Insights & Book Review #4: The Globalization Myth, Why Regions Matter by Shannon K. O'Neil

Bucking Conventional Wisdom and the Case for "near-shoring"

This is my 4th book review, following Dead Aid (86%), The World for Sale (95%), and Where Credit is Due (97%). For The Globalization Myth, I give it a 98%. It’s a thought-provoking book that challenges conventional wisdom on globalization.

Dr. O’Neil presents data-driven arguments that post-Cold War, global trade is more 'regionalized' than 'internationalized’ and has brought more benefits than harm. To compete with China, Dr. O’Neil argues the U.S. should regionalize rather than rely solely on ‘building in America,’ though this lacks political support today.

About Dr. O’Neil

Shannon K. O’Neil, an economist, is the Senior Vice President at the Council on Foreign Relations(CFR), the “brains” of the 'American Military Industrial Complex.' For those who don’t know, many CFR members came up with the Soviet “Containment” Strategy, US Marshall Plan, NATO, the proto-European Union, non-nuclear proliferation, and more.

It’s worth saying that the Pentagon does not always listen to top leaders in CFR. For example, many lead members of the CFR were against the Vietnam and Iraq War.

Dr. O’Neil earned her undergraduate and master’s degrees from Yale, followed by a PhD in government from Harvard. Her research focuses on Latin America, and she has worked in Latin American investment firms specializing in equity and macro research.

Why is it the Globalization “Myth”?

Dr. O’Neil challenges several misconceptions about globalization. The biggest? People usually think of America as a high-trade intensity economy. This is not true. America is relatively open for trade, however, America is a low-trade intensity economy. This means America is far less globalized than many assume:

America has one of the lowest trade-to-GDP ratios of any nation on earth. You are probably shocked, but America has the 3rd lowest trade intensity on earth:

While the U.S. has very global capital & financial flows, its trade intensity is much lower than you would think. Since 2011, U.S. trade with the world has declined and the proportion isn’t very high to start with.

In 2023, America’s total trade volume was $6.85T (exported $3.05T and imported $3.8T). American trade accounted for only a quarter of its GDP ($27.4T)—a surprisingly low proportion, but it makes sense given America’s huge domestic economic size and composition.

The U.S. remains largely a service economy (75% of GDP). Services like construction, healthcare, social assistance, wealth management, government services, real estate brokerage, education, legal services, and etc. mainly service domestic markets and rarely have cross-border flows. Also, America is not an export-driven economy. Exports only make up 11% of America’s GDP.

America is a very different economy than a country like South Korea, where manufacturing makes up 24% of GDP. South Korea is a relatively small, fast aging country. Since the market is relatively small and old people don’t consume as much, it depends more on firms like LG, Hyundai, & Samsung selling goods to big markets like China, America, and the EU.

Here are the Top 10 most open trading economies:

Supply Chains Are not as International as you think: O’Neil dismantles the myth of a fully internationalized economy, showing that most trade happens regionally. The numbers back this up:

Most trade is within regions: The average traded good travels about 3,000 miles (Boston to LA or Seoul to Singapore)—far from the ‘hyper-globalized’ world we imagine. So the average distance of trade is still within a region among these trade hubs.

Commodity vs. Intermediate Trade: Commodity trade—oil from the Middle East, soybeans from Brazil, and copper from Congo truly travel the world. However, most of global trade is in intermediate goods, commodities are at the tail end of the supply chain. Most manufacturing supply chains stay within regional hubs.

85% of global trade is concentrated in just three regions—North America, Europe, and East Asia. Latin America, the Caribbean, Africa, the Middle East, Eurasia, Central Asia, Caucasia, and South Asia make up the remaining ~15%.

Europe and East Asia trade mostly within their blocs, while the U.S. is less regionally concentrated. Everywhere else trades significantly more outside their bloc than within. See chart below:

This shows that the distinction of free trade & autarkic isolation is a false choice. Regionalization allows you take advantage of your neighbor’s competitive advantages, improve economies of scale, and utilize lower labor costs to help your firms to dominate.

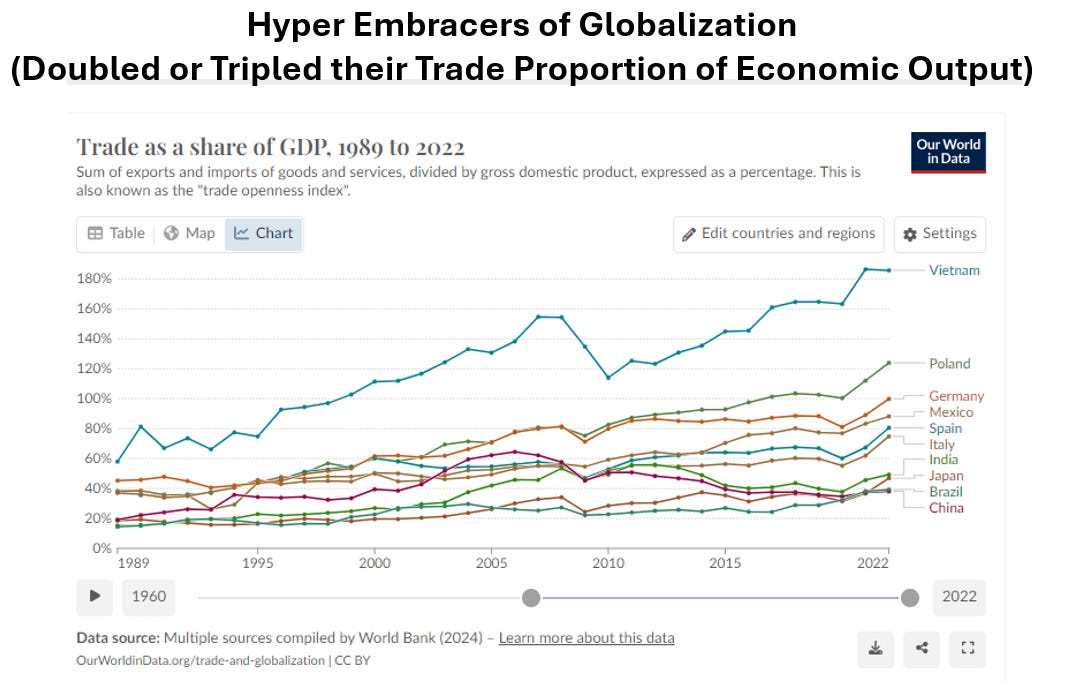

Not every country embraced globalization to the same degree. Countries roughly fall into four broad categories based on their level of globalization:

Super Embracers: China, Vietnam, and India saw explosive growth in trade as a share of GDP.

Modest Participants: Countries like the U.S. and Canada expanded trade not as much as the Super Embracers.

Rejectors: Nations like Tanzania and Indonesia have deglobalized.

No Changers: Cameroon, Bahrain, and Mongolia. These countries' trade composition remained largely unchanged from 1991 to 2023.

Let’s see some examples:

The relationship between trade openness and economic growth is weak. Some hyper-globalizers, like Italy, Brazil, and Japan, have stagnated, showing that trade alone isn’t a magic formula for growth.

The graph below compares trade growth (y-axis) to inflation-adjusted GDP per capita growth (x-axis) from 1990 to 2023. Countries further east (e.g., China) saw rapid growth, while those westward experienced slower growth (e.g., Greece), with further west showing decline (e.g., Congo).

Notably in the graph, there’s a cluster of countries that embraced trade but got poorer (Madagascar, Congo) while there’s another cluster of countries that deglobalized and grew richer (e.g., Dominican Republic, Ethiopia, Indonesia).

Patterns vary widely:

Hyper-globalizers that had slow growth: Italy, Mexico, Japan, Chad

Hyper-globalizers that declined: Madagascar, Congo, Brunei

Fast-growing hyper-globalizers: Vietnam, China, India, Laos

Fast-growing de-globalizers: Indonesia, DR, Tanzania, Kazakhstan

Trade Maintainer, high growth: Singapore, Malaysia, Chile, Israel

The regression analysis from the graph confirms the weak link—only 2% of economic growth from 1990 to 2023 can be explained by increased trade openness (R² ≈ 0.02). Other factors, like development stage, human capital, and demographics, matter more.

Normally, people don’t realize how “regionalized” globalization currently is. You have people like Thomas Friedman of the NYT who says “The World is Flat”. Also, there are some firms that are truly globalized. For example, the Boeing 787 Dreamliner brings wings from Japan, engine from America, flaps from Canada, horizontal stabilizers from Italy, landing gear from France, and more. I can make a similar argument about how global Pfizer vaccines are, using labor and talent pools in Turkey, Germany, America, Canada, India, and China.

But Boeing and Pfizer are exceptions rather than the norm. Most manufacturing doesn’t go very far and the firms sell to closer foreign suppliers than you think.

Take the American Ford Edge. The seats are made in Tennessee, cushions are made in South Carolina, embellishments are made in Mexico, and the seats are attached in Matamoros, Mexico and shipped to Ontario, Canada to fit the metal frames. Also the breaking system, battery, engine, and transmission are all made nearly entirely in North America.

For the Chinese Great Wall Motors, the transmissions, chassis, and bumpers come from Japan, South Korea, China, and Taiwan to make the Haval H6 SUV.

For the German Audi whose plant is in Danube, the company pulls in Swedish power steering, Italian water pumps, Czech wheels, and French circuits.

Same story for the regionalization of Chinese Lenovo ThinkPads, European Airbus, and etc.

The network effects of small & medium sized firms, regional trade hubs, and industrial clustering makes trade more regionalized.

Here’s France, as you can see, most French firms buy and sell to customers in the European market.

How does Globalization Help/Hurt?

The fact is America has barely embraced globalization compared to a country like China or Vietnam, but even with America’s modest embrace, there are ambivalent results about American globalization.

Globalization’s Trade-Offs: Who Wins & Who Loses?

Winners:

Consumers in the U.S. enjoy cheaper products, from TVs to sneakers, adding an estimated $10,000 in extra purchasing power per household. Even working class people in the West Bronx have flat screen TVs, light bulbs, a refrigerator, and other goods that they can afford at low cost in their apartment.

Businesses win. They get new markets to sell to and new talent to utilize.

Professional Managerial jobs (sales, HR, business law, supply chain management, marketing, data science) have thrived under globalization, expanding opportunities for MBAs and highly skilled workers. The benefit is that all those PMC jobs are generally middle and upper middle class jobs, but the issue is that those jobs are usually reserved for advanced degree holders or experienced hires.

Losers:

The American Midwest lost thousands of assembly-line jobs, as manufacturing moved abroad or the South. Americans don’t make TVs, kitchen supplies, carpets, sneakers, and rubber tires anymore.

Businesses that failed to adapt. With little competition after WWII, many U.S. firms were thriving until the 1970s. By then many American firms were unprepared for Japanese and European rivals in the 1970s-1980s and Chinese competition in the 2010-Present.

Job polarization: New jobs favor college-educated workers in specific industries, leaving behind those without degrees or degrees that aren’t valued by the job market. This leads to education polarization.

This is the dilemma with free trade, the benefits of cheap goods are distributed across the country but the downsides were concentrated in the Midwest.

To cope with job loss under globalization, Clinton, Bush and Obama invested in re-training programs. They were largely unsuccessful.

This has made globalization create a two sided coin. The pros are that everyone gets $10K richer, working class people have cars & TVs, and there are plenty of six figure, professional managerial class jobs. But the result is, the American Midwest loses opportunities and the jobs that are available aren’t hiring people without a degree. A coastal person with a masters degree working in business development at a tech startup has benefited from globalization while a Midwesterner with no degree who used to make rubber tires has lost out. This explains Trump’s 2016 win and his tariffs & tax cuts, which Biden has largely maintained while expanding subsidies & tax credits. Both parties now cater to swing-state manufacturing workers and have undermined the WTO.

Some people forget the benefits of globalization because people harken back to 1950s America which was the heyday of American economic power. Those times aren’t coming back, because in the 1950s every other place of competition was either blown up in WW2 (Europe or Japan), didn’t trade with the world (The Soviet Union & its client states), was a super poor country that was barely getting buy (China, India, Ethiopia, & most of Latin America), or was still a colony or a recently independent (most of Asia & Africa).

In 1945, the U.S. produced half of global manufacturing. Even in 1960, it accounted for 40% of world GDP and barely had global competition. You cannot relive 1950’s America unless you want to bomb the world to the stone ages, with America left standing.

Even then, nostalgia blurs the vision. Back then, 20% of households didn’t own a car, less than 10% of people had a TV. Those goods were too expensive for working class people.

While today due to a modest embrace of globalization, the average American has 2 cars, 3 TVs, and 90% of people have a computer and 80% have a smartphone. Air conditioning, washing machines, and dishwashers used to be luxuries, but now they are staples.

Case Study: The Rise & Fall of Akron, Ohio

Pre-1980s: Akron was the rubber and tire capital of the world, producing 60% of the world’s tires. Between the two world wars, Akron’s rubber firms turned rubber into tires, shoes, guns, blimps, and planes. As Eisenhower made the interstate highway system, and more people drove cars rather than ride rail, the rubber firms like Goodyear and Firestone grew and expanded.

Akron, Ohio exploded in population. See chart below, people wanted to move to Akron until the 1960s:

By 1982, Akron was dead. Almost all of these firms were sold to foreign competitors. So what happened?

Foreign competition & innovation: French (Michelin) and Japanese (Bridgestone) firms outcompeted U.S. companies. They made better technology that lowered cost while improving equality.

Strong U.S. dollar: A strong dollar made U.S. goods pricier than European and Asian competitors.

Foreign competition regionalized trade: Japan was able to use China, Thailand, and other countries for cheap labor, while France used Spain, Portugal & Greece.

Some left wing critics blame Reagan for “neoliberalism”, outsourcing and offshoring. A convenient narrative, but that betrays the facts. Reagan was only in office for a year in 1982, while the decline in rubber manufacturing was trending for over a decade. Right wing protectionists blame Bill Clinton for signing NAFTA, which still doesn’t make sense because Akron was already dead 12 years before NAFTA was signed.

In reality, American Tire firms were just getting clobbered by French and Japanese firms. Look at the chart below to see how American firms’ market share (Goodyear, Goodrich, General Tire) was eroded by French Michelin or Japanese Bridgestone.

If your competition has cheaper labor & currency, the only way to compete is through innovative technology that lowers marginal costs (higher productivity), lower taxes (either tax credits like Biden or tax cuts like Trump), suppress your wages, or protectionist policy (tariffs on foreign goods, cheap loans for domestic firms, or accelerated depreciation). Each one of these have different multiplier effects.

Another option is “bullying allies”. Under Reagan, the U.S. pressured the UK, France, Japan, and West Germany to revalue their currencies through the Plaza Accords to make American goods more competitive. I am sure Trump took notes.

How did Europe Regionalize?

Europe regionalized by government coordination. Through the treaty of Rome, Brussels, Maastricht, Amsterdam, Nice, Lisbon, and more. These treaties bounded European economies, companies, and workers together. Then institutions, regulations, and courts grew with it to govern commerce and the citizens in these countries.

Brexit hurt the UK. A Swiss-style or Norway-style deal (EU access without full membership) would have been better. Now for the UK to sell goods to Europe, the UK has to follow EU trade standards but now faces tariffs and quotas.

How did East Asia Regionalize?

Unlike Europe, East Asia regionalization was business-led, not government-led. The Japanese government in the early 1900s, as it was the first non-white country to industrialize quickly, wanted to coordinate a Pan-Asian bloc that liberated Asia from colonialism called the “Greater East Asia Co-Prosperity Sphere”. As cool as this sounded, Japanese Pan-Asianism turned into colonization of Korea & Taiwan, and mass murder & rape of millions of Chinese, Vietnamese, and more while being high on meth.

So that “Pan-Asianism 1.0” failed. So after America rewrote Japan’s constitution, Japan reindustrialized using the Korean war to make America the ultimate Japanese customer. By the 1960s, due to falling birth rates, low immigration, and a robust economy, Japan faced a labor shortage in the 1960s. Japanese CEOs went out to Taiwan, Malaysia, Thailand, Singapore, Hong Kong, and South Korea as cheap labor pools to make TVs, cars, and footwear.

As Taiwan, Hong Kong, Singapore, and South Korea got richer, had falling birthrates, and had labor shortages, their firms + Japanese firms used Malaysia, Indonesia, Thailand, the Philippines, and China when it opened up in the late 1970s. That was “Pan Asianism 3.0” or “Flying Geese Theory”.

Now we live in Pan-Asianism 4.0, where now China is a big investor in other East Asian countries including Indonesia, Laos, Cambodia, Vietnam, and etc. As America is tariffing the world, China is allowing more free trade deals.

Now we live in an era where roughly half of all greenfield investments (when a company makes a new subsidiary in a foreign country and that subsidiary builds factories and offices in that country) comes from other Asian countries.

How did North America Semi-Regionalize?

North America is more regionalized than Latin America, the Middle East, and Africa, but less so than East Asia or Europe.

NAFTA saved places like Columbus, Indiana & Hartford, Connecticut. Their populations continued to grow.

Columbus, Indiana, thrived post-WWII but struggled in the 1970s and 1980s against Japanese and European engine firms like Mitsubishi, Komatsu, and Siemens. Japan leveraged cheap labor from its neighbors and eventually Ford and GM sourced engines from Japan and Europe instead of Cummins. Look at this NYT article below to see:

However, NAFTA changed the game. In 2001, Cummins invested in San Luis Potosí, Mexico, expanding into Canadian and Mexican markets. By 2016, these two countries contributed $2.5B (14%) of Cummins' $17.5B revenue.

Relocating some labor to Mexico cut costs significantly—Mexican engineers earn 463K pesos($23K/year) compared to $82K–$110K for American engineers. This shift helped reduced labor costs to 12% of revenue ($2B of $17.5B), allowing Cummins to offer competitive pricing against Mitsubishi (which used Chinese and Thai labor) and Siemens (which used Eastern European labor).

Instead of dying like many Rust Belt firms, Cummins survived, expanded, and created U.S. jobs. The same argument applies to UTC (now Raytheon) and Pratt & Whitney in Hartford, which might have fallen to British BAE Systems or French Safran without NAFTA’s market access and cost efficiencies.

NAFTA (1993) boosted North American trade to over 50% regionally, but by the mid-2000s, it declined to the 40% range. What caused this shift?

Once China entered the WTO, China actually sucked up investment and trade that would have naturally went to Mexico!

Now these three regional blocks compete in high-end goods like electronics, cars, aerospace vehicles, pharmaceutical drugs, semiconductor chips, component manufacturing, and medical equipment.

Implications on Policy:

Based off the data and examples Shannon provided, her solution isn’t isolationism or free trade. Europe and East Asia will always take advantage of the cheap labor pools and high paying specialized talent that exist in the various countries in their region. This builds specialization, economies of scale, and etc.

Dr. O’Neil’s solution is that American regionalization is incomplete, and for America to compete there must be stronger regionalization with neighbors.

Book Score: 98%

I think this book does a fantastic job simplifying complex trends into meaningful narratives. There’s so much of the book that I didn’t mention. Dr. O’Neil had amazing case studies of Germany’s Mittelstand manufacturing boom to Japanese keiretsu conglomerates to the tri-national production of Bombardier jets. All of these examples demonstrate how regional supply chains can boost innovation and competitiveness.

This book makes a powerful case for more regional trade or “nearshoring”. China is pursing this strategy with its free trade deal across the entire Pacific region, while America is trying to build up itself. Which strategy will work? Only time will tell the tale.

Yea i didn't write about it but I can explain it. Very good question. As said before, Europe is more regionalized than North America which is more regionalized than Africa.

In europe, when you think of making an Airbus, most of the parts that go into making that plane are employing people in Europe.

In north america, due to the first China shock, America imports a lot of intermediate goods from China, if more trade was between America-Mexico, even more intermediate goods jobs would in the Texas-Arizona to Mexico border than more.

Places like Sub Saharan Africa or Latin America trade more outside than their region than in. A place like Bolivia or Congo just sells copper but is not getting into the piece of the action of making an EV since they just sell the raw copper. They aren't getting the jobs for the other use cases than copper firms or any firm that uses copper could be employing then for.

The Myth:

Many people believe that globalization has created a "flat" world where goods are traded freely and widely across all regions. You'll see that by NYT writere like Thomas Friedman or CNN people like Fareed Zakaria.

The Reality:

In practice, most trade is concentrated within three major regional hubs:

North America, Europe and East Asia & the Pacific

Other regions—such as Latin America, Russia, Central Asia, Africa, the Middle East, and South Asia—are far less integrated into global supply chains.

Why This Matters:

Most trade consists of intermediate goods, meaning production happens within regional supply chains rather than truly global networks.

Global trade in commodities (oil, metals, agriculture) is an exception, but this occurs at the tail end of supply chains rather than driving globalization itself.

The::

The real world isn’t a single, unified trading system but rather three dominant trade blocs that do most of their trade within their own regions (with North America less compared to East Asia & EU) rather than across the entire globe.