Nigeria's Economy General Trends (1960-2021)

Nigeria started off with issues, had around 12 years of oil fueled growth, then two decades of oil price collapse

As mentioned before, Nigeria is a lower-middle country with over 200M people. It’s really hard to summarize Nigeria’s economic history in one article and do it justice. If you’d like to read my previous two articles (pre-independence and Nigeria vs. the rest of West Africa). on Nigeria read them here.

Nigeria is a petrostate, just like Gabon. Almost 90% of Nigeria’s exports are fossil fuels.

Top 10 exports in 2021 (the chart above is 2020 data) :

Oil & mineral fuels: $42.4B (89.1%)

Ships, boats $1.4B 3%

Fertilizers: $950M 2%

Cocoa: $630M 1.3%

Oil Seeds: $326.2M

Zinc $259M (.5%)

Aluminum: $190M (.4%)

Aircraft & Spacecraft: $190M (.4%)

Tobacco: $113M (.2%)

Lead: $94.1M (.2%)

Nigeria’s top 3 trading partners are: The EU, India, & Canada.

Nigeria some heavy & light manufacturing in italics, but it is mainly an oil exporter.

A country being dependent on the price of oil is not great for the following reasons: It’s quite disappointing that Nigeria can export $30B amount of crude oil yet has little domestic capacity to refine oil ($600M). As, a result Nigeria ends up being a huge importer of refined oil… from crude oil that was brought from Nigeria. Nigeria ends up buying its own oil because its firms don’t refine enough.

Slave to Oil Prices:

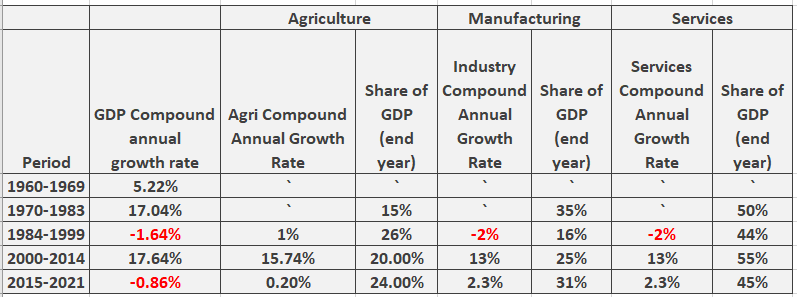

Nigeria's economy heavily relies on the price of oil. It saw a significant increase in the 1970s, declined from 1980 to 2000, increased again from 2000 to 2014, and faced a severe downturn from 2014-2019, worsened by the COVID pandemic in 2020. Currently, there is a slight recovery in oil prices.

Nigeria’s economic growth grows in tandem, with the price of oil.

Unfortunately, Nigeria did not give the World Bank its agricultural, manufacturing, or services data from 1960-1981. The data starts in 1983. Every red you see corresponds to an oil collapse, and the GDP growth corresponds to oil booms. Nigeria’s industrial output composes of oil & gas, construction, manufacturing and etc. Nigeria’s industrial output booms in oil booms and dies in oil busts.

If you were a high skilled service sector job, real estate developer, or a Nigerian working in drilling, extraction, and exploration of crude oil, you apart of the Nigerian middle and upper-middle class. Oil multinationals were investing in the country and tax revenues were going up; unfortunately, the oil spurred growth also was accompanied with high levels of corruption.

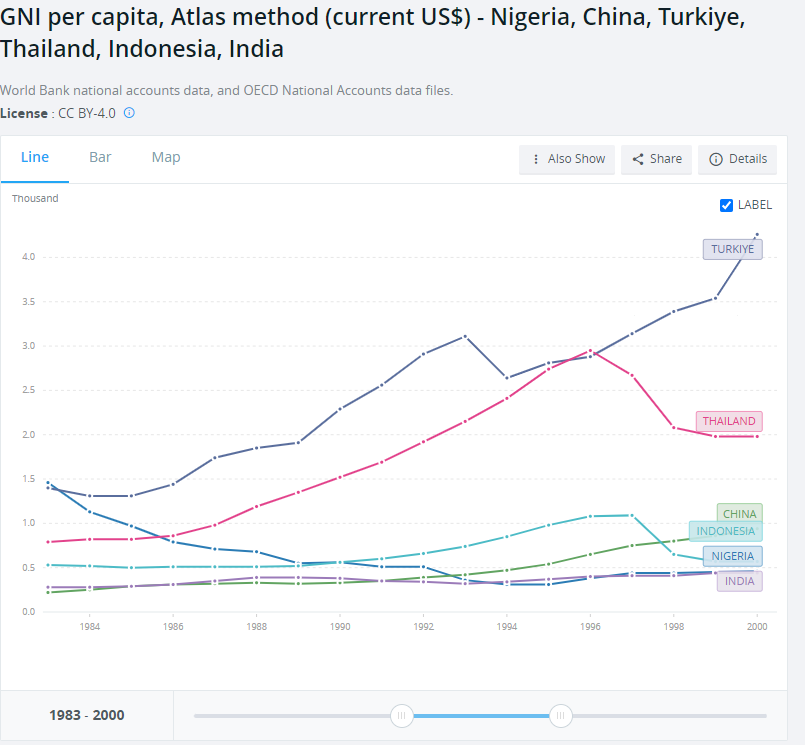

Nigeria’s history can be put in 5 parts: I’ll compare Nigeria to Thailand, China, Indonesia, India and Turkey for comparison, since Nigeria is much bigger and has higher per capita incomes than most of its West African neighbors.

Part 1: Genocide, wars, and laggard growth between 1960-1970.

Due to tribal, religious, and cultural differences, coups & counter-coups, a political reality that favored the North, and mass pogroms against the Igbos, Nigeria had a terrible civil war. Britain and Russia sided with the Nigerian government (UK: oil, Russia: geopolitical influence in Africa) while France supported the secessionist state Biafra (France: oil). The Nigerian government genocided and starved 2M Igbos. If you want a detailed explanation watch here. Nigeria didn’t really get its act together until after the war ended in 1970.

Part 2: King Nigeria! The oil boom and income growth between 1970-early 80s. (And massive looting)

Nigeria from 1970 to the early 80s, Nigeria was booming due to the oil price spikes from the drops of production from OPEC’s revenge against the West in supporting Israel in the Yom Kippur War in 1973, the Iranian Revolution in 1979, and the impetus of the Iran-Iraq War in early 1980. In addition, Nigeria changed its revenue collection system from royalties to the government collecting revenues. Nigeria was able to sell oil at high volumes, which increased government revenues and foreign exchange earnings, but most of the gains went to the elite. Despite massive corruption and the lack of diligence on environmental effects before engaging in capital-intensive projects, the Nigerian government made strategic moves to join Saudi Arabia’s oil cartel, Organization of Petroleum Exporting Countries (OPEC) and made the state owned company called Nigerian National Petroleum Company(NNPC) in 1977. NNPC has many subsidiaries involved in producing, exploring, refining and distributing oil and it also regulates the industry. During this oil boom, Nigeria was urbanizing at a fast rate, as a result farmers were not cereal crop production (oats, maize, rice) didn’t grow as the population was rising. This led to Nigeria using its foreign currency to increasingly by food imports (which the government sometimes banned).

NNPC became a major player in the upstream and downstream oil sectors. NNPC consistently negotiates equity stakes in oil projects with British Shell & BP, American ExxonMobil, Tenneco & Chevron, Italian Agip & Eni, and French Elf & TotalEnergies.

Unfortunately having a state owned enterprise (SOE) is a two sided coin. In theory, shareholders are supposed to be the nation. The government firm will invest in areas where a multinational like Exxon won’t have an obligation to. But in practice, SOE can be black boxes of corruption where Nigerian politicians loot millions oil profits to put them in Swiss bank accounts or London real estate. In reality, government officials hold ownership instead of the public.

Anyone who has ever told you that “Africa can never beat non-African countries” is a liar, a racist, or is uninformed. Nigeria, while misusing and looting its oil, was more richer per person on average than Turkey or China during this time.

Nigeria maintained a currency peg to the dollar at parity to artificially make the currency strong so that food and fuel imports could be cheap. Maintaining the peg was not difficult at the time due to the foreign currency that Nigeria’s oil exports were bringing in. Nigeria was paying Indians and Ghanaians decently well to teach at Nigerian high schools and universities, and they would come because Nigeria was just a much richer place than Ghana or India at the time.

In addition, General Yakubu Gowon implemented the indigenization programs in 1972 and 1977. These programs transferred at least 60% of ownership and control from foreign owners to Nigerians. Nigerian steel, iron, petrochemical plants, cement, textiles, breweries, farming, insurance, banking, and cottage industries were now owned by Nigerian investors or the government.

An example of this is the First Bank of Nigeria or FBN. In 1894 it was the Bank of British West Africa. In 1965, Apartheid South Africa’s Standard Bank acquired it and it became Standard Bank of West Africa. The Nigerian military government took a controlling share and the bank was reorganized to become a Nigerian bank. Union Bank Of Nigeria used to be a Barclays Bank.

But the goal of the Nigerian Indigenization Decrees were to promote local ownership and control of key industries in Nigeria. The Nigerian government believed that this would help to develop the country's economy and reduce the influence of foreign companies in the Nigerian market. Over 1100 foreign owned firms became Nigerianized. Unfortunately, some Western companies were reluctant to sell their shares to Nigerians, and some divested from the country. Although it gave Nigerians more jobs it sent a signal to Western firms to not do businesses in Nigeria. In the end, the wealth concentrated to a few Nigerians, especially politically connected ones.

Part 3:The two lost decades of pain and Japa between 1983-2000.

But during 1980s-2000s, Nigeria slipped down from lower-middle income to low-income due to the price of oil declining due to over supply which outpaced the West’s demand (Average incomes went from $1460 in 1983 to $310 by 1994) . The articles from the 1980s describing how oil overproduction disrupted Nigeria are legion.

The economic crash didn’t hurt other oil states as hard because they were forward thinking enough to create sovereign wealth funds to draw upon in case oil prices collapsed: Kuwait(in 1953, Kuwait made the world’s first sovereign wealth fund) Saudi Arabia (1971), and United Arab Emirates (1976). Nigeria did not create their oil based, sovereign wealth fund until 2011.

This ruined the Nigerian governments budget estimates. This led Nigeria to a series of balance of payment crises, where they asked the International Monetary Fund a bail out four times, to receive over $2B dollars between 1980 to 2000. To obtain the loan, Nigeria had to follow IMF’s demands. During this time IMF imposed a harsh structural adjustment program where austerity measures were imposed to make Nigeria fiscally prudent. Nigeria’s currency had to float instead of keeping their peg, since oil was in lower demand during this period, the market’s demand for the naira plummeted, making food and fuel imports more expensive. Nigeria had sell bankrupt government owned firms in hotels, agriculture, breweries, cement firms, pig farms, chicken farms, textile mills, flour mills, boatyards, insurance companies distilleries, food, beverage, and electronic firms to raise capital and remove expensive subsides on petroleum products. Nigeria also fully commercialized the state own firms, which means state firms have to profit without subsidies or go bankrupt. That included the coal, oil and telephone firms. Partial privatization was done for the national parks, national TV stations, railroads, and steel mills. Many Lebanese business executives bought up these firms. Nigeria had to make deep cuts in the public sector, reduce funding in education and fuel subsidies (without Nigeria paying to make fuel cheap, this caused massive inflation). Science education was so defunded that there weren’t enough teachers in secondary schools and universities. This hampered the ability of Nigeria to produce engineers. University professors held strikes protesting the low wages and inadequate benefits.

Part of the privatization program was successful. The cement industry benefited from privatization as now Nigeria produces more cement from private investors than when cement was owned by the Nigerian government, finally becoming an net exporter. It also made, Alito Dangote, Africa’s richest man, rich from being a buyer of the formerly owned state owned cement firm.

However, efforts to sell publicly owned power plants have failed. The government couldn’t find buyers who could operate the plants and the Nigeria still has daily blackouts.

While Nigeria, was going to the IMF, it’s former economic rivals: Turkey, China, Thailand, Egypt, and Indonesia grew while Nigeria declined. With a weaker currency, this made leaving Nigeria more attractive to the skilled-labor, as one could go to the west, make money in dollars and build homes and send remittances easily back in Nigeria. This kickstarted "Japa” (flee in Yoruba) , aka brain drain of the middle-class and highly skilled Nigerians. Almost two decades of pain and decline, while the rest of the world surpassed Nigeria.

Part 4: The second oil boom and Nigerian rebirth between 2000-2014. And the looting.

Not only was this era an oil boom, but it was also the golden era of growth for the non-Western nations. India, Indonesia, and Nigeria become lower-middle income (Nigeria for the second time). Thailand and China become upper middle income. Turkey was border line a rich country.

Part 5: The oil slump and Covid between 2015-present.

But damn look at the growth of China! China is almost a high income country

We will focus more on Nigeria’s rebirth and rebust from 2000 to Present next time —>

Please do, I enjoyed it and shared it with a few of my friends

Quick aside : "Nigeria some heavy & light manufacturing in italics" is a statistical mistake

These special purpose ships (and scarp vessels) are basically previously imported oil rigs (and similar) being re-exported as most of them are rented by oil producing companies are move to other locations. But customs (which are ultimately the source of OEC data) do record the equipment full value when it gets in the country and when it gets out.

In any given year, you can see that category being significant in either imports or exports of most oil producing west African countries. I bet (I haven't tried) it all nets in a multi-year time scale.

I suspect aircraft is probably the same.

(and fertilizer is a derivative of the oil industry)