada’s average income in USD hasn’t changed between 2012 to 2022 for this reason. 2012 was during a commodity boom, making Canada’s dollar at parity to the American dollar, but in 2022, investors are buying American bonds, which means they had higher demand for American dollars. In 2022, US’s dollar was much than Canada’s. However, if I measured in international dollars in purchasing power parity, Canada has seen income economic growth. I used USD because most countries deal in US dollars for commodity purchases and loans, and the World Bank , United Nations, & IMF classify nations by income using exchange rates in dollars.

The Double Digit, Economic Super Miracle Income growers: (10-11% average growth per year for 10 years): Bangladesh and Guyana

These two countries, from 2012 to 2022 were the fastest growing nations on earth. 10 years ago Bangladesh was low-income nation that was about as rich is Togo is in 2022. However, in 2022, Bangladesh has graduated from a poor nation and joined the (lower) middle income club, surpassing nations like India, Nigeria, Pakistan and etc. Bangladesh’s secret has been manufacturing textile exports. Bangladesh is the third highest seller in garments and clothes, losing only to China and the European Union (EU). Bangladeshi firms like Dragon Group & KDS, along with joint venture clothing firms with the British, Japanese, & Malaysian companies, have sold billions worth of shoes, knitted clothes, and accessories to the Western markets. The Bangladesh government made special economic zones, which are basically free market zones of low taxes and low regulations to obtain foreign direct investment, targeted the labor-intensive, light manufacturing, textile industry. When a government chooses a specific industry to subsidize with low taxes, low tariffs and etc, it’s call “industrial policy”. Sometimes industrial policy fails when governments choose the wrong industry to specialize in, picks the wrong company to subsidize, develops cronyism with the companies, or fail to beat other governments for investments.

In contrast, Guyana, experienced black gold when Exxon Mobil discovered an ocean of oil in Guyana in 2015. Guyana went from zero oil reserves to 11B. This is humongous for Guyana’s small ~800K population, giving Guyana an insane oil reserves per capita. Guyana only started pumping oil in 2019 after the 2014-2016 oil crash which impoverished Venezuela.

The Miracle growers (5% to 10% average growth per year for 10 years):

Africa: Ethiopia, Djibouti, Ivory Coast, Sao Tome & Principe, Kenya, Guinea

East Asia: China, Vietnam, Laos & Cambodia

Latin America: Panama, Guatemala

South Asia: Nepal

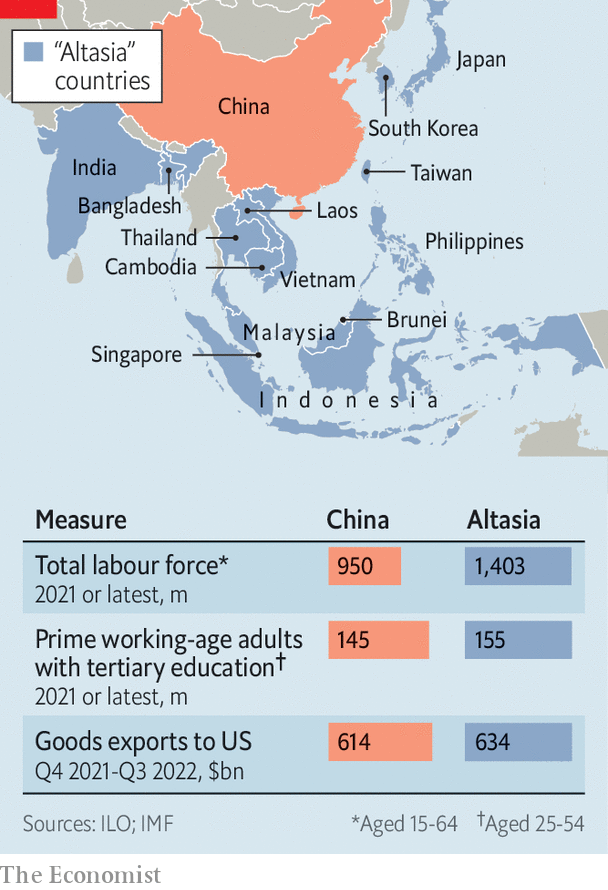

These countries are still growing fast, but just not as insane as the double digit nations. Everyone knows about the rise of China, which is about to become a high income country by 2023-2025. But not everyone knows that China, Japan, South Korea and the West are now making Southeast Asian countries (Vietnam, Laos, and Cambodia) the new low-wage manufacturing hubs. With Chinese wages are no longer super low, global firms are now eyeing South East Asia as the alternative destination to diversify their supply chains. South East Asia is now considered to be “Alt-Asia”. Vietnam, in particular, has been a huge beneficiary and will become an upper-middle income country before 2030. Through a series of economic reforms and privatizing some government-owned industries like China did, Vietnam has emerged as a diversified economy. Vietnam now exports hundreds of billions of electronics, tens of billions in machines, shoes, furniture, clothes, steel, and billions of plastics, medical equipment, and rubber. Vietnam’s proximity to electronics powerhouses like China, South Korea, Singapore, Taiwan, and Japan makes it an attractive destination for development.

In addition, Ethiopia, a country that was once synonymous with famine, is now exploding in growth. This growth can be attributed to various factors, including the ultra efficient national airline which has transformed Ethiopia into a continental hub.

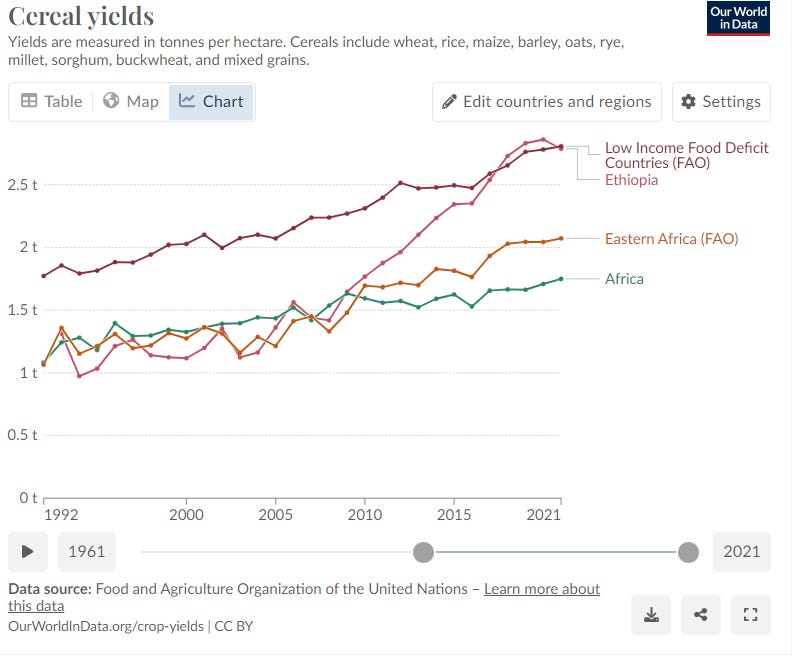

One factor that is under looked is that Ethiopia learned to increase food yields.

Most of Africa can’t even grow 2 tons of food per hectare on average (i.e. wheat, rice, maize, barley, oats), but Ethiopia’s food productivity increased from under 1.4 tons per hectare in the 90s to 2.79 tons per hectare which almost beats the Low Income Food Deficit country average.

Sustaining an impressive average annual growth rate of 9% growth per year, Ethiopia has implemented a sound industrialization strategy, exemplified by initiatives like the Hawassa industrial park, which attracts significant foreign direct investment.

Ethiopia also has an unusually high investment rate: 38% of GDP which has been thrown into energy generation and internet connectivity. Ethiopia has been able to finance its development not with domestic savings (which are relatively low) or aid, but by securing commercial loans from China. Ethiopia is still quite poor and has been hindered by the civil war, but Ethiopia is on track to become a (lower) middle income country by 2025.

The Good Growers (4% to 5%)

These countries are growing fast but they are doubling living standards closer to a 20 year time frame rather than a 10 year time frame.

Middle East: Israel, Egypt

Former Soviet Union: Moldova, Armenia

South Asia: India, Pakistan

Sub-Saharan Africa: Ghana, Tanzania, Democratic Republic of Congo (DRC)

Latin America: Dominican Republic, Bolivia, El Salvador, Honduras

DRC is the world’s largest exporter of cobalt, which is used for lithium-ion batteries for electric vehciles. The cobalt market is small (~$8B as opposed to the $1T oil market) but is growing at 12% per year for 9 years. DRC exported over half of the world’s cobalt, $4.4B in 2021, while America and Canada combined only sold ~$800M. Thanks to China and DRC cultivating a relationship of resource extraction, DRC has negotiated contracts to growth its economy. The Congo President, Felix is renegotiating a contract with China after the previous President Joseph did a “poorly negotiated” mining contract before. Felix is trying to renegotiate a $6B cobalt-for-infrastructure deal with China.

However, DRC is growing from a low base. To put in perspective, Ghana, Tanzania, and DRC have been growing at similar rates over the past decade. But the average Ghanaian double the average Tanzanian, which makes double than the average Congolese.

Steady growth (2% to 4%)

These countries are steadily growing instead of having explosive growth. Both the European Union & The United States of America are in this list of steady growth. Indonesia is in this list and has graduated from lower middle income to an upper middle income country. Indonesia is committing to an industrialization strategy called “resource downstreaming”. This involves the implementation of a ban on the export of commodities, which incentivizes foreign firms to establish joint ventures and invest within Indonesia.

Indonesia’s decision to ban the sale of nickel ore, considering Indonesia’s status as the nation with the world’s largest reserves of nickel, has attracted nickel processing facilities and resulted in a notable increase of over 40%+ foreign direct investment within in a year. Indonesia is now prepping to ban the sale of copper, tin and bauxite. All of this is helping Indonesia. In 2021, Indonesian firms exported of goods $248B, in 2022 Indonesia exported $292B, With ambitious plans for the future Indonesia aims to exceed $300B in 2023.

East Asia & Pacific: Singapore, New Zealand, South Korea, Thailand, Indonesia, The Philippines

Latin America: Uruguay, Belize, Costa Rica, Grenada

Former Soviet Union: Georgia, Kyrgyzstan

Africa: Rwanda, Zimbabwe, Benin, Guinea-Bissau, Togo, Liberia,

Countries like Rwanda, are growing steadily, and it’s reputation is incredible. Rwanda’s brand exceeds it’s economic growth (for now). But people buy into the vision of Paul Kagame, the President of Rwanda. Just look at the Youtube videos on Rwanda.

Very small Growth (1% to 2%)

These nations are growing but not by much over the decade. For an advanced nation like UK slow growth is fine, and for upper-middle income nations like Botswana slow growth is tolerable. But low income African countries or Haiti can’t afford to be this stagnant.

Middle East: United Arab Emirates, Bahrain, Saudi Arabia

Europe: United Kingdom, Switzerland, Sweden

East Asia & Pacific: Malaysia, Papua New Guinea, Mongolia, Myanmar

Africa: Seychelles, Botswana, Mauritius, Mauritania, Senegal, Mali, Uganda, , Burkina Faso, Morocco, Cabo Verde, Cameroon, Gambia, Niger,

Latin America: Peru, Ecuador, Nicaragua, Chile, Paraguay

Caribbean: Jamaica & Haiti

Former Soviet Union: Tajikistan, Ukraine, Belarus

Countries that are basically the same as 10 years ago

Latin America: Argentina

North America: Canada & Mexico

Middle East: Jordan

Caribbean: Trinidad

The Former Soviet Union: Uzbekistan, Kazakhstan,

Europe: Norway

African countries: Malawi, Burundi, Madagascar, Sierra Leone

Countries that are poorer than they were 10 years ago

Some countries are poorer than they were a decade ago simply because their growth is highly dependent on a single commodity like oil. In 2012, oil was near a peak, but unfortunately oil had a massive commodity bust between 2014-2016. Prices fell from highs of $140 per gallon to $43.3 by 2016. If you were a country that made oil backed loans and the price of oil declined, that would be painful.

Countries that have declined 1% to 3% per year on average since 2012

All of these nations are oil exporters that declined a bit due to the oil bust. ,

Russia, Oman, Qatar, Kuwait, Azerbaijan, Colombia, Gabon, Iraq, Nigeria, are all oil commodity exporters that were hurt by the commodity bust.

Other countries that have lagged but are not oil exporters involve Turkey & Japan. Erdogan in Turkey pursued an illiterate economic policy of trying to lower interest rates to curb inflation (the opposite is true). Japan has always been an example of a country that has been experiencing “lost decades” and a weak yen has made Japan have stagnate wages for 30 years.

African countries: Tunisia, Central African Republic, Eswatini, Namibia, Mozambique:

Central African Republic has been decade civil war since 2012.

South Africa is an industrialized nation that was growing until the mid 2010s commodity bust. Now South Africa is suffering. It has been plagued from corruption from Zuma. and nearly half the youth are unemployed. South Africa’s state power utility, Eskom has been incapable of producing enough megawatts to meet South African demand, leaving your average South African to go up to 10 hours a day with no electricity. This has been hurting industries like mining and car manufacturing, and thus hurting employment. This is knockback effects for its neighbors. Eswatini & Namibia also have half of their youth are unemployed as well. Also, Mozambique has had trouble in the Cabo Delgado province and corruption with “tuna bonds”.

Lastly, Tunisia is in a balance of payments crisis and has refused to take a $2B IMF loan under IMF’s conditions. Tunisia now lacks foreign currency to buy for crucial imports, leading to shortages in sugar and food. Now young Tunisians are trying to flee to Europe.

Countries that have declined 3% to 5% per year on average since 2012

Brazil is a massive economy that exports iron, soybeans, oil, sugar and meat in the multi-billions. Unfortunately Brazil has a lot of corruption. A perfect example is “Operation Car Wash” which uncovered that Brazil’s state-owned nation oil company, Petrobras, stole over $5B. Petrobras executives accepted bribes in return for awarding contracts to construction firm at inflated prices. The commodity crash hurt Brazil as well.

Algeria & Chad depend on oil which declined due to the oil commodity bust affecting their growth.

Congo-Brazzaville and Zambia, are nations that depend on exports. Both their economies declined due to the 2013-2015 copper price plunge. Congo-Brazzaville is also an oil exporter so it was a double whammy for them.

Countries that have declined 6% to 8% per year on average since 2012

Angola, Equatorial Guinea, East Timor, Libya, and Iran are all dependent on oil exports. The oil commodity bust in 2014-2016 hurt them. Iran was also re-hit with sanctions by Trump. Libya also suffered from the civil wars after NATO helped the rebels kill Qaddafi..

Sudan became poorer due to losing its 75% of oil after South Sudan ceded.

No latest data

North Korea, Afghanistan, Yemen, Venezuela, Turkmenistan, Syria, South Sudan, Lebanon, Eritrea, Cuba, Bhutan

Conclusion:

Overall, the biggest winners have been Guyana by winning the oil lottery after the oil crash and Bangladesh, Southeast Asia, China, Ethiopia for fantastic industrialization strategies. The biggest losers were countries that were complacent big oil producers that didn’t diversify enough to prepare for an oil crash. Will the next 10 years be the same? Will there be new winners? We’ll revisit again next year.

Links are attached!