Guns, Germs & Cobalt's 6th Q&A: Petrodollars, Commodity Traders, Nigeria's population, South Korea's Development

Reserve Currency, Sovereign Holders of Treasuries, Glencore owning a Congo mine, Nigeria's population, South Korea vs. Ghana

If you are a new subscriber read the others parts below if interested:

Part 1

Part 2

Part 3

Part 4

Part 5

1. Does Being the World’s Reserve Currency Impact Interest rates?

Someone shared an article from Eurasia Review about the "petrodollar deal." I’ll Summarize the article:

_________________________________________________

Saudi Arabia is retaliating against Biden by revoking the "American-Saudi petrodollar agreement."

After the gold standard collapsed, the US arranged for Saudi Arabia to sell oil exclusively in US dollars and invest surplus revenues in US treasury bonds, in exchange for American protection. This deal ensured a stable oil supply for the US and a buyer for its debt, helping the dollar remain the world’s reserve currency, keeping it strong and maintaining low interest rates.

Now, Saudi Arabia's departure from the petrodollar could reduce global demand for the US dollar, leading to higher inflation, higher interest rates, and a weaker bond market. Saudi Arabia is now working with China on cross-border trade, potentially shifting the global power dynamic.

_______________________________________________

Honestly, I was going to write a full Substack post about this, but it got too long. The Eurasian Review Article contains both true and misleading statements. Dissecting each point took too much time.

Instead, I will address the implications: Does “being the world’s reserve currency raise interest rates?”

The answer: A weaker demand for the dollar doesn’t necessarily mean higher interest rates. Central Bank Monetary Policy is far more important.

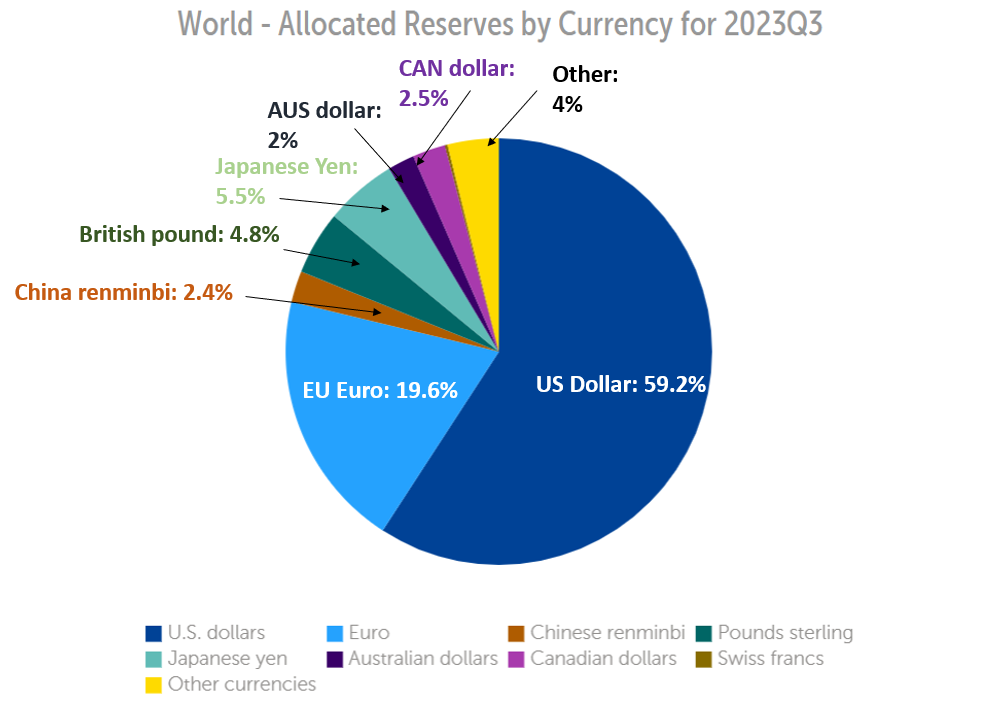

As of Q3 2023, 59% of the world’s reserves are denominated in US dollars, followed by the Euro, Yen, Pound, Canadian dollar, and Renminbi.

We know America has the highest demand for its currency, for now, but that doesn't directly affect interest rates.

Looking at the correlation between the 10-year bond rates and reserve currency status, the R² value is 15%. This means only 15% of the difference in interest rates between countries is explained by their reserve currency status, indicating it has weak predictive power for determining interest rates.

The dollar is used 12x than the pound, yet both have similar 10-year bond yields. Similarly, the Chinese renminbi and Canadian dollar are used almost equally in global trade, but China has lower rates. Factors like the central bank's monetary policy play a bigger role in determining interest rates.

The major impact of countries moving away from the dollar would be the ability to avoid US sanctions, but the US cooperates with other countries when sanctioning as well. US dollar sanctions often also mean euro, pound sterling, Canadian dollar, New Zealand dollar, Australian dollar, and Japanese yen sanctions as well. To avoid sanctions, its not just avoiding the dollar but the West in general.

#2. Is American Hegemony backed by Saudi Arabia’s oil?

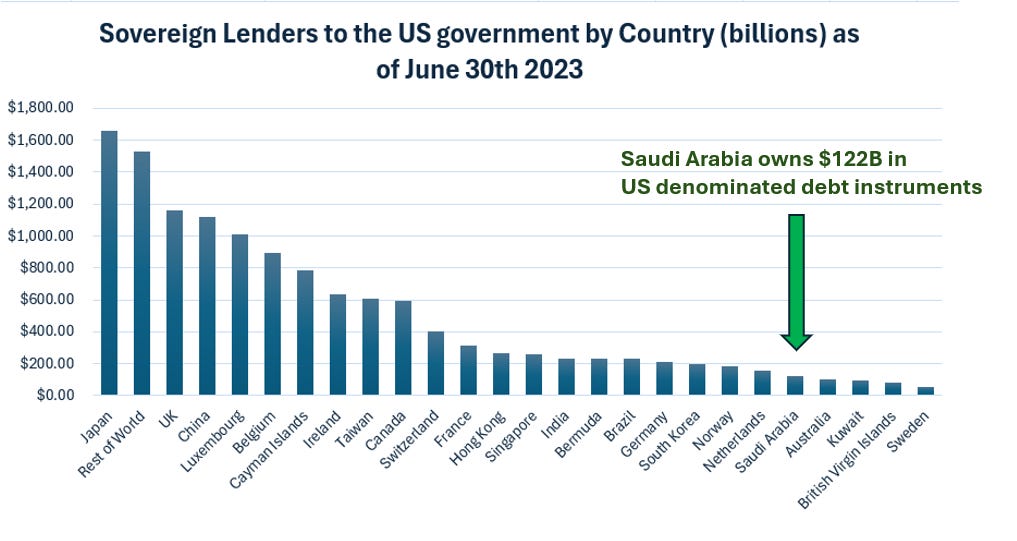

While it's true that oil is the most traded commodity and that Saudi Arabia buys military equipment and U.S. bonds, the notion that America's currency is propped up by Saudi Arabia is mathematically incoherent. Saudi Arabia has never been the largest buyer of U.S. treasury bonds.

In 1980, Saudi Arabia’s US government bond holdings were $12.2B, only 1.3% of America’s $908B federal debt at the time. Even if I add other oil states like Bahrain, Iraq, Iran, Oman, Kuwait, Qatar, UAE, Libya, Nigeria, and Gabon’s holdings as well, that’s $16.3B, just 1.8%. This minimal percentage indicates that the dollar isn’t propped up by these holdings.

Currently, Saudi Arabia ranks 22nd in buying U.S. treasury bonds, with $122B out of the $13.1T total foreign owned debt, about 1%. Kuwait owns more U.S. treasuries than Saudi Arabia. The largest holders are Japan, the UK, China, and Luxembourg, each with over $1T. Thus, the idea that Saudi Arabia's bond holdings uphold American supremacy is unfounded.

#3 Which Entities or Firms “Take Resources?”

Are you familiar with Vitriol? It's a Swiss-based energy and commodity trading firm that provides services like oil trading and shipping. Other similar firms include Glencore, Trafigura, Gunvor, and Phibro.

These companies are the "international clearing houses for essential goods," acting as intermediaries between resource-selling countries and consuming firms. They are often involved in opaque loans, corrupt deals, sanction avoidance, and controversial resource dealings. For instance, Glencore owns 100% a cobalt/copper mine in the Democratic Republic of Congo. You can see the mine below:

Most firms do a joint venture with the Congolese state owned firm, Gecamines. Glencore initially owned 30% of the mine in 2007, there were other investors, and Congo’s Gecamines initially owned 20%, but Glencore expanded its ownership over time. In 2022, Glencore admitted that they bribed many African government officials, including the DRC to secure “improper business advantages”. Glencore admitted to paying millions in bribes to officials in Cameroon, Equatorial Guinea, Ivory Coast, Nigeria, South Sudan, Brazil and Venezuela.

Even when Saddam Hussein of Iraq, Muammar Gaddafi of Libya, the Mullahs of Iran, or Apartheid South Africa were under sanctions, these firms bought their oil, and sold it to countries willing to bypass UN sanctions. These firms swapped Cuba’s sugar for oil to kept Castro’s government alive. When Russian oligarch & former Deputy Prime Minister, Igor Sechin, the leader of Rosneft wanted to raise $10B quickly, he called these commodity traders. These firms don’t care about sanctions, risk, or etc.

Marc Rich, the founder of Glencore, was indicted by U.S. for tax evasion, wire fraud, racketeering, and making oil deals with Iran during the Iran hostage crisis. Bill Clinton pardoned him during Clinton’s last day in office. People assume its because Rich’s ex-wife, Denise, made large donations to the democratic party.

These firms do three things: source, trade, and market.

They purchase resources (oil, metals, grains) from producing countries or firms. Then they transport and store the commodities, often using their own logistics and infrastructure. Then they sell these resources to refineries, manufacturers, or other consumers.

Most of these companies have their headquarters in Switzerland. Except Cargill and Phibro, which is headquartered in Stamford, Connecticut. Olam is in Singapore.

Why are most of these firms in Switzerland? As Pestalozzi, a Swiss law firm says, “Commodity trading firms are hardly regulated in Switzerland.”

Phibro’s & Vitrol specializs in hydrocarbon trading, Glencore specializes in metals, and Cargill specializes in agriculture. Trafigura is good at metals and oil.

Their job is buy natural resources at a place and time, and sell them to another at a higher price to profit. The reason why this job is so lucrative is because supply and demand of commodities don’t match. The mines, farms, oilfields aren’t located at the same location as the buyer of those goods. Not every peanut farmer, soybean agriculturalist, or lithium miner has a vast network of offices to sell their products. That’s where the commodity trader comes in to help the commodity producer sell their product.

They can profit from “buying low and sell high” or “buying long” or by “borrow to sell high and buy low to payback a loan” or short selling. These companies are the “invisible hand” that Adam Smith speaks about when it comes to raw materials.

#4: Does Nigeria lie about its population size?

“No census has been credible in Nigeria since 1816. Even the one conducted in 2006 is not credible. I have the records and evidence produced by scholars and professors of repute; this is not my report. If the current laws are not amended, the planned 2016 census will not succeed,” — Festus Odimegwu as Chairman of the National Population Commission

Odimegwu was then fired for saying this.

The answer is Yes. Nigeria probably does not have 220M people. However, we don’t have better estimates available than from the government.

The question is… why?

Nigeria is a large country with no deep shared history among the different tribes. Due to the historical realities of different tribes hating, enslaving, and warring each other, it is a low trust society. Most Nigerians don’t trust other Nigerians and corruption is rampant.

In a low trust society, in order to ensure loyalty, you must buy off elites - political patronage. Nigeria has one of the lowest tax revenues as a proportion of its economic output among nations, even by Africa standards. Instead 65% of Nigeria’s government revenue is oil export proceeds. Then oil is distributed to provinces to “buy” them off. The oil revenue is distributed in proportion to the population of each province. This incentivizes a system where more money is concentrated in more populace regions. This incentivizes provinces to over report fertility rates, undercount child mortality rates, undercut emigration rates, over report population sizes, and not check population estimates accurately. Nigeria hasn’t done a census since 2006. Nigeria was supposed to do a census in 2023, but it was postponed. Even as of June 2024, the census has not been done yet.

To be honest, I wouldn’t be surprised if Nigeria’s population was closer to 170M.

#5 Is it true that Ghana was richer than South Korea in the 1950s and 1960s?

I am seeing posts like this lately:

Basically the idea was South Korea was poorer than Ghana, but South Korea climbed quickly meanwhile Ghana has stagnated.

The question is: is it true? Did South Korea start out poorer than Ghana?

The answer is Yes. In fact, even North Korea was even richer than South Korea initially. South Korea didn’t surpass North Korea until 1974. But anyone back then in the 1970s could tell you that South Korea was going to surpass Ghana eventually.

Why? If we compare literacy rates of 1960s, then you will see exactly what I mean.

Guess what South Korea’s literacy rate was in 1960? South Korea already achieved near universal literacy in 1960. South Korea stopped testing for illiteracy in 1958, which was the year they achieved 96%. Guess what Ghana’s literacy rate at 1960. 80%, 50%?

Ghana’s literacy rate in 1960 was 25%…. and Ghana was one of the more educated African countries. In fact, half of all Sub-Saharan African university grads just came from two countries in the 1960s - Ghana and Southern Nigeria. Ghana just achieved 80% literacy in 2020.

Right there you could tell that even though Ghanaian farmers were slightly richer from cocoa farming or gold mining in 1960, South Korea was a very literate society. Also Japan made many factories in South Korea when they colonized them. South Korea had pharmaceutical manufacturing, chemical product manufacturing, bicycle manufacturing, tire manufacturing. textiles, and railway firms under Japanese colonialism. Samsung started off as a construction and overseas trading firm under Japanese rule.

Even though South Korea lost its industrial base after the Korean war, South Korea had a level of organizational capacity that Ghana never had. Even though South Korea started poorer, they had much higher human capital.

Now in 2022, at least Ghanaians are almost 3x richer than North Koreans.

Like, comment, share and subscribe